Eric Balchunas Highlights ETFs’ Crucial Role in Bitcoin’s Growth

- Balchunas argues that ETFs and strategic buying prevented Bitcoin from crashing from $30K to $10K.

- ETFs absorbed Bitcoin sell-offs, providing stability and enabling a 340% price increase.

- Institutional ETF capital has been essential in maintaining Bitcoin’s stability and growth.

As October approaches, excitement is building in the cryptocurrency market for what Bloomberg ETF analyst Eric Balchunas has called “Cointober.” This pivotal month could be a turning point for the market, with the U.S. Securities and Exchange Commission (SEC) set to make decisions on several spot crypto ETF filings.

The market’s anticipation is high as the SEC prepares to rule on spot ETFs for major altcoins like Litecoin, Solana, and XRP. The approval of these funds could mark a significant milestone in crypto’s journey to mainstream adoption.

Balchunas highlighted that without ETF support and strategic buying by figures like Michael Saylor, Bitcoin’s price could have dropped from $30K to $10K. He reframes the market “crash” narrative by highlighting how ETFs have played a crucial role in stabilizing Bitcoin.

Since ETFs entered the market, Bitcoin has seen a 340% increase in value. He further explains that the 350% growth in Bitcoin’s price since ETFs entered the market is closer to 500% when considering their impact. However, many fail to recognize the vital role ETFs have played in this growth.

Balchunas points out that ETFs were instrumental in absorbing market dips when retail investors were selling. Without this institutional support, Bitcoin’s price would have faced much more severe declines, illustrating the significant role of ETFs.

ETFs as the Backbone of Bitcoin’s Stability Amid Market Volatility

ETFs have absorbed most of Bitcoin’s sell-off for over 18 months. This influx of institutional money has been vital in keeping the Bitcoin price steady. Though retail investors tend to be quicker to react with their gut and demonstrate the extremes of that fear psychology, ETFs actually make liquidity available during extreme price moves. This has helped Bitcoin to scale gradually, despite periods of turmoil.

Balchunas argues that many critics overlook the stabilizing influence of ETFs in the market. He explains that retail sentiment often drives short-term price movements, while ETFs provide long-term market mechanics that counterbalance these fluctuations. As a result, Bitcoin’s price trajectory has been far more resilient than it would have been without institutional intervention from ETFs.

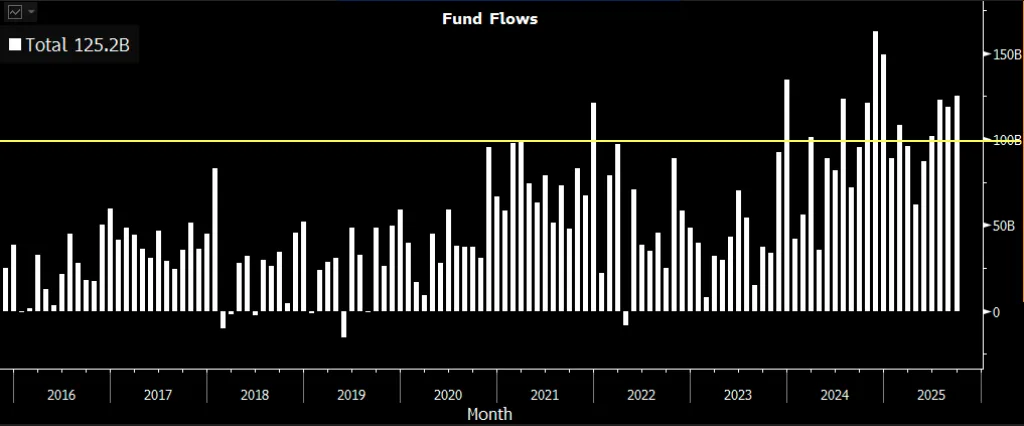

Inflows into ETFs have been more than $100 billion a month for the past four months. This level of investment is a testament to the unbridled confidence that institutions have in ETFs as an important market buoy. This institutional support has laid the foundation for Bitcoin’s further ascent.

Spot Crypto ETFs to Boost Institutional Involvement

The upcoming decision on spot crypto ETFs for altcoins such as Litecoin, Solana, and XRP next month would further cement the value of ETFs in the world of cryptocurrency. These ETFs are expected to fuel further institutional interest in the market, analysts said. If these ETFs are approved, it would mean that investors could gain exposure to altcoins without the hassle of owning them directly.

Related: XRP Prepares for ETF Decisions as BXE Expands Media Payments

The increased involvement of institutions in the crypto market, coupled with the potential approval of an ETF, could result in notable gains. This may ultimately bring about more stability in the markets, providing small and large investors alike with a secure investment vehicle. ETFs would offer a more convenient and safer way for people to invest in cryptocurrencies and garner acceptance.

ETFs are far from passive plays in crypto. They have been perhaps one of the most stabilizing factors to Bitcoin, contributing to its growth and durability. ETFs absorbed the sell-off price-wise and kept it so Bitcoin could bloom. And with more filings of crypto ETFs to be approved, the influence that institutional investment would play in the future market becomes increasingly clear.