Zcash Bulls Test: ZEC Rally Meets Critical Resistance as Institutional Demand Surges

- ZEC nears a strong resistance band as traders increase leverage around key levels.

- Institutional buying supports supply-demand tightness as ZEC tests the wedge pattern.

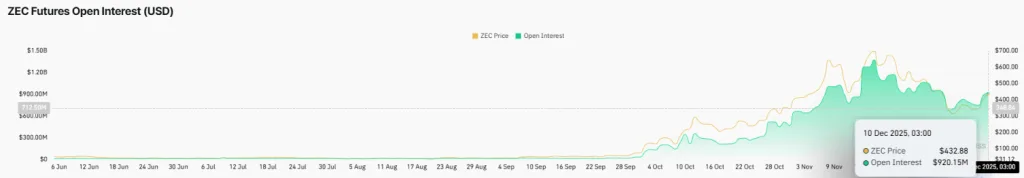

- Futures open interest expands sharply and signals mounting tension near the resistance.

Zcash moves toward a critical resistance zone as the token trades inside an ascending broadening wedge, while futures activity rises near record levels. From a technical perspective, ZEC rebounded from the $300 support region and advanced toward the $445–$470 zone, where Fibonacci levels and the 200-day moving average create a significant technical barrier.

Derivatives open interest also expanded to $920 million as traders increased leverage ahead of the December 10 Federal Reserve meeting. Liquidation flows across long and short positions added further tension as ZEC hovered near $424 during the latest session.

ZEC Approaches Major Technical Barrier

Zcash continues its upward attempt inside a widening wedge pattern on the 4-hour chart. The structure began after buyers stepped in near the $300 support level. That region acted as a strong demand zone during earlier declines.

As a result, ZEC moved toward the $448 area as bulls maintained control during the latest rebound. The wedge pattern created larger swings as price action stretched toward resistance. The $445–$470 region now forms the key ceiling.

This zone aligns with the 38.2% Fibonacci retracement level at $468.50. It sits just under the 200-day moving average, where both technical points slowed previous rallies. However, a break above the zone offers room toward the 50% Fibonacci marker at $519.99.

Yet the pattern also carries risk. The lower trendline supports the move but could fail if momentum weakens. A drop back toward the $300–$328 region remains possible if sellers resume pressure. Besides, RSI readings sit near the overbought area. This signals slowing strength as ZEC approaches a decision point.

This raises the question: can buyers secure a breakout before momentum fades?

Institutional Activity Expands

Large-scale buyers reentered the market as ZEC advanced. On December 9, Cypherpunk announced the purchase of 203,775 ZEC. The acquisition totaled roughly $87 million at current prices.

According to reports, the firm, supported by Winklevoss Capital, aims to hold at least 5% of ZEC’s total supply. It also added Zcash founder Zooko Wilcox as an advisor. Those moves added fresh attention to ZEC’s long-term supply outlook.

This development follows the recent expansion of Grayscale’s Zcash Trust. It also aligns with Arthur Hayes’ support for shielded transactions as key privacy infrastructure. ZEC’s privacy features remained a core topic across institutional discussions.

Consequently, markets continue to watch whether Cypherpunk increases its buying pace. Further institutional interest could tighten supply conditions in the coming weeks.

Related: DOGE Jumps 5% After Key Support Rebound: Will the Rally Hold?

Macro Shifts and Futures Leverage Create New Pressure

Crypto markets strengthened as expectations rose for a 25-basis-point rate cut at the December 10 Federal Reserve meeting. Analysts assigned a 96% probability to the reduction. ZEC’s rise outpaced BTC and ETH during the session. Yet privacy tokens often trail during periods known as “Bitcoin Season.”

The Altcoin Season Index remained at 17 out of 100. That reading reflected limited rotation into privacy assets. Shielded transaction activity stayed low. Only about 25% of the ZEC supply currently moves through private channels. This suggested that the rally contained speculative drivers rather than increased protocol usage.

At the same time, ZEC futures activity climbed sharply. Open interest reached $920.15 million on December 10. This represented one of the highest levels recorded in 2025. Traders expanded leverage as the price approached the resistance zone.

Notably, liquidation data showed active two-way speculation. The past 24 hours produced $6.54M in liquidations. Longs saw $2.34M in losses. Shorts absorbed $4.21M. During the 12-hour period, longs faced $509.38k, while shorts took $421.31k.

At press time, ZEC traded near $424.99 during this period. Rising leverage often precedes strong volatility. Consequently, traders monitored resistance closely as technical and derivative conditions converged.