XRP Eyes $3.15 as Whale Activity Grows and Traders Watch ETF Moves

- Whale accumulation and retail demand keep XRP stable as traders await fresh market cues.

- On-chain activity surges with 1.58B XRP moved in a day, signaling stronger network utility.

- ETF decisions this month may define XRP’s next major move above or below the $3.00 zone.

XRP traded above $2.98 on Saturday after rising for three straight days. The token’s rally began from September lows near $2.70. It was driven by renewed whale activity, steady retail demand, and optimism linked to the “Uptober” trend. Market data showed a pause in the uptrend as traders waited for new signals.

A close above the $3.00 mark could strengthen bullish sentiment. This move might support a potential rise toward its mid-July record of $3.66. The price action remains stable despite light profit-taking in recent sessions. Market participants continue to monitor whale accumulation and overall liquidity patterns.

Whales Boost XRP Holdings as Network Activity and Trader Interest Surge

Santiment data showed large XRP holders doubled down on their bets this week. Wallets with 10-100 million XRP hold 12.27% of supply (from 12.06% on Sep 25). The group with 100 million–1 billion XRP likewise increased its possession from 13.85% to 14.6%. This jump indicates that confidence is coming back to big investors.

On-chain data of the XRP Ledger indicated a sudden surge in transaction volume. Payment volume surged to 1.58 billion XRP in one day. The spike in on-chain transfers hints at users being more active, indicating a wider containing speculative traders.

Retail investors also had elevated activity in derivatives markets. Open interest in futures mounted from $7.35 billion at the beginning of September to $8.69 billion as of Saturday. The funding rate was flat at 0.0108%. This rising activity indicates increasingly active involvement from both short-term speculators and long- term holders looking for exposure.

XRP Consolidates Near $3.00 as Liquidity Clusters Shape Next Market Move

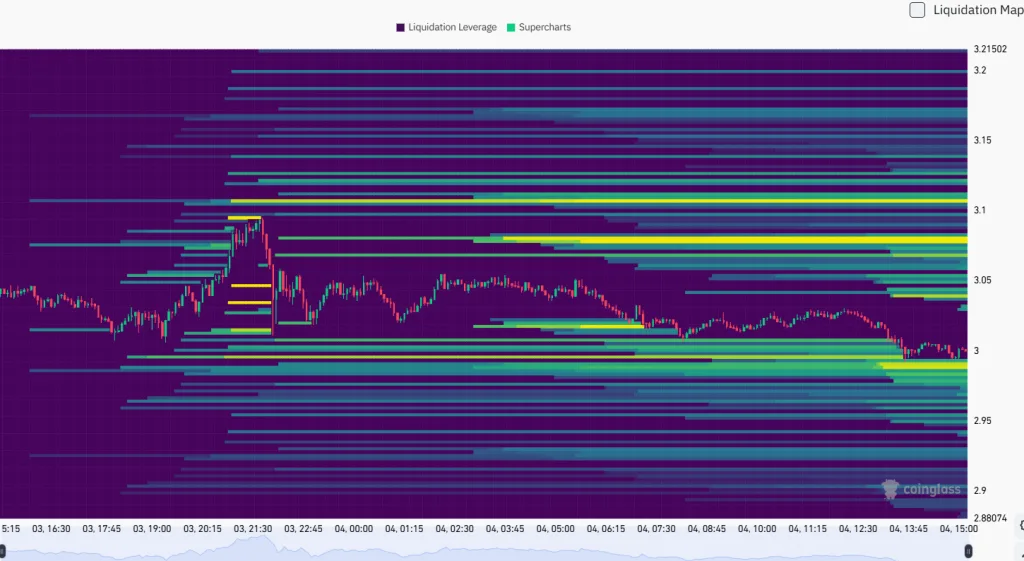

The past 24 hours saw liquidations worth $6.44 million in total. Long positions covered $4.34 million, while short positions were valued at $2.10 million. XRP liquidation heatmaps have also shown a very constricted price consolidation in the $2.95 to $3.15 range.

Most of the liquidations were concentrated around the $3.10 to $3.15 range where shorts got trapped in a quick push upwards. Strong buy-side liquidity continued to be aggregated from $2.95- $3.00 forming a strong level of support with an ability to absorb selling activity strongly.

As of press time, XRP is trading at $2.99, down by 1.68% over the past day and increase by 7.18% over the past week. The 50-day moving average stands at $2.93, with the 100-day close at $2.91. The 200-day near $2.56 provides solid support against further decline. The MACD at 0.0183 is slightly higher than the signal at 0.0042 and indicates a slight upward trend.

If XRP sustains above $3.00 and breaks $3.15, it may advance toward $3.30. Failure to hold $2.90 could pull it back toward $2.75 or even $2.60. The short-term bias remains neutral to mildly positive. Traders are watching whether volume increases as October begins, which could confirm a direction shift.

Related: XRP Nears $3 While Analysts Point to $10 Floor Amidst Whale Demand

ETF action would be a particularly important factor for the market this month. U.S. SEC to decide on 6 XRP ETFs in October. Dates are October 18 for Grayscale, October 19 for 21Shares, October 22 for Bitwise, October 23 from Canary Capital and CoinShares and October 24 from WisdomTree. Every decision could impact investor sentiment.

A recent government funding shutdown had postponed several SEC deadlines. The missed rulings have sparked speculation over extensions and late approvals. For now, XRP performs as an exercise in patience for a market taking on faith. The $3.00 level remains support, and the region is still both neutral and choppy.