Stablecoins May Drain $1 Trillion from Emerging Banks by 2028

- Stablecoins may become the primary dollar-saving tools across emerging economies by 2028.

- Standard Chartered warns of deposit flight as users turn to dollar-pegged digital assets.

- Banks could adapt through custody services while regulators pursue rapid digital reforms.

Standard Chartered estimates that up to $1 trillion could flow from emerging market bank deposits into U.S. dollar-pegged stablecoins by 2028. The bank’s report suggests that households and firms in emerging economies are increasingly seeking low-friction exposure to the U.S. dollar without relying on local banks. This potential migration signals one of the largest capital realignments between traditional finance and digital assets in recent history.

Stablecoins are digital tokens tied to the U.S. dollar and backed 1:1 by cash or short-term Treasurys. They are redeemable on demand, providing users with a secure, stable store of value. Geoffrey Kendrick, Standard Chartered’s global head of digital asset research, and Madhur Jha, the bank’s global economist, describe them as “USD-based bank accounts” for many users in emerging markets.

Historically, these markets have adopted stablecoins more quickly than developed economies, primarily due to limited banking access and currency volatility. Standard Chartered notes that this trend could accelerate even with the U.S. GENIUS Act preventing issuers from offering yields, since users prioritize the safety of their funds over returns.

Growing Stablecoin Use and Emerging Market Pressure

The bank forecasts the global stablecoin market will reach $2 trillion by 2028, with two-thirds of demand coming from emerging markets. Analysts estimate that stablecoin “savings” could surge from $173 billion to over $1.22 trillion within three years. That projection suggests a potential $1 trillion withdrawal from emerging market bank deposits, posing a direct challenge to domestic banking systems.

“Future growth in stablecoin use for savings is likely to expand from a few large wallets to many small holders,” Kendrick and Jha stated. The analysts add that smaller but widespread holdings could prove transformative across developing economies where trust in local financial institutions remains fragile.

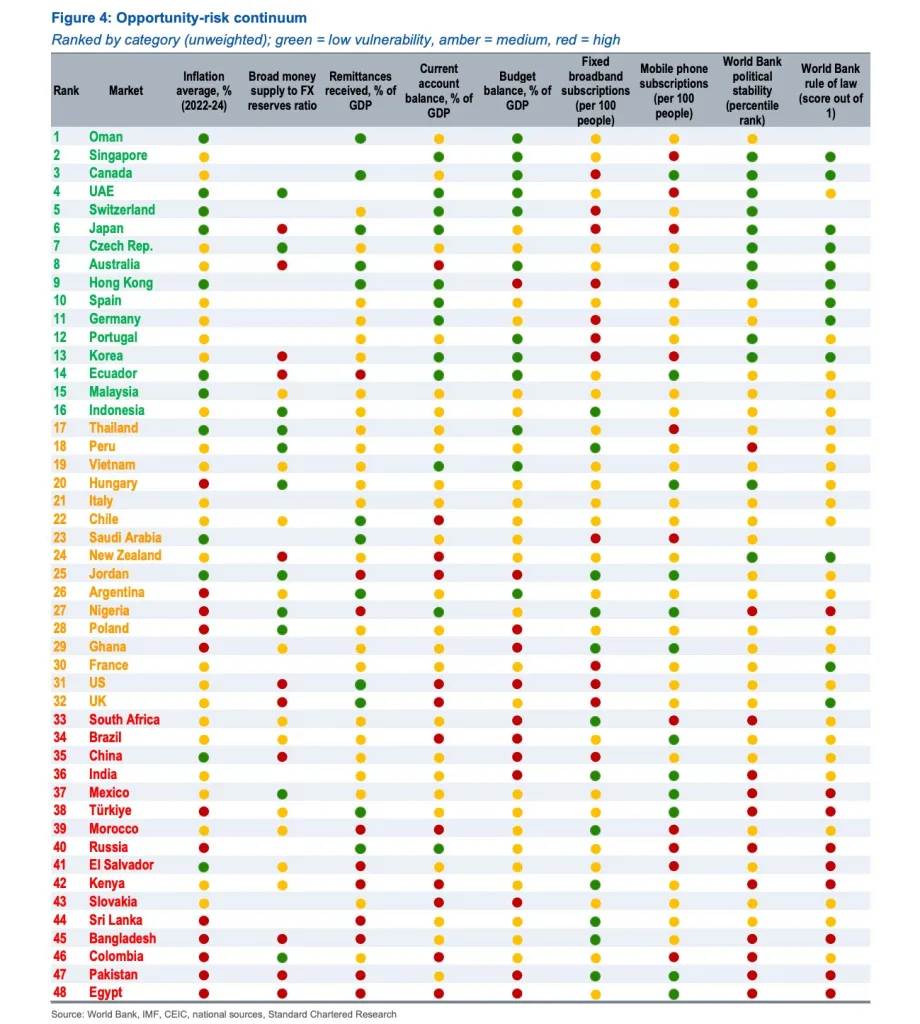

Standard Chartered’s framework ranks Egypt, Pakistan, Colombia, Bangladesh, and Sri Lanka among the most at-risk countries. Turkey, India, China, Brazil, South Africa, and Kenya also appear on the list of potential hotspots for stablecoin-driven deposit outflows. These nations, the report notes, share high inflation rates, limited access to hard currency, and rising demand for alternative savings vehicles.

Could stablecoins soon become the preferred dollar savings tool for millions in emerging markets? According to the bank, there may be some degree of reality to this possibility, owing to the rapid adoption of stablecoins and the relative convenience digital assets offer compared to legacy banking systems.

Implication for Banks and Regulatory Response

Standard Chartered warns that banks in emerging markets may face further revenue pressures that extend beyond deposit losses. Traditional sources of revenue, such as foreign exchange spreads, correspondent banking, and payments, may well be under threat of disruption. Yet, the report indicates that financial institutions might adapt by integrating stablecoin services, offering custody solutions, or acting as reserve custodians for issuers.

Meanwhile, across these various emerging economies, the regulators are working out their CNS pilots, as well as launching RTGS operational upgrades. Countries are also teaching digital literacy so that their citizens are prepared for new financial technologies. Still, the bank warns that, left unchecked, stablecoins could alter financial ecosystems and erode conventional banking models.

Standard Chartered notes that the U.S. GENIUS Act, even if aimed at restricting deposit flight by outlawing yield payments, may not necessarily dissuade adoption; for most users, stablecoins become an attractive option for everyday savings and cross-border payments precisely because of their guaranteed value preservation without any associated returns.

Related: Standard Chartered Sees Ethereum Hitting $4K by 2025

Shift That Defines Global Finance

With the projection of a trillion-dollar shift into stablecoins, Standard Chartered presents a landmark first in the annals of global finance. The report suggests that stablecoins are no longer speculative assets but have evolved into a functioning financial infrastructure. Their meteoric rise heralds the advent of digital dollars vying side by side with bank deposits in providing a venue for emerging markets to store value and mobilize liquidity.

If this evolution is truly realized, it could lead to a permanent reevaluation of how global capital flows between traditional banks and digital asset networks, ingloriously heralding a new dawn of dollar-denominated tranquility emanating from developing economies.