BNB Chain Hits Record Growth and Takes Third Spot Globally

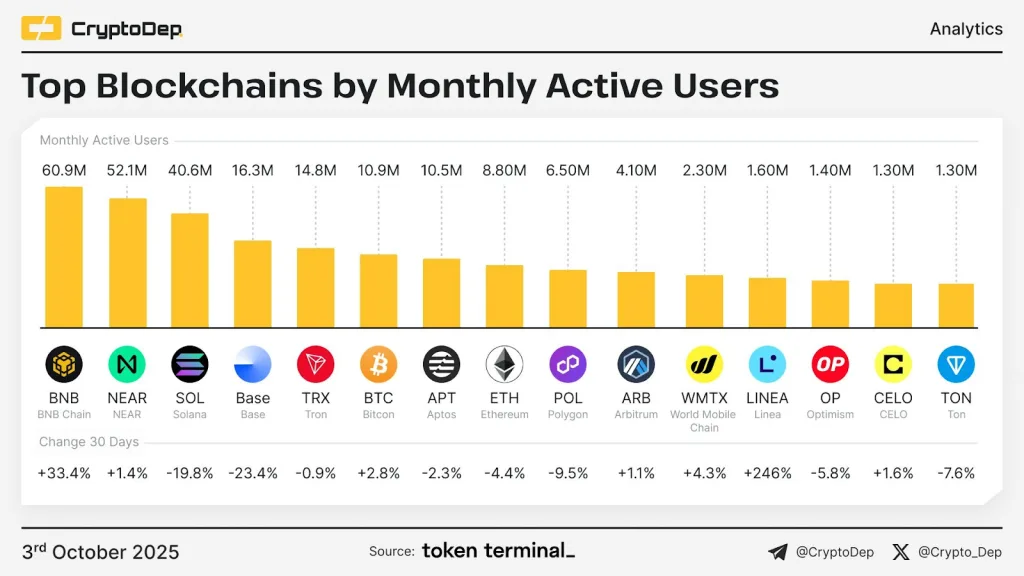

- BNB Chain now ranks third worldwide with over 60M active users and 20M daily transactions.

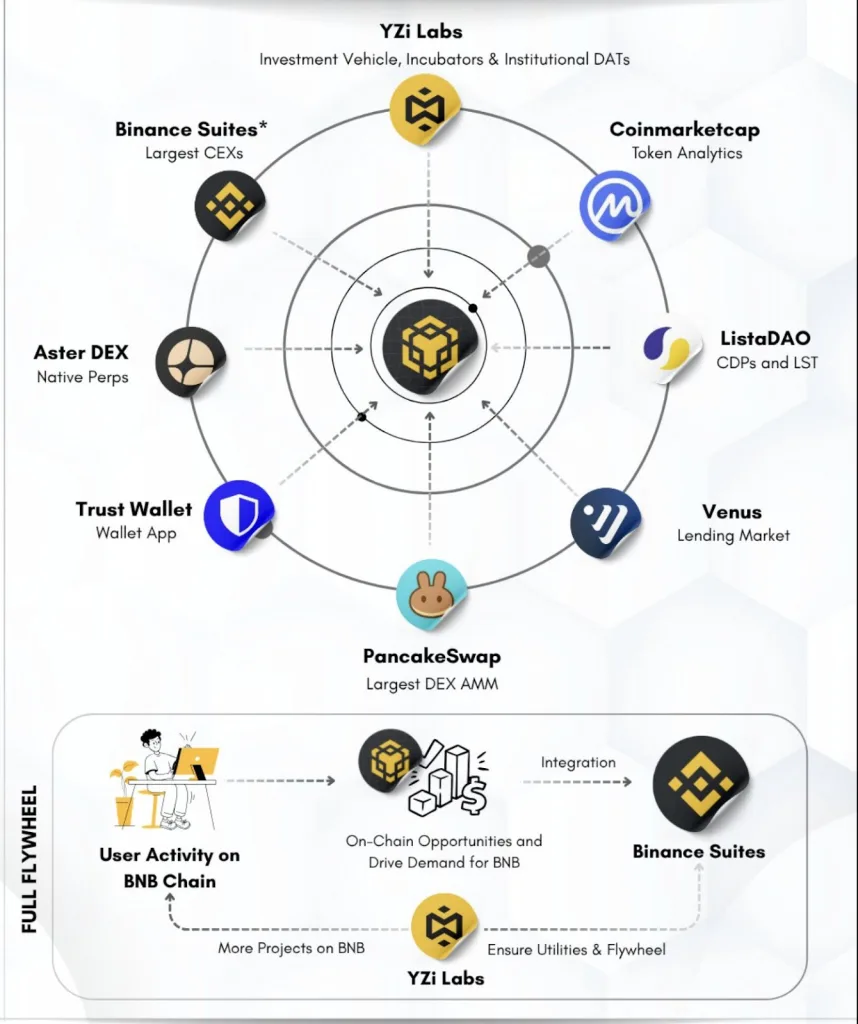

- Aster DEX, PancakeSwap, ListaDAO, and Trust Wallet power the token’s ecosystem growth.

- BNB proves progress can transform a network into lasting blockchain infrastructure.

BNB Chain has surged to new heights, securing its position as the world’s third-largest blockchain network, trailing only Bitcoin and Ethereum. This milestone marks the beginning of what analysts describe as “BNB Szn”—a phase defined by record-breaking user growth, rising DeFi participation, and strengthened institutional activity.

The chain registered over 60.9 million monthly active users and more than 20 million daily transactions, which substantiates its status as one of the most vibrant ecosystems in Web3. Now, the question arises: Is it the real breakout cycle of BNB or another hype-driven wave?

An Accelerated Ascent of Data and Consistency.

Recent statistics of BNB Chain indicate a steady increase in network usage and adoption. The network measures have been ahead of most other competitors in recent months, which is an indicator of strong structural development rather than speculation.

Analyst Momin shared a detailed post, noting that BNB’s momentum stems from consistency and execution, rather than shifting narratives. Momin reported that BNB’s price has set a new all-time high and is pushing its market capitalization above $180 billion.

This achievement moved BNB ahead of XRP and Tether, earning the network the third position on CoinMarketCap’s global ranking based on market capitalization. Charts also revealed that BNB Chain leads all blockchains in daily fees, surpassing Ethereum, Solana, Tron, and Hyperliquid, based on data from Artemis Analytics.

Despite its dominance, the network continues to maintain ultra-low gas fees—often just fractions of a cent—and delivers a throughput of up to 10,000 transactions per second. These attributes highlight the network’s efficiency and ability to handle growing demand.

Ecosystem Growth Driving a Full-On-Chain Flywheel

The development of the BNB is also based on the interconnected ecosystem. Analysts demonstrated how the Aster DEX, PancakeSwap, ListaDAO, Venus, and Trust Wallet platforms combined to solidify network activity. The projects are all different, with contributions to perpetual trading, Aster DEX; decentralized liquidity, PancakeSwap; collateralized debt and liquid staking, ListaDAO; and decentralized lending, Venus.

All these elements perpetuate a user-liquidity-development feedback loop, which drives further growth. The YZi Labs project, as the investment and incubation center of the BNB, is essential in facilitating institutional adoption and increasing innovation in the sector of decentralized applications.

Related: Aster’s 2,200% Rally and BNB’s $1,300 Surge, Coincidence or Chain Reaction?

Leadership, Strategy, and Market Confidence

Analysts credit Changpeng Zhao for maintaining a strategic focus on scalability and accessibility, while other chains pivoted through multiple narratives. Furthermore, he attributes BNB’s success to its long-term discipline. Under this approach, gas fees remain minimal, throughput remains strong, and adoption continues to rise across markets.

The analyst also noted a resurgence in DeFi volumes, an increase in tokenization of real-world assets (RWAs), and the growing popularity of native projects, such as ASTER, which has attracted traffic to the network. These indicators suggest that the development of BNB is based on real usage and not just hype.

Still, challenges remain. Inflows can decrease in case of market sentiment or tightening of regulatory conditions. The long-term momentum will require further development of governance, institutional participation, and involvement of developers. However, at this point, BNB Chain is a vivid demonstration of how a rigorous implementation, practical design, and user-centric expansion can make a blockchain an actual financial infrastructure.