CME Crypto Futures Hit Record in Q3 as Ether Leads Growth

- CME posted over nine hundred billion dollars in crypto futures and options trades in Q3.

- New Solana and XRP options were launched to extend regulated market participation.

- CME’s Ether futures and options see record volumes, signaling rising institutional adoption.

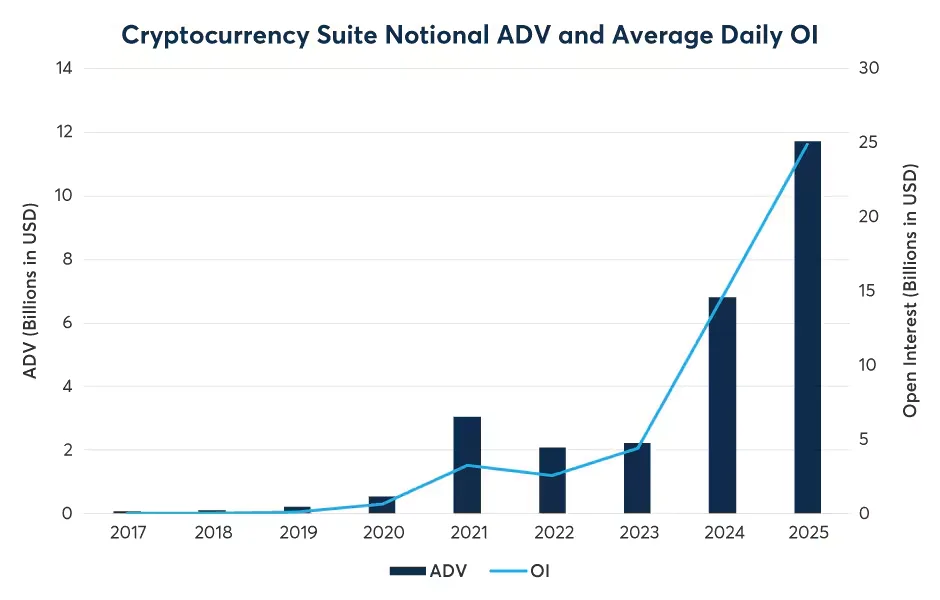

CME Group’s Crypto Insights report for October 2025 showed an exceptional expansion in its cryptocurrency derivatives business. The world’s largest derivatives exchange recorded over $900 billion in combined crypto futures and options volume during the third quarter of 2025. This marked the highest quarterly total since its crypto listings began.

Average daily open interest (ADOI) amounted to $31.3 billion, while notional open interest got very close to $39 billion on September 18. The exchange also tallied 1,014 large open interest holders (LOIH) at mid-September, which is a sign of increasing institutional participation. This uplift in activity proved that crypto derivatives have gone beyond the hands of specialty traders and now engage a wide spectrum of institutional investors.

Within the broader surge, Ether (ETH) products delivered outstanding growth. During August, CME’s Ether and Micro Ether futures achieved record daily volumes of 543,900 contracts worth around $13.1 billion, alongside open interest of $10.6 billion. By September, ETH futures posted an ADOI of 203,000 contracts (valued near $8.7 billion), while Ether options rose to an ADOI of $1.2 billion, a 37% jump from the prior month.

These milestones reflect rising confidence from asset managers and trading firms in integrating regulated digital-asset instruments into their broader strategies.

CME Launches First-Ever Solana and XRP Options

CME Group expanded its regulated crypto offerings by launching options for Solana (SOL) and XRP futures in October 2025. The contracts are approved by the U.S. Commodity Futures Trading Commission (CFTC), placing them alongside Bitcoin and Ether options on the same venue.

All SOL and XRP options are physically settled into their respective futures and available in standard and micro sizes. Traders can choose from daily, monthly, or quarterly expirations, providing multiple avenues for hedging and price speculation.

Giovanni Vicioso, Global Head of Cryptocurrency Products at CME Group, said, “With the deep liquidity we’ve built in our Solana and XRP futures markets, these new options provide traders with additional tools to enhance their growing cryptocurrency investment and hedging strategies.”

According to CME data, the first XRP options block trade took place on October 12 between Wintermute and Superstate. One day later, Cumberland DRW and Galaxy executed the first Solana options block trade. The exchange described these trades as early signs of broad client interest and proof of expanding institutional depth beyond Bitcoin and Ether derivatives.

Could this growing adoption of altcoin derivatives redefine how institutions approach diversified crypto portfolios?

Related: CME to Launch SOL and XRP Options for Institutional Traders

Spot-Quoted Futures and Expanding Institutional Access

CME’s October 2025 report also noted the success of its spot-quoted futures, specifically QBTC for Bitcoin and QETH for Ether. These products provide capital-efficient exposure similar to spot trading while maintaining the advantages of regulated futures.

Since launch, over 3.5 million contracts across CME’s combined Crypto + Equity suite have been traded, including roughly 400,000 QBTC and QETH contracts representing $380 million in notional value. September’s activity recorded a sharp 97% monthly increase, reaching an average daily volume (ADV) of 107,000 contracts.

CME viewed this growth as an indication of the strong institutional demand for the crypto exposure that is transparent and efficient, coming through the established financial infrastructures. CME’s October 2025 Crypto Insights presents a rapidly maturing digital asset scenario, where the institutional participation, product innovations, and regulatory clarity are all changing the direction of derivatives markets.

As per CME’s official communication and Giovanni Vicioso’s statements, the firm’s crypto division is gaining more ground as investors search for compliant instruments through a wide range of assets.