Warren Buffett’s S&P 500 Pick Lags 88% Behind Bitcoin

- S&P 500 gained 106% since 2020, yet dipped by 88% when measured in Bitcoin value.

- A $100 Bitcoin stake from 2020 is now $1,474, while the same in the S&P 500 returns only $210.

- Bitcoin’s market cap hit $2.47T in 2025, still far below the S&P 500’s $56.7T size.

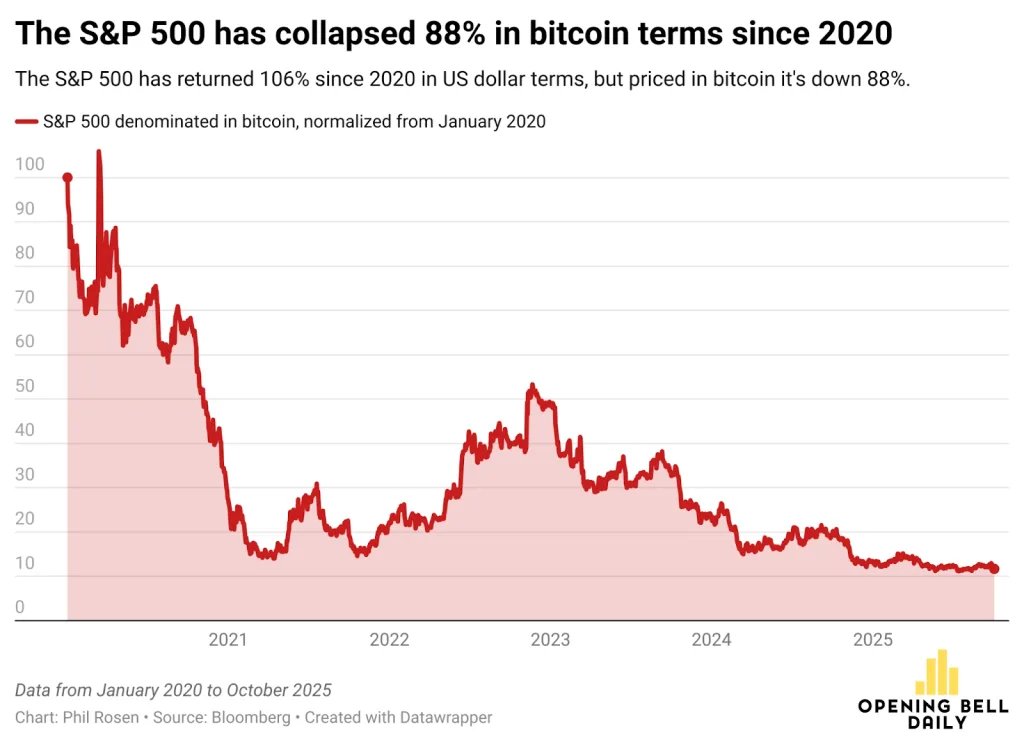

For decades, Warren Buffett’s advice to average investors has been to buy and hold the S&P 500. Market data released on October 5 shows that the index, despite record gains in U.S. dollar terms, has collapsed against Bitcoin. According to sources, the S&P 500 has risen 106% since 2020 but is down 88% when priced in Bitcoin.

S&P 500 Climbs To Records, But Bitcoin Moves Faster

The S&P 500 index, which tracks 500 of the largest publicly traded U.S. companies, reached 6,715.79 points this month. It has gained 14.43% in 2025, setting new records, indicating corporate earnings strength.

Since its inception in 1957, the index has delivered inflation-adjusted returns of about 6.68% annually, usually above the average U.S. inflation rate. Notably, Warren Buffett has consistently endorsed the index for long-term wealth growth.

His 90/10 investment strategy allocates 90% of a portfolio to the S&P 500 and 10% to short-term U.S. Treasury bills. The strategy shows confidence in broad U.S. equities. However, Bitcoin’s stronger movement has recently overshadowed these returns.

Bitcoin surges Past $125,000

On October 5, Bitcoin surged to a new ATH of above $125,000, a 32% increase from January. That growth is different from the S&P 500’s 14% rise during that same time. A S&P 500 investment of $100 in January 2020 would be worth $209.85 now.

By contrast, the same $100 staked in Bitcoin at the start of 2020 today would equal nearly $1,474. This performance difference shows Bitcoin’s fast ascent over traditional benchmarks. The asset’s market cap now is near $2.47 trillion, compared with the S&P 500’s $56.7 trillion.

Related: Michael Saylor Anticipates Digital Gold Rush for Bitcoin

Different Assets, Different Principles

While the comparisons gain strength, the two investments operate under different foundations. The S&P 500 shows corporate America’s collective output, backed by earnings, dividends, and long-term economic stability. It is a diversified benchmark designed for steady compounding.

Bitcoin, however, is a decentralized digital asset with a fixed supply of 21 million coins. Its scarcity and design as a hedge against monetary debasement appeal to investors watching government debt and inflation. Though volatile, Bitcoin’s deflationary structure has driven strong adoption across global markets.

The gap between the $56 trillion value of the S&P 500 and Bitcoin’s $2.47 trillion shows scale differences. However, according to Rosen, Bitcoin’s pace of growth since 2020 has effectively made the S&P 500 look weaker in comparative terms. This change places renewed scrutiny on Buffett’s long-standing preference for equities.

Meanwhile, recent performance trends have changed the outlook on how investors compare traditional indexes and digital assets. While the S&P 500 continues to show corporate strength, Bitcoin’s acceleration has forced a broader re-evaluation of long standing allocation strategies. The contrast is less in raw returns and now more in how each asset defines growth in a growing financial sector.