WLFI-Backed USD1 Enters Stablecoin Top Five Market Ranks

- USD1 reaches the 5th largest stablecoin spot as market capitalization approaches $5 billion.

- WLFI vote approved treasury support for USD1, raising questions over governance fairness.

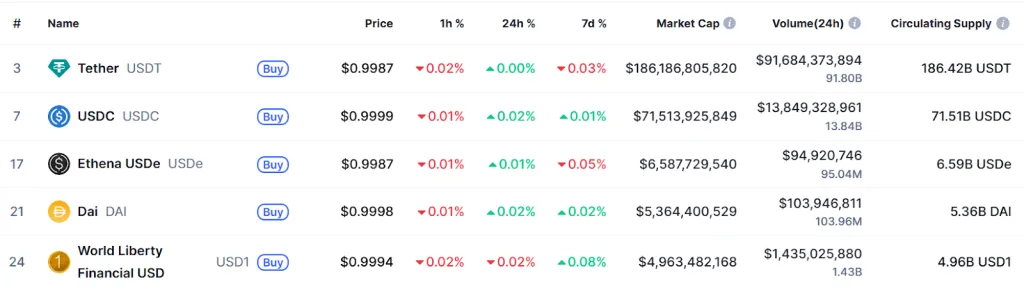

- USD1 enters the top five but remains far smaller than the USDT and USDC market leaders.

USD1 has moved into the top tier of the stablecoin market after a sharp rise in supply. The token, issued by World Liberty Financial, now ranks fifth by market value. Data shows capitalization near five billion dollars. The move places USD1 ahead of PYUSD and DAI during a period of tight competition. Recent disclosures confirm the shift in public markets.

Source: CoinMarketCap

USD1 outpaced most peers over the past few months, market data showed. The rise signifies more issuance and wider circulation across crypto venues. The rankings put USD1 behind only USDT, USDC, USDS and USDe. The move is a significant foray into a group long dominated by established issuers.

WLFI Governance Vote and Trump Family Role Shape USD1 Expansion

World Liberty Financial is the entity behind USD1. The company was co-founded by members of the Trump family. Eric Trump serves as a co-founder and public representative of the project. He acknowledged the stablecoin’s rise in a public statement following the ranking update.

In his remarks, Eric Trump linked USD1’s growth to changes in digital finance. He described the expansion as part of a wider shift toward blockchain-based dollars. The statement focused on payment efficiency and global reach. No additional operational details were disclosed alongside the comment.

USD1’s growth followed a governance decision by WLFI. The protocol approved a proposal allowing part of its unlocked treasury to support the stablecoin. The vote authorized the use of internal assets to strengthen liquidity and adoption. The decision was executed through WLFI’s governance framework.

The governance process soon attracted criticism from analysts. DeFi² reported that voting power was concentrated among wallets linked to WLFI’s team and strategic partners. According to the analysis, these wallets held enough influence to determine the outcome. Critics said this raised concerns about decentralization.

Distribution Concerns Emerge as USD1 Lags Market Leaders

Further criticism focused on how benefits may be distributed. WLFI Gold Paper, which outlines revenue flows and affiliations. They argued that the approved structure may favor entities tied to the Trump family and the Witkoff group. At the same time, many WLFI tokens remain locked.

Related: World Liberty Expands USD1 Into Satellite Internet Payments

Some token holders questioned whether the vote treated participants equally. Locked holders did not receive direct benefits from the treasury allocation. The episode renewed debate over governance fairness within WLFI. The project has not disputed the voting data cited by DeFi².

Despite its rise, USD1 remains far smaller than the market leaders. Tether’s USDT and Circle’s USDC dominate the sector. Together, they account for more than 82 percent of the roughly $313 billion stablecoin market. Their scale and liquidity remain unmatched.

Below them sit USDS and USDe. These tokens hold established positions through existing DeFi and exchange integrations. USD1’s entry into the top five highlights momentum but not parity. Analysts note a wide gap in circulation and usage.

Eric Trump has also commented on traditional finance in recent remarks. He criticized major banks for opposing crypto-related legislation. He said settlement delays benefit banks by allowing them to earn interest on idle funds. His comments framed crypto as a challenge to existing systems.

Trump stated that digital assets enable faster money movement. He argued that this reduces reliance on intermediaries. According to him, resistance from banks reflects economic incentives. These statements coincided with USD1’s continued expansion.

The future of USD1 would be determined by governance procedures and regulations. Rankings can shift as supply and demand move. For now, USD1 is one of the top-five cryptocurrencies by market cap. The development brings WLFI under more scrutiny from the cryptocurrency industry.