SHIB Forecast Reveals Bearish Outlook As Traders Exit

- Analysis confirms SHIB’s bearish outlook with a clean sell-side sweep below support.

- Prices trade under imbalance zones as traders exit positions amid a weak structure.

- Open interest drops to $115M while $3M in SHIB leaves exchanges since October.

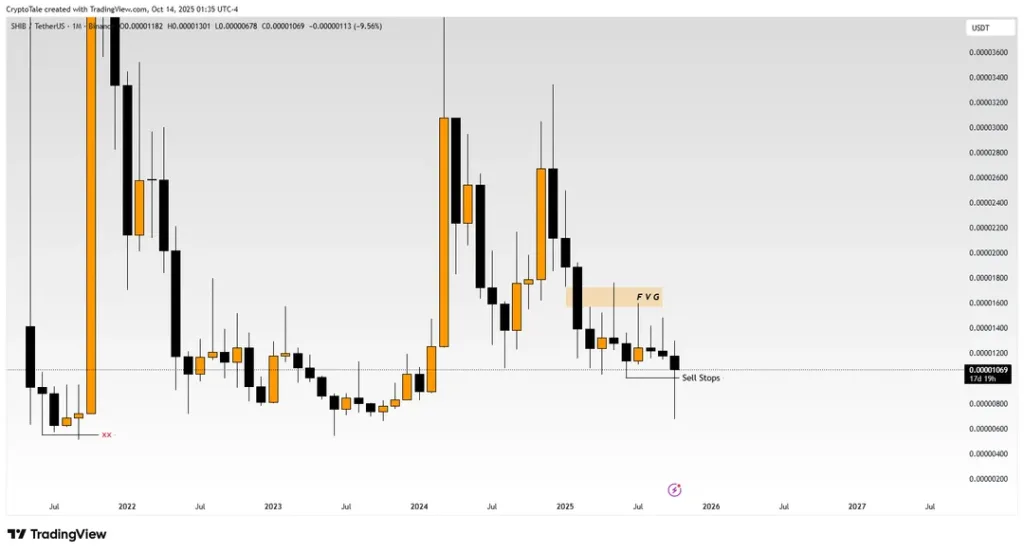

CryptoTale’s recent outlook for SHIB/USDT has unfolded as expected, with the token sweeping sell-side liquidity after a measured decline from the monthly Fair Value Gap (FVG) zone. The move confirms earlier projections that pointed to growing weakness in structure and sustained downward momentum.

Source: TradingView

According to CryptoTale’s update, SHIB tapped into a liquidity pocket below recent lows, confirming a sell-side sweep that often follows extended periods of exhaustion. The drop came after a clear rejection within the FVG zone, where the price failed to sustain higher levels and began forming a pattern of lower highs, a familiar sign of fading strength.

The broader picture still leans bearish, as the pair continues to trade below key imbalance levels that now act as strong resistance. Analysts have marked 0.000011 as a level of interest; losing this zone could open the door for further downside before a potential shift in direction.

Source: TradingView

Besides, data compiled by CoinMarketCap during writing shows SHIB gained approximately 2% over the last 24 hours, but has dipped by 11% over the week and 19% over the month.

Even so, a reaction or accumulation phase could begin once selling pressure eases. According to CryptoTale’s analysis, once liquidity is fully absorbed, a short-term recovery may appear, offering traders an opportunity to reassess market sentiment.

Market Breathes as SHIB Bears Show Signs of Exhaustion

Shiba Inu’s (SHIB) recent trading pattern suggests that sellers may be losing strength, as key indicators hint at a slowdown in bearish momentum. The token continues to hover near vital support levels, and both chart and on-chain data indicate a possible short-term rebound.

On the charts, the Relative Strength Index sits near 37, still weak, but not collapsing. That level has often marked the moment when sellers begin to tire, and it’s close enough to oversold territory that a slight buying interest could easily turn into a short-term bounce.

Source: TradingView

Volume tells a similar story. The red bars that once screamed panic have thinned out, showing that traders are less aggressive now. Markets often breathe during these pauses, trading sideways before deciding what comes next.

This kind of lull has preceded many consolidation phases in the past, a calm before the next decisive move. On the other hand, Murrey Math levels mark the battleground. SHIB sits around the 1/8 line near $0.00001043, a price that often sparks reactions.

Beneath it waits the 0/8 level at $0.00000894, the line many chart watchers call “ultimate support.” If bulls regain some ground, resistance appears near $0.00001192 and again around $0.00001341, where past rallies have paused.

Related: ASTER’s Price Dips After Stage 2 Airdrop Launch, Rebound or More Pain?

Data Shows Confidence Wavering Across the SHIB Market

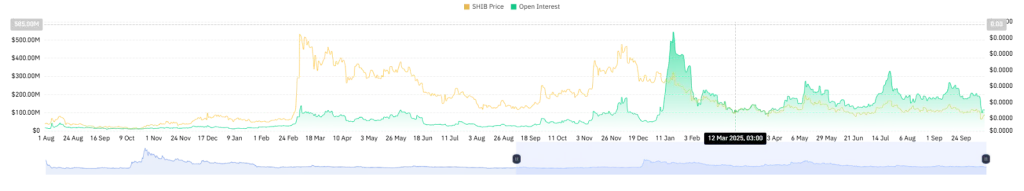

SHIB’s open interest continues to slide, hovering near $115 million after peaking around $542 million in mid-January. The decline indicates that traders are closing their positions rather than opening new ones, a clear sign of waning enthusiasm.

Source: CoinGlass

Many appear to be taking profits while uncertainty lingers, reflecting reduced confidence in the token’s near-term strength. This kind of pullback in open interest often cools volatility across the market.

With fewer leveraged positions in play, price swings tend to narrow, paving the way for a consolidation phase if sentiment fails to improve. At the same time, on-chain data shows persistent outflows from exchanges.

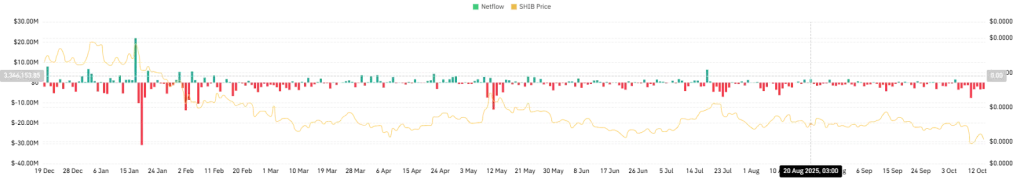

Source: CoinGlass

Since early October, over $3 million worth of SHIB has been withdrawn, indicating sustained selling activity. The steady drain of liquidity from trading platforms underscores growing caution among holders, a pattern that could keep short-term price pressure intact unless buying interest returns.

In summary, SHIB’s recent market behaviour reflects fading trader confidence and ongoing caution. Declining open interest, steady outflows, and weakening structure all point to a cautious phase. Until strong buying momentum returns, the token is likely to remain range-bound, awaiting renewed sentiment to drive direction.