Whale With 100% Win-Rate Enters Market With Bold $275M Long

- The whale’s $275M crypto longs show conviction after the Fed’s 25 bps rate cut.

- Powell’s words on future policy warn traders against unmeasured bullish momentum.

- The move signals confidence, yet market caution grows as risk assets face pressure.

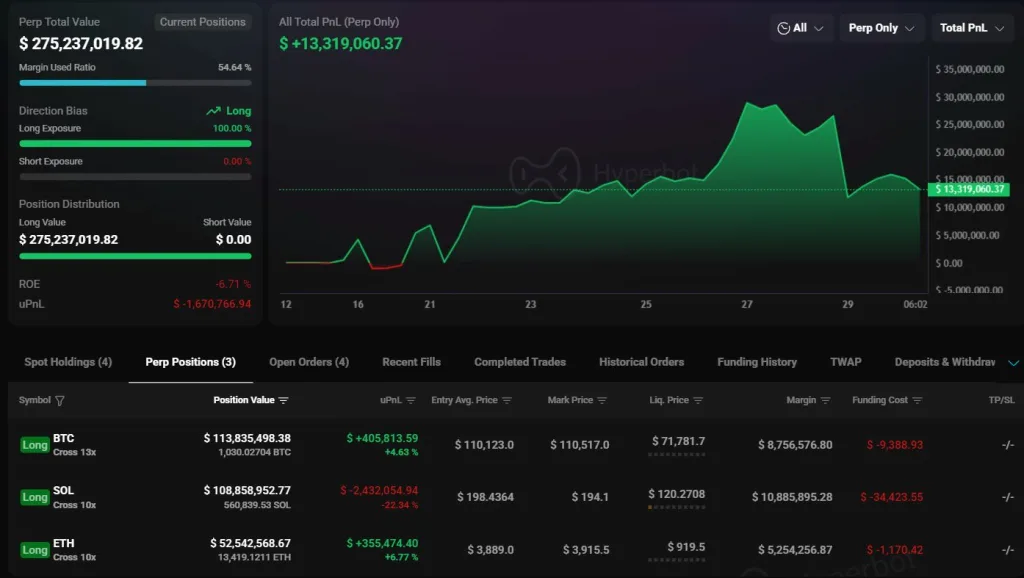

A trader known for a spotless winning streak since October 11 has placed another enormous wager on a crypto rebound. According to data from Hyperliquid, the whale reopened $275 million in leveraged long positions across Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) shortly after the Federal Reserve cut interest rates by 25 basis points and the U.S. President Donald Trump confirmed a tariff rollback agreement with China’s Xi Jinping. These back-to-back headlines lifted market sentiment and drew investors back toward risk assets. Despite showing a floating loss of approximately $1.67 million, the account still reports a total realized profit of $13.31 million, indicating a trader confident enough to withstand short-term volatility.

Bitcoin at the Front of the Portfolio

The most significant single position is held by Bitcoin. The whale controls 1,030.02 BTC, worth approximately $113.83 million, with 13x leverage. The entry price averages $110,123, with the mark price at $110,517, resulting in an unrealized gain of $405,813 (+4.63%).

With a liquidation level of $71,781, the position has a comfortable safety margin, suggesting a planned approach rather than a gamble. Next comes Ethereum with 13,419.12 ETH, valued at $52.54 million under 10× leverage. The trade opened at around $3,889 and mark price at $3,915.50, producing a profit of $355,474 (+6.77%). Its liquidation price of $919.50 implies the trader can absorb heavy swings before facing risk.

Solana, however, tells a rougher story. The whale’s 560,839.53 SOL, worth $108.86 million, entered near $198.4 and has an unrealized loss of $ 2.43 million (–22.34%). Even so, the liquidation level of $120.27 offers room to maneuver.

Overall exposure stands at 100 percent, accompanied by a margin-utilization ratio of 54.64 percent and a -6.71 percent return on equity, underscoring an aggressive yet calculated strategy.

Related: ETH Whale Activity Signals Growing Investor Confidence

Powell’s Warning and Market Reality

Nevertheless, Federal Reserve Chairman Jerome Powell’s latest comments have dampened some people’s enthusiasm for the market’s upward trajectory. In his address, Powell mentioned that the Fed had reduced the interest rate by 25 basis points, but another cut in December is still “far from certain.”

His caution suggests that the monetary authority may be on the verge of adopting a neutral policy stance, in which it is evaluating inflation risks before taking any further steps toward easing. The markets have already taken into account the recent cut, thus limiting the upside potential to a small degree.

The way Powell spoke suggested that riskier investments, such as the crypto market, might have rougher times ahead if the Fed resumes its policy of tightening. The message for traders considering mimicking the whale is quite clear: even though conviction trades may be compelling, the macro scenario remains highly unstable.

Without the whale’s exceptional timing and large margin cushion, the rest may find themselves swimming against the current instead of with it. If tightening resumes, leveraged positions like these could turn quickly. For traders tempted to mirror the whale’s moves, the data point is clear: conviction must be matched with capital and timing. Without both, even confident followers could end up swimming against the current instead of alongside it.