Aster’s 2,200% Rally and BNB’s $1,300 Surge, Coincidence or Chain Reaction?

- Aster’s 2,200% surge injects billions in liquidity and sparks fresh DeFi market momentum.

- BNB’s $1,300 breakout is driven by ecosystem demand and rising network participation activity.

- Analysts are divided on whether Aster’s rally marks a DeFi hype cycle or true market correlation.

Aster and BNB have captured the spotlight this month, commanding trader attention with back-to-back surges that few saw coming. Aster’s sustained rise, for instance, has set a new pace in the DeFi arena, soaring more than 2,200% within weeks of its debut.

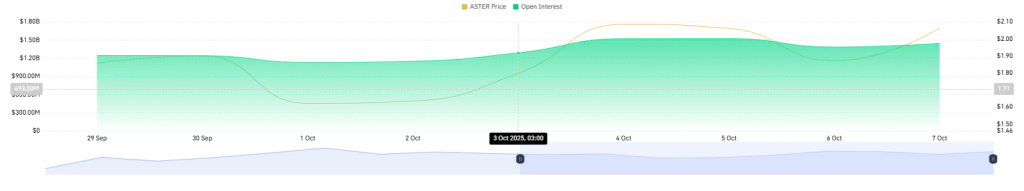

The token skyrocketed to a peak of $2.42 in its first week of trading before easing to $1.99, yet it still holds a resilient 10% weekly gain, a signal of sustained investor confidence rather than fading hype.

Fueling this rally, Aster’s market cap now stands at $3.38 billion, supported by a decisive 70% jump in daily trading volume to $2.16 billion. The numbers reveal not just momentum, but a surge in market participation that underscores growing faith in the platform’s potential and its influence across the BNB ecosystem.

At the same time, BNB has mirrored the excitement with its own strong rebound, climbing more than $450 from a low near $870 to breach the $1,300 mark. The token recently reached a peak of $1,336, increasing its market capitalization to $182 billion, driven by impressive $8.06 billion in 24-hour trading activity.

Now, as both tokens move in striking rhythm, a question lingers over the market: Is this alignment a product of bullish timing, or could Aster’s explosive growth be quietly energizing BNB’s momentum through shared liquidity and ecosystem flow?

Is Aster Quietly Fueling BNB’s Momentum?

The two surges landed almost in sync, a pattern too aligned to dismiss as chance. Data from blockchain analytics and trading platforms reveal an evident interplay rather than random market alignment.

Within just days of launch, Aster’s perpetual DEX on BNB Chain accumulated $1.45 billion in open interest and $2.41 billion in total value locked, instantly placing it among the largest decentralized trading venues. These flows required traders to bridge capital, post collateral, and pay gas fees in BNB, effectively boosting demand for the native token and deepening network liquidity.

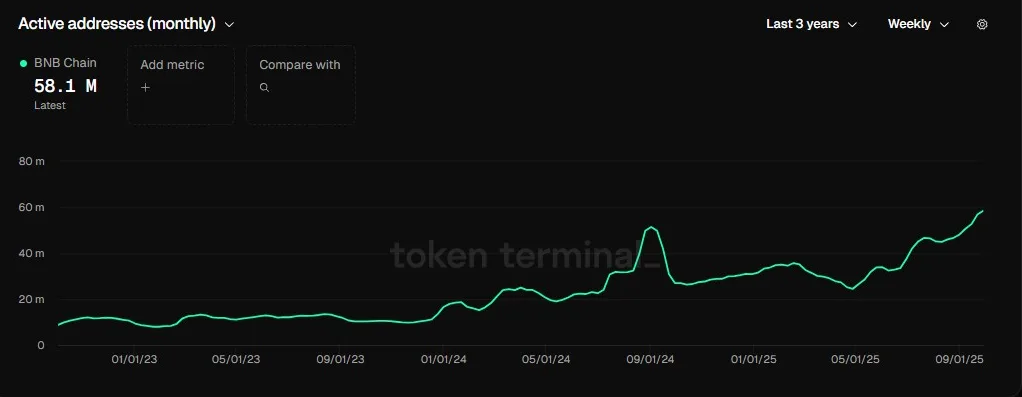

This uptick was mirrored in network metrics. As Aster’s traction grew, BNB Chain’s active addresses hit roughly over 52 million in September, regaining the lead among major Layer 1 blockchains. This sentiment has persisted, with the number of addresses reaching an all-time high of over 58 million at the time of writing, marking a 19% increase in the past month.

Under BEP-95, higher transaction volumes translate directly into accelerated token burns, cutting BNB’s supply as activity surges. This blend of user growth and programmed scarcity created a natural lift for BNB’s valuation.

Whales, Liquidity Flows, and Market Rotation

At the whale level, liquidity flows further underscored the link. One wallet spent 1,090 BNB (approximately $1.11 million) to acquire 549K ASTER in a single transaction, while others purchased 595K and 1.83 million ASTER worth over $3 million combined.

Many of these tokens were later transferred to centralized exchanges once their listings went live, a sign of profit rotation that often channels gains back into core ecosystem assets, such as BNB. The narrative momentum didn’t stop there.

CZ’s vocal endorsement of Aster’s explosive ascent, coupled with his renewed push to spotlight the strength of the BNB Chain, further ignited investor confidence. Major outlets quickly drew attention to how Aster’s sustained rise unfolded in tandem with BNB’s breakout, cementing the perception of a tightly interlinked ecosystem thriving under coordinated momentum.

Related: DefiLlama Delists Aster for Unusual Trading Volumes

Skeptics Argue Aster’s Surge Mirrors Market Euphoria

Still, not everyone is convinced that Aster directly drove BNB’s rally. Some analysts attribute both surges to the same macro conditions. September’s “Uptober” optimism traditionally ushers in strong altcoin performance, and BNB’s breakout may have been fueled by broader catalysts, such as ETF speculation, Bitcoin’s strength, and short liquidations.

From this lens, Aster’s 2,200% ascent could represent a classic DeFi hype cycle rather than a fundamental liquidity link. While the timing is remarkable, skeptics argue that it may reflect a shared sentiment rather than a causal interplay.

Coincidence or Chain Reaction?

The evidence, however, points toward a feedback loop rather than coincidence. Aster’s launch brought billions in liquidity, thousands of new users, and record engagement to BNB Chain, all factors that directly enhance BNB’s fundamentals. Meanwhile, BNB’s rising price, liquidity depth, and exchange dominance gave Aster an ideal launch environment, accelerating its adoption and visibility.

Together, the two tokens formed a self-reinforcing ecosystem effect: Aster’s success energized network activity and token demand, while BNB’s strength amplified confidence and capital flow back into Aster’s markets. Whether orchestrated or organic, the result was the same: a synchronized rally powered by ecosystem synergy.