XRP Price Forecast: Can Bulls Break $3, or Will Bears Drag It Back to $2?

- XRP holds steady as bulls defend support following the Fed’s recent rate cuts.

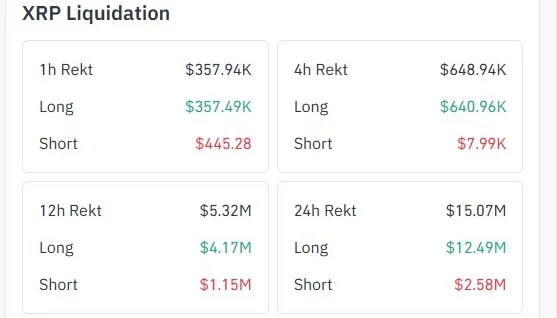

- Over $357K in XRP longs liquidated within an hour as traders cut risk post-Fed move.

- Technical charts hint at a potential XRP move toward $3.00 as MACD signals bullish momentum.

At press time, XRP was trading within a tight resistance range between $2.65 and $2.50, a level that has held steady for several sessions. The move followed the Federal Reserve’s recent quarter-point rate cut, which briefly rattled the crypto market. XRP dipped about 2% in 24 hours but later found stability near $2.58.

Even with short-term pressure, sentiment toward the token hasn’t turned negative. Over the past week, XRP climbed more than 7%, suggesting that buyers are still active. Daily trading volume rose roughly 12% to about $6 billion, showing steady participation from both individual traders and larger investors.

However, fresh data from CoinGlass showed more than $357k in long positions wiped out within an hour, against just $445 in shorts. That difference hints that many traders locked in profits or trimmed risk after the Fed’s decision.

Not to leave out, XRP remains caught inside a descending channel that has shaped its price for months. The mixed setup has sparked debate across the market. Analysts are divided: will bullish traders finally take rein, or will the weakness carry over into November? Let’s find out.

Fed Rate Cuts Stall XRP Rally as Bulls Battle to Reclaim $2.6

Initially, XRP was trading in an upward rhythm, carving higher lows even as it stayed locked inside a descending channel. From a base near $2.18, the token jumped more than 23%, touching $2.69, and momentarily pushing through a narrow supply zone that had stalled earlier rallies.

Then came the Federal Reserve’s quarter-point rate cut. The move unsettled traders and froze XRP’s climb, leaving bulls unable to retake the $2.69 level. Yet, the token still trades above the middle band of its channel, a sign that buyers have not stepped back.

Charts show room for another push toward $2.80 in the near term, and it could potentially reach $3. The MACD indicator adds weight to that idea: its MACD line sits around –0.0424, forming a bullish divergence that hints at renewed buying interest. On the histogram, green bars have widened above zero, now near 0.0323, confirming the build-up of positive momentum.

Beyond the charts, the Fed’s latest statement revealed that it will stop allowing Treasury holdings to roll off its balance sheet. Instead, it plans to inject an estimated $1.5 trillion in liquidity into the banking system, effectively ending the quantitative-tightening cycle that began in 2022.

Often, more liquidity usually stirs risk appetite. When borrowing costs fall and cash levels rise, equities, credit markets, and digital assets often tend to move higher.

Trump–Xi Talks Spark Market Cheer

Adding further optimism, U.S. President Donald Trump described his Thursday meeting with China’s leader Xi Jinping as “amazing,” claiming it produced “very important decisions.” Reports suggest that the U.S. will cut tariffs imposed earlier this year on certain Chinese chemical exports from 20% to 10%, bringing the combined tariff rate from 57% to 47%.

He added that he plans to visit China in April, with Xi scheduled to travel to the U.S. later in the year. The leaders also discussed the export of advanced computer chips, with Nvidia expected to begin talks with Chinese officials soon. Trump noted that a new trade deal with China could be signed “pretty soon.”

Related: PI Price Prediction: 20% Rally Breaks Bearish Channel, Targets $0.40 Level

XRP Price Action: Path to $3

With sentiment improving, XRP looks ready to test higher ground. The first target sits at $2.80, roughly a 13% rise from current levels. A clean break above it could confirm a bullish reversal and open the door past the $3 region before November ends.

If the mood turns sour, however, support lies between $2.29 and $2.18, the zone last seen in mid-October. A deeper slide could send the token toward $2.00, erasing the bullish setup and handing control back to sellers.