Retail Panic Sparks Bitcoin Rally as Analysts Eye Market Bottom

- Santiment data shows fear spikes often come right before Bitcoin recovers strongly.

- Analysts say emotional retail panic has marked bottoms in past market cycles.

- Bitcoin and altcoins usually increase fast when sentiment becomes most negative.

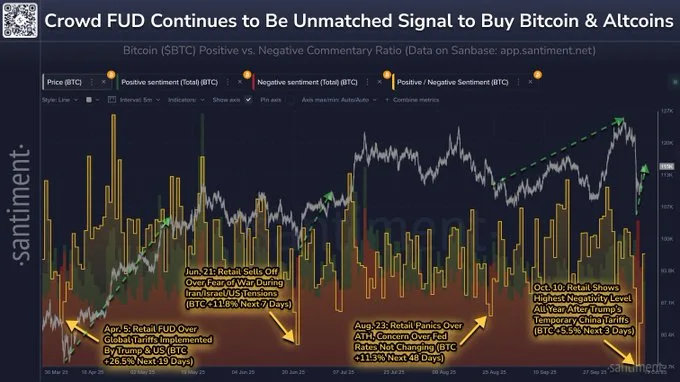

On-chain analytics firm Santiment has reported that spikes in retail fear and social media negativity have repeatedly preceded Bitcoin (BTC) rebounds throughout 2025. According to data shared on X, every major sentiment dip tied to global events triggered market recoveries within days, underscoring how fear often creates opportunity.

Source: X

The data, gathered over seven months from March to October, measures the ratio of positive versus negative Bitcoin commentary across social media. Santiment’s chart identified four specific dates showing the year’s deepest fear levels, each followed by price increases ranging between 5.5% and 26.5%.

The platform stated, “The chart represents the ratio of all positive vs. negative comments across social media over the past seven months. We’ve marked arrows next to the four most negative days since March, with the latest one occurring Friday after the U.S. temporarily implemented 100% tariffs on China.”

The firm explained that crowd emotions during these moments of panic typically lead to an opposite reaction in price action. This behavior has become one of the most reliable contrarian indicators in crypto markets.

Historical Panic Events Triggered Strong Bitcoin Rebounds

The initial sentiment breakdown was on April 5, when the U.S., led by Donald Trump, declared new international tariffs. The reaction to the retail traders was to sell off in large numbers. However, unexpectedly, Bitcoin closed the 19 days up by 26.5 percent, not submitting to bearish views, and showing that retail panic is a potential bullish indicator.

The second wave of fear actually came on June 21, when the tension between Iran, Israel, and the U.S. escalated. The unpredictability of the geopolitical situation made several investors divest their positions, as they feared that it could degenerate into war. With the anxiety, BTC has returned 11.8 percent within the next seven days, which confirms that the emotionally based responses never tend to respond well to the long-term trends.

By August 23, sentiment dropped again as traders panicked about the Federal Reserve’s decision to maintain interest rates. Retail commentary turned sharply negative even as Bitcoin hit new all-time highs. Yet, the digital asset advanced 11.3% over the next 48 days, displaying market resilience in the face of pessimism.

The latest and most severe episode arrived on October 10, when Trump temporarily imposed 100% tariffs on China. Santiment recorded the highest level of retail negativity for the entire year. Within only three days, Bitcoin rebounded 5.5%, continuing the pattern of post-FUD recovery.

Related: Bitcoin ETFs Surpass $70B as Institutions Flow In, IBIT Leads

Analysts Identify Historical Parallels to Major Bull Phases

According to Santiment, traders who purchased during these fear-driven sell-offs consistently outperformed. The firm wrote, “Retail’s emotions often dictate that Bitcoin’s and altcoins’ prices are about to do the opposite.”

Supporting this view, independent analyst Bull Theory noted that major corrections historically precede powerful rallies. He referenced March 2020 and May 2021, when markets fell by 50–60% but later produced record highs. The same dynamic, he added, repeated after the April 2025 market crash that was initially mistaken for the start of a new bear phase.

Ash Crypto, a researcher, also said that past corrections saw 25-100 times in valuation to altcoins. Market player Merlijn The Trader, in the meantime, also saw a bullish cross of the monthly Bitcoin and altcoin charts’ MACD indicators- a pattern that has not been observed since the 2017 and 2021 altseasons.

Such regular data have made Santiment propose that the existing negativity in the retail market could be an indicator of a possible market bottom in the future. The historical trend of fear before recovery may reoccur as sentiment is still shaky. The analysis provided by Santiment suggests that retail panic may be taking the headlines, but under the carpet, smart money is still hoarding as it gears up to the next event of rising momentum in the market, both in Bitcoin and in altcoins.