Whale Dumps $PEPE at $1M Loss, Shifts to Aster Amid Sell-Off

- PEPE whale exits with $1.02M loss and transfers $1.47M USDT to Aster DEX for yield gains.

- ASTER drops over 30% then rebounds above $1.20 but faces weak demand and cautious trading.

- Whales offload 62.6M ASTER tokens in 24 hours, reflecting fading confidence across markets.

A major PEPE whale has exited the meme coin market with a loss of about $1.02 million, closing one of the week’s largest sell-offs. Blockchain data from Nansen shows that wallet 0x06b36a…6848 sold roughly 227.8 billion PEPE for 394 ETH, worth around $1.52 million, after holding the tokens for nearly 100 days.

Back in July, this same wallet had made headlines for purchasing the exact amount of PEPE with 858.55 ETH (approximately $2.39M) and 150,748 USDT, according to Onchain Lens. That bold entry has now turned into a full retreat, showing that even major investors have struggled to ride out PEPE’s deep pullback.

Soon after the sale, the trader converted nearly all of the ETH proceeds into $1.47 million in USDT and sent the funds to Aster DEX, a decentralized platform built around yield farming and liquidity aggregation. The quick move suggests a deliberate switch from risky meme coins to steadier income-earning assets.

As PEPE’s price drifts and trading volumes thin, analysts are watching to see if this rotation marks a turn toward steadier, yield-based plays in a cooling altcoin market.

Related: ASTER’s Price Dips After Stage 2 Airdrop Launch, Rebound or More Pain?

ASTER Price Action: Big Holders Exit as Confidence Wavers

The ASTER token has spent most of the week under pressure, sliding more than 30% in just three days. The sell-off began after the price met stiff resistance near $1.50 midweek, a point where bullish momentum quickly faded and traders chose to cash out.

After the sharp drop, the market found some balance between $1.14 and $1.02. That range acted as a floor, giving the token room to breathe. Buyers stepped back in, helping ASTER recover roughly 12% over the last day and lift back above the $1.20 mark.

Regardless, enthusiasm appears limited. The token’s trading activity has dropped by about 21% in the past 24 hours, suggesting fewer participants are willing to take fresh positions. Even with the recent lift, the weekly chart still shows a 14% decline, a reminder that the broader sentiment remains cautious.

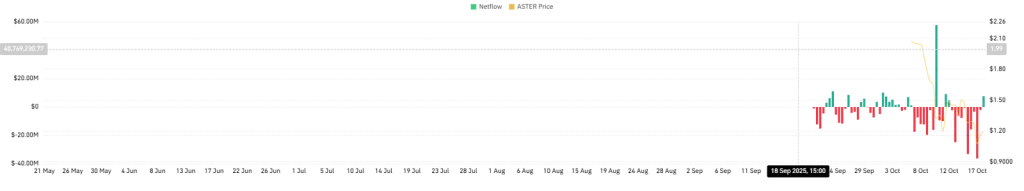

Besides, on-chain data adds another layer to the story. At press time, ASTER’s spot exchange inflows have exceeded $8 million, which often points to potential selling pressure as holders move their tokens to exchanges.

Source: CoinGlass

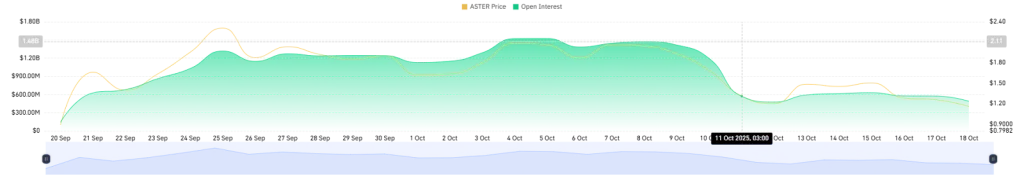

Open interest has also fallen sharply, now sitting near $489 million compared to more than $2 billion at the start of October. The pullback hints that traders are opting to close their positions and lock in gains, leaving the market with lower volatility and a potential consolidation phase.

Source: CoinGlass

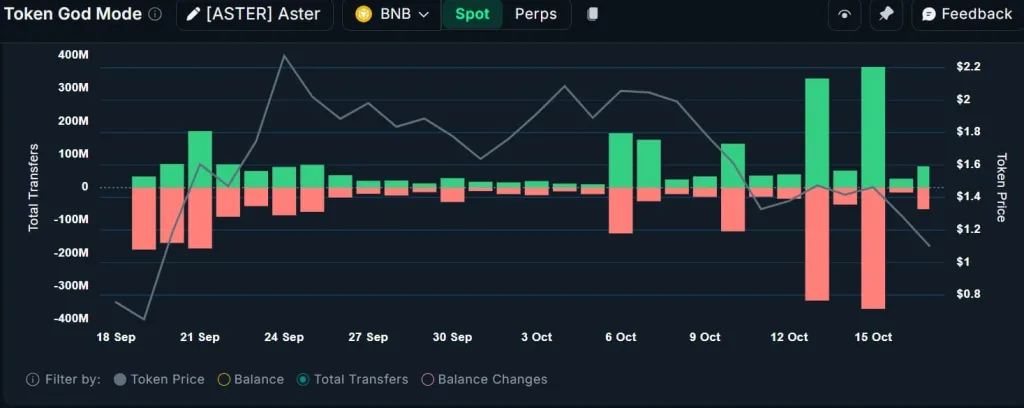

Matching the broader market mood, large holders have started to unwind their long-term stakes. Data shared by EmberCN showed one major holder sending 9.57 million ASTER, worth about $12.5 million, to Binance, while another moved 8.28 million tokens to Bybit. Together, they unloaded roughly 17.85 million tokens valued close to $22.9 million.

The exits don’t stop there. Figures from Nansen reveal that large holders collectively sold about 62.6 million ASTER tokens in the last 24 hours. The scale of these moves points to a broader round of profit-taking across major wallets.

Source: Nansen

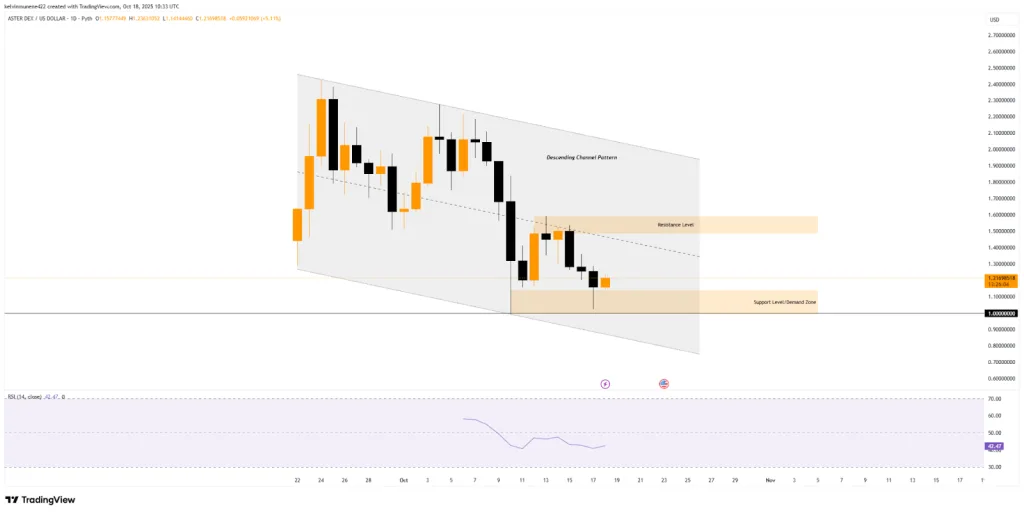

Key Levels to Watch

If the current sentiment across the market continues, ASTER looks set to revisit its familiar base between $1.14 and $1.00. That zone has quietly acted as a cushion through earlier sell-offs. A slip below it could shift the tone entirely, strengthening bearish control and possibly sending the token closer to $0.90 in the days ahead.

Source: TradingView

Moreover, technical readings lean toward caution. The RSI now hovers around 42, hinting that sellers are still steering the short-term direction. It also leaves enough room for one more leg lower before the market reaches oversold levels, where momentum often pauses.

On the other hand, if retail traders manage to hold their ground and keep the recent rebound alive, ASTER could pull back above $1.39. Sustained buying from that point might revive confidence and lead to another attempt at the $1.50 mark, a level that once drew heavy resistance and now defines whether the token can break its losing streak.