XRP Futures Hit $1B Open Interest Fastest in CME History

- XRP futures passed $1B open interest in three months at CME, showing strong demand.

- XRP futures contracts hit $1B daily turnover on Aug 25, lifting total volume to $9.02B.

- Analysts believe rising futures activity may bring faster approval for spot ETFs.

XRP set a new benchmark at the Chicago Mercantile Exchange (CME), Wall Street’s largest crypto trading venue, by becoming the fastest futures contract in history to surpass $1 billion in open interest. The record was achieved just over three months after its May 2025 launch, marking a historic moment that underlines institutional conviction in the token. According to CME Group, the broader suite of crypto futures also reached a milestone, with total notional open interest exceeding $30 billion for the first time.

The achievement places XRP firmly alongside Bitcoin, Ethereum, and Solana in CME’s high-volume derivatives arena. While both XRP and Solana futures crossed the $1 billion threshold.

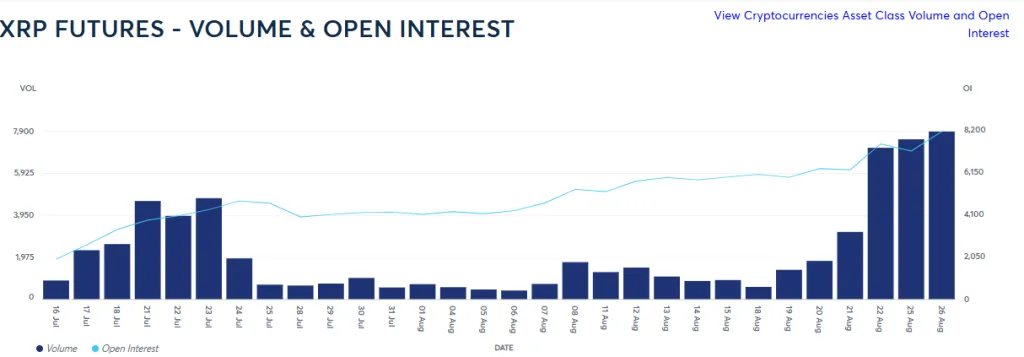

Daily activity also reflected this momentum. On August 25, XRP futures recorded their heaviest trading volume since mid-July, with 7,533 contracts traded, equating to more than $1 billion in turnover. Since launch, the contracts have generated 251,000 trades, representing $9.02 billion in cumulative notional volume.

Expanding Institutional Participation

XRP’s futures growth is not just about derivatives trading but a deep reflection of its institutional positioning. CME contracts are regulated, cash-settled to the CME CF XRP-Dollar Reference Rate, and supervised by the CFTC. These features provide transparency, security, and reliability that appeal directly to fund managers and corporate treasuries. The consistent rise in open interest, climbing past 8,000 contracts by August 26, signals growing professional participation.

Trading volumes also surged throughout August, particularly between August 21 and 26, when daily turnover exceeded $7.9 billion. Earlier July activity showed periods of volatility, yet August momentum confirmed that institutional traders were steadily increasing their exposure.

Market analysts have drawn attention to the potential impact on future product development. Nate Geraci, president of the ETF Store, commented, “CME Group says XRP futures contracts have crossed over $1B in open interest… the fastest-ever contract to do so. There’s already $800+ million in futures-based XRP ETFs. Think people might be underestimating demand for spot XRP ETFs.” His remarks raise the pivotal question: Could this surge in regulated futures trading pave the way for an eventual approval of spot XRP ETFs?

Related: Ripple Developers Defend XRP Ledger Amid Kaiko Assessment

Persistent Divide Between Institutions and Retail

Despite strong future demand, XRP remains a polarizing asset in professional circles. Pro-XRP attorney John E. Deaton remarked, “XRP is the single most hated crypto by institutional and professional traders/holders. XRP is the most loved crypto by retail investors/holders.” The discord that has existed for so long serves as a perfect example of the opposition of retail support and what can only be described as institutional doubt.

According to CoinMarketCap, XRP is currently valued at $3.00, which represents a 7.3% decline in the last month. The token is valued at $178.47 billion in market capitalization, supported by a circulating supply of 59.48 billion. Its daily trade volume is $6.68 billion, which is down 2.61%. XRP’s steady liquidity is underscored by its volume-to-market cap ratio of 3.74%, which is sustained by both institutional and retail investors