Trump’s Media Files For ‘Crypto Blue Chip’ ETF Tracking BTC, ETH, SOL, XRP, and CRO

- Trump Media filed a new ETF plan with the SEC to cover Bitcoin, Ethereum, SOL, and XRP.

- The ETF will use Crypto.com to handle custody execution and provide liquidity services.

- If approved, the ETF will trade on NYSE Arca and hold BTC, ETH, SOL, CRO, and XRP assets.

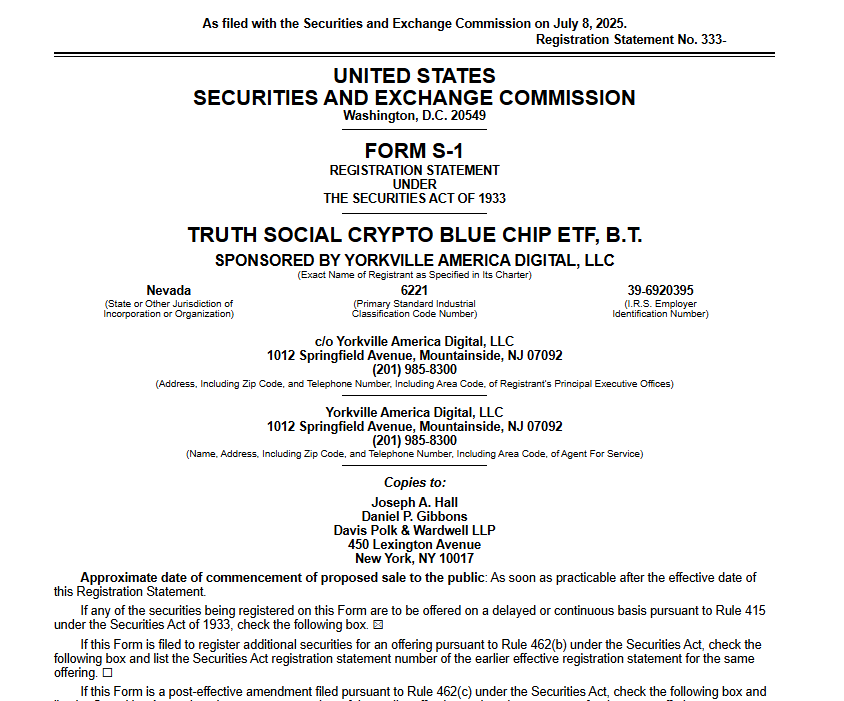

Trump Media & Technology Group has filed for a new crypto ETF tied to Bitcoin, Ethereum, Solana, Ripple XRP, and Cronos. Truth Social, the media arm of Trump Media, submitted an S-1 registration to the U.S. Securities and Exchange Commission (SEC) for approval on July 8th. If greenlit, the “Crypto Blue Chip ETF” would trade on the New York Stock Exchange Arca. The fund plans to offer shares backed by digital assets, with Crypto.com serving as custodian and execution agent.

Source: sec.gov

According to the preliminary prospectus, the ETF will include a weighted allocation across five cryptocurrencies. These include 70% in Bitcoin, 15% in Ethereum, 8% in Solana, 5% in Cronos, and 2% in XRP.

Trump Media Expands ETF Ambitions

This is not Trump Media’s first foray into ETFs. The firm previously filed applications for a spot Bitcoin ETF and a Bitcoin-Ethereum hybrid fund. Each filing has been sponsored by Yorkville America Digital. Yorkville again sponsors this new filing, with Foris DAX Trust Company listed as the custodian of the ETF’s crypto assets. Crypto.com, closely tied to the Cronos ecosystem, will manage staking and liquidity services.

At a press event last month, Trump defended his administration’s focus on digital currency expansion. “If we didn’t have it, China would,” he said, addressing allegations of conflict of interest.

$50 Billion ETF Trends

The ETF market for digital assets has exploded since January 2024. Farside Investors data shows Bitcoin ETFs have pulled in nearly $50 billion in inflows. Trump Media’s announcement aligns with the broader industry trend, where new ETF products seek to tap into retail and institutional interest. According to Bitwise CIO Matt Hougan, Ethereum ETFs alone may attract $10 billion in investment by year-end. He made this prediction in a July 2 post on social platform X.

Other major asset managers—including Grayscale, Franklin Templeton, Bitwise, and REX Shares—have also joined the ETF rush. Many are pushing products that include coins like Dogecoin, Avalanche, Cardano, and Litecoin.

In March, Cronos made headlines by approving a $6.9 billion reissuance of 70 billion CRO tokens that were previously burned. That move drew controversy, but it set the stage for the token’s inclusion in ETF conversations.

Related: SEC Approves Trump Media’s $2.3B Bitcoin Treasury Filing

Political Connections Spark Crypto Debate

Trump’s crypto involvement has not come without controversy. Once a Bitcoin skeptic, Trump has since embraced the space. His family and administration have both become deeply involved with crypto-related businesses and donations.

Ripple Labs, which is currently facing legal scrutiny over XRP, was one of the largest contributors to Trump’s inaugural committee. These ties have fueled political debates over regulation and fairness.

While Trump dismissed any allegations of wrongdoing, critics argue his support for pro-crypto regulations could impact family investments. Meanwhile, some Democrats cite conflicts of interest and industry credibility. Nonetheless, there has been a change of audio under the Trump administration. Observers expect approvals to be accelerated and hearings to be rendered friendlier than they were under the Biden administration in the preceding regulatory climate.