Why Strategy Failure Could Shock Crypto Markets In 2026

- Strategy controls over 3 percent of Bitcoin supply, tying its fate to price moves.

- Strategy controls a critical share of Bitcoin supply tied to leveraged financing.

- A long Bitcoin slump could block funding paths and amplify market stress risks now.

Strategy Inc., formerly known as MicroStrategy, is the largest corporate holder of Bitcoin, controlling 671,268 BTC, with more than 3.2% of the token’s total circulation. That exposure places the company at the center of Bitcoin’s financial structure and connects its balance sheet to crypto market stability. A failure could ripple across markets in ways that exceed the 2022 FTX collapse, given Strategy’s scale, leverage, and concentrated holdings.

The company has acquired over $50 billion in Bitcoin, mainly through the issuance of debt and the sale of its shares. On the other hand, its traditional software division contributes approximately $460 million in yearly revenue, which is drastically lower than its exposure to cryptocurrencies. Such an unequal situation has transformed the Strategy into a highly leveraged Bitcoin vehicle instead of a tech firm with diversified services.

Bitcoin Holdings and Market Exposure

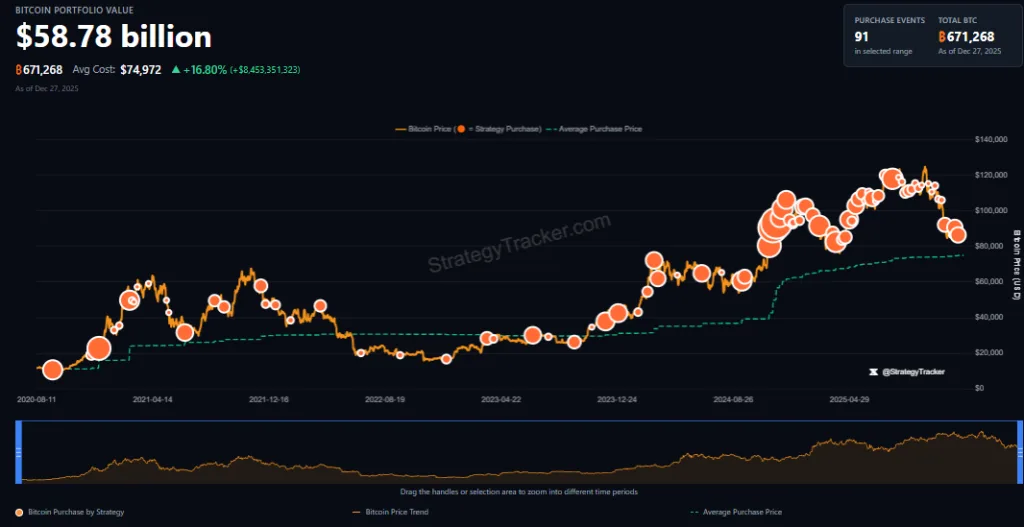

According to Strategy Tracker, Strategy’s Bitcoin portfolio stood at $58.78 billion as of Dec. 27, 2025. The company acquired its holdings through 91 purchase events at an average price of $74,972 per Bitcoin. At current levels, the position shows an unrealized gain of 16.80%, or roughly $8.45 billion.

Historical data from 2020 through 2025 shows repeated accumulation during both downturns and rallies. The chart displays Bitcoin’s price trend alongside Strategy’s purchase points and rising average acquisition cost. Even after Bitcoin pulled back from highs near $120,000, Strategy’s average cost remains well below market prices.

With a holding of this scale, Strategy ranks behind only a handful of ETFs and governments in Bitcoin ownership. Any forced sale or distress-linked liquidation would inject a large supply into the market. That risk ties Strategy’s financial health directly to broader crypto price stability.

Balance Sheet Pressure and Debt Structure

Strategy funded its Bitcoin strategy using aggressive capital tools. It issued common stock, introduced preferred shares, and raised over $8.2 billion through convertible debt. In addition, the company carries more than $7.5 billion in preferred stock obligations.

These instruments require about $779 million each year in interest and dividend payments. As of late 2025, Strategy held roughly $2.2 billion in cash reserves. That buffer covers about two years of payouts if market access remains open.

If Bitcoin stays below $50,000, the market value of the Strategy could go beneath its liabilities. At that stage, the raising of capital could be stopped, thus restricting the options for refinancing. These kinds of conditions could result in the company being forced to either restructure or sell off some of its assets. At extreme levels, analysts note that Bitcoin below $13,000 could render the company insolvent.

While such prices are distant, Bitcoin has recorded repeated 70% to 80% drawdowns in past cycles. A sharp decline combined with tight liquidity could accelerate stress.

Related: Saylor Renews Bitcoin Banking Vision as Strategy Buys More BTC

Stock Performance and Systemic Risk

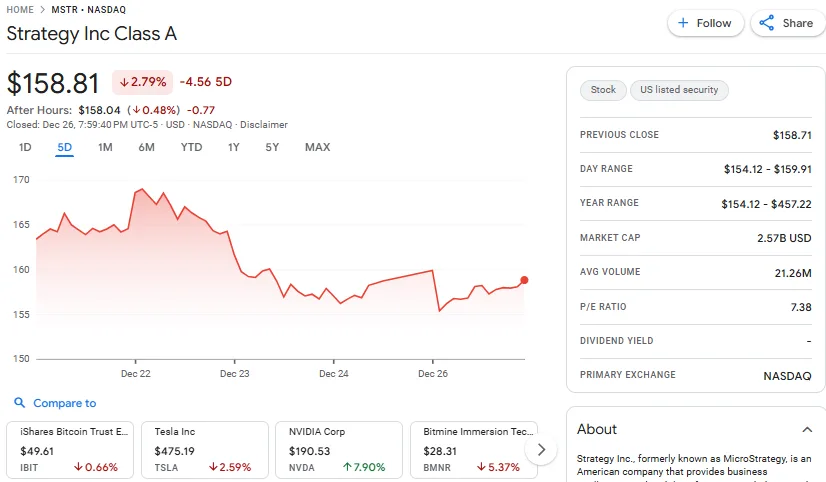

Shares of Strategy Inc. Class A closed Thursday at $158.81, down 2.79%, according to Google Finance. The stock lost $4.56 over five days and slipped another 0.48% after hours to $158.04. Trading on NASDAQ ranged between $154.12 and $159.91 during the session.

The stock’s 52-week range spans from $154.12 to $457.22, showing extreme volatility. Strategy carries a market capitalization of $2.57 billion with an average daily volume of 21.26 million shares. The company reports a price-to-earnings ratio of 7.38 and pays no dividend.

Unlike FTX, Strategy does not custody customer funds, yet its role remains structurally critical. It holds a massive share of Bitcoin’s supply rather than operating a trading venue. If its holdings hit the market during distress, price declines could trigger a wider crypto sell-off.

A total collapse in 2026 remains uncertain, and estimates of its likelihood vary widely from 10% to 20%. These probabilities look at leverage, Bitcoin’s price fluctuations, and the dependency on capital markets.