XRP Nears $3 While Analysts Point to $10 Floor Amidst Whale Demand

- Analyst Cobb notes XRP’s steady growth and with $10 seen as a possible floor soon.

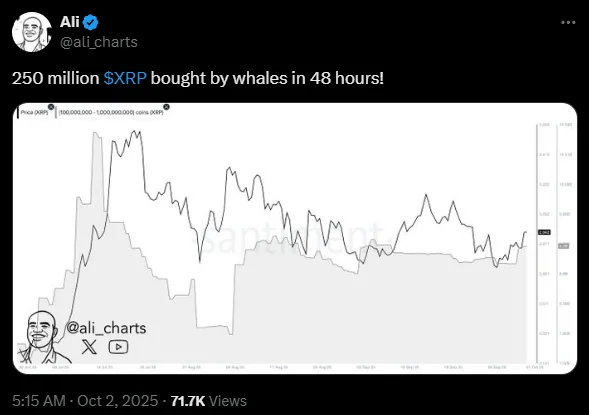

- Whales bought 250 million XRP in under two days this week.

- On-chain shows that the XRP supply is fixed at 100 billion, with inflation near zero.

XRP has demonstrated strong upward momentum, as analysts and on-chain data suggest renewed confidence in the token’s long-term prospects. Analyst Cobb shared on X that XRP is trading at $2.9831 with the current monthly candle active at 29 days and 21 hours. The chart he presented outlined key price levels at $1.40, $1.80, $2.10, $2.40, $3.20, and $3.60, showing steady upward progress.

Several large green candles dominated recent sessions, signaling a shift in buying pressure after a prolonged period of consolidation. Cobb declared, “XRP is about to go crazy. $10.00 will become a normal floor.”

Whale Accumulation Signals Confidence

In another report shared on X, analyst Ali Martinez revealed that wallets holding between 100 million and 1 billion XRP have expanded. According to Martinez, these wallets now hold around 9.2 billion XRP, showing rising institutional-scale participation. His chart showed price swings between $2.15 and $3.59, with XRP recently positioned at $2.94. Despite the volatility in August and September 2025, large investors continued to accumulate tokens during downturns, demonstrating a pattern of commitment to long-term positions.

Source: X

Martinez also said that within 48 hours, whales bought 250 million $XRP. Historically, such concentrated activity shows confidence in the token’s performance and provides a degree of asset stability. Through such large-scale acquisition, the risk to the sell side diminishes, thereby facilitating the establishment of stronger price support levels. If that stays ongoing, the month ahead could see positive momentum for the XRP, insofar as the market boosts its confidence.

Market Data Shows Strength

With the whales’ ongoing activity, XRP is trading at $2.96, registering a solid 5.85% gain for the month as per the data from CoinMarketCap during press time. It caps a market capitalization of $177.44 billion, representing a 4.22% increase, whereas the fully diluted valuation stands at $296.36 billion. Meanwhile, daily trading volume increased by an impressive 30.18% to $6.59 billion, with the volume-to-market capitalization ratio standing at 3.72%; strong liquidity is therefore confirmed between these exchanges.

The circulating supply stands at 59.87 billion XRP, against a total supply of 99.98 billion, with a maximum supply of 100 billion XRP. The total number of holders has increased to 476,414, bringing more involvement from both retail and institutional investors.

The monthly price chart shows a steady climb from $2.78 to above $3.20, followed by periods of retracement. Despite corrections in mid-September, XRP showed great strength and swiftly bounced back, presenting clear evidence of demand that remains intact in the marketplace.

Related: XRP Prepares for ETF Decisions as BXE Expands Media Payments

On-Chain Insights from Santiment

On-chain metrics as provided by Santiment offer an additional perspective. The six-month chart tracked price, annual inflation rate, total supply, and development activity. Current price data records XRP at $2.962, consistent with earlier market observations. The total supply remains fixed at 100.09 billion XRP, aligning with the red line, while circulation hovers close to that figure, preventing inflationary pressure.

Source: Santiment

Annual inflation stands at -0.00004, which is practically negligible, meaning no dilution risks for holders. Development activity exhibited alternating peaks and troughs corresponding to periods of active coding, testing, and integration, followed by quieter periods. Such cycles simply mean that development momentum on the XRP Ledger remains present.

From below $2.00 in April, the price of XRP moved up to more than $3.60 in July and remained around $3.00 in September. There have been fluctuations, but the longer-term trend has been upward with support from whale activity, increased development, and discipline over supply.