Whales Move 230K ETH as Shorts Dominate, Is a Rebound Coming?

- Over 230K ETH moved by whales this week, signaling renewed market anxiety among traders.

- Funding rates show a surge in short positions as Ethereum slips back to the $3,760 mark.

- Analysts warn that increased whale activity could deepen volatility before Ethereum stabilizes.

Ethereum’s price has pulled back, but on-chain activity hints at a possible turnaround. The second-largest cryptocurrency dipped to $3,760 this week, sparking anxiety among traders. Yet, behind the scenes, major Ethereum holders are making moves that could reshape the market’s direction.

According to data from CryptoQuant, large holders shifted more than 230,000 ETH in the past week. At current prices, the transfers represent over $850 million. Analysts are closely watching these moves as funding rates across exchanges turn sharply negative, a condition that often precedes market rebounds.

Whale Activity and Exchange Movements

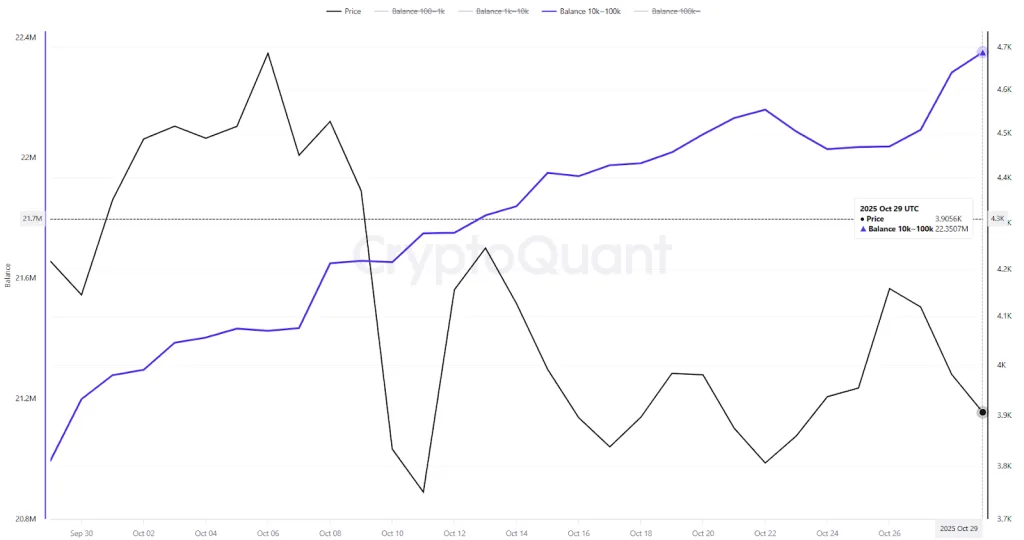

The on-chain data shows that wallets holding between 10,000 and 100,000 ETH have become more active. Their combined balance reached 22.35 million ETH on October 29 before dipping slightly. Such adjustments usually signal portfolio repositioning rather than panic selling.

Market watchers note that these whale movements frequently precede notable price shifts. Large transfers may be the result of strategic positioning, internal reorganization, or even inflows to exchanges before volatility. In this instance, the pattern aligns with increased uncertainty in wider cryptocurrency markets following the correction of Bitcoin.

The correction of Ethereum came just after weeks of steady gains. Traders initially showed optimism, but the sentiment changed as prices dropped below the $4,200 resistance. Even amid the recent downturn, whale activity remains one of the strongest indicators of market direction.

The drop in large-holder balances also suggests several possible factors. Some whales may be moving coins to exchanges for liquidity or hedging. Others could be reallocating assets into staking contracts as DeFi yields fluctuate. Smaller holders, meanwhile, have stayed relatively stable, suggesting broader confidence remains intact.

Funding Rates Turn Negative

While whales adjust positions, derivatives data adds another piece to the story. Data from Santiment shows Ethereum’s funding rates, a key measure of trader positioning, have flipped negative across major exchanges.

This change suggests that traders are placing more short positions as they speculate against the price of Ethereum. Historically, such conditions often pave the way for short squeezes, in which forced liquidations raise prices. Similar setups occurred in mid-September and early October. Each time, Ethereum rebounded quickly once funding rates turned red.

The pattern now appears to be repeating. As shorts dominate, the potential energy for a bounce increases. Traders who remain cautious risk being caught on the wrong side of a sudden reversal. It is uncommon for negative funding rates to last for very long, particularly when whale repositioning is involved.

At the same time, Ethereum’s fundamentals remain strong. The network leads the crypto market in total value locked (TVL) over the past 24 hours. This demonstrates its ongoing supremacy in decentralized finance. Additionally, developers are preparing for the December 3 Fusaka upgrade. The upgrade seeks to lower Layer-2 costs and increase scalability.

Related: Ethereum Developers Set December 3 for Fusaka Upgrade

These technical and structural advancements strengthen Ethereum’s long-term fundamentals, even as volatility in the short term escalates. Whales moving coins ahead of Fusaka may be positioning for the next growth phase.

At the time of writing, Ethereum was trading around $3,834, a 2.63% decline over the last 24 hours. Still, technical levels suggest that a recovery could gain traction above $3,950 and $4,200. Breaking above these levels would probably bring back positive market sentiments.

The current setup blends on-chain and market sentiment signals. Whales are moving assets while traders increase shorts, a mix that has historically preceded strong rebounds. The next few days could determine whether Ethereum repeats its earlier recovery patterns or continues consolidating near current levels.