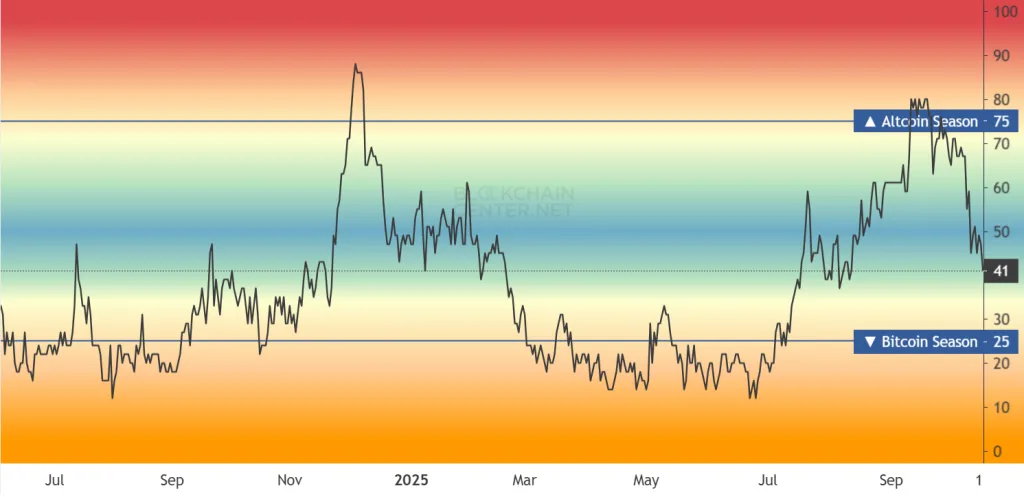

Altcoin Season Index Drops from 80 to 41 in a Month: Report

- The Altcoin Season Index dropped from 80 to 41, signaling a shift toward Bitcoin dominance.

- Bitcoin’s stability contrasts with altcoin volatility, reflecting growing investor caution.

- Analysts see potential for BTC’s $100K support level to spark a rally in the coming months.

The Altcoin Season Index has seen a significant drop, falling from 80 to 41 in just one month. This sharp decline signals a major shift in market sentiment, with Bitcoin once again taking the lead. The move suggests traders are rotating out of altcoins and into Bitcoin as the market faces increased volatility and broader macroeconomic uncertainty.

Source: Blockchaincenter

The crypto market has experienced heightened fluctuations, exacerbated by global tensions and unpredictable trading patterns. As Bitcoin hovers above $107,000, down 6.51% over the past week, investors have shifted their focus back to the leading cryptocurrency. Meanwhile, altcoins have seen diminished activity as their market dominance weakens.

Altcoin Season Index Drops Sharply

The Altcoin Season Index, an essential measure of the market mood, is at 41. This is a long way from its peak of earlier this year, when it hit 80. That’s a dramatic shift that reveals escalating caution among traders, who are hedging their bets with Bitcoin. The liquidity that once flowed freely into altcoins is now being redirected towards Bitcoin as it emerges as a safer asset during this uncertain period.

The broader market slump has affected altcoins as well. The combined cryptocurrency market capitalization (excluding Bitcoin and stablecoins) fell from $1.5 trillion to $1.1 trillion. This contraction indicates that investors are turning more risk-averse, especially since global trade tensions have been increasing with China and the United States.

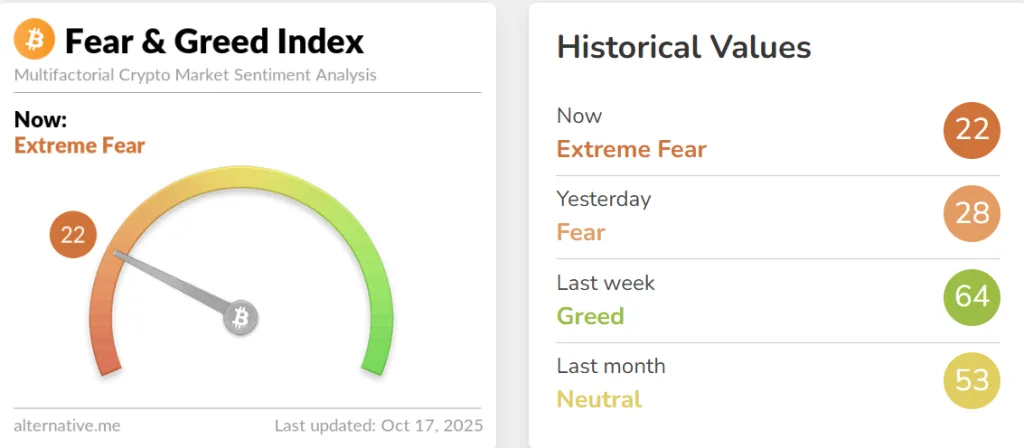

The Fear and Greed Index has also moved into the “fear” territory, displaying 22 today. This gauge measures investor sentiment and has been an accurate indicator of market turns in the past. A reading in the fear zone indicates panic selling and liquidation is increasing, which may lead to further falls on the wider market.

Source: Alternative

Despite the ongoing pullback in alts, some traders feel this reset could be an opportunity for specific alts to be accumulated. Historically, when the level of the Altcoin Season Index has been below 25, it was usually the end of a market correction with the beginning to return to the track.

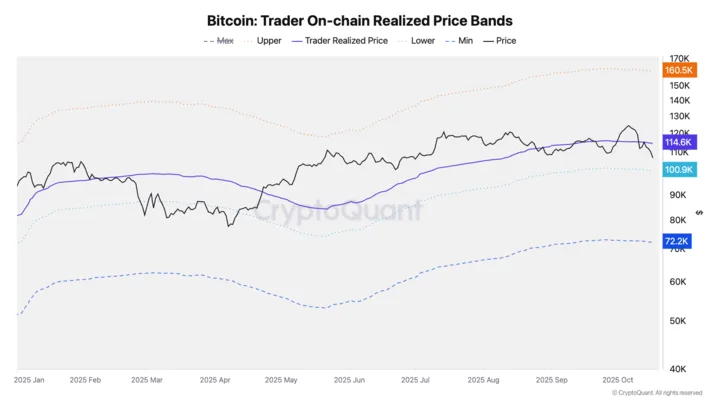

Bitcoin’s $100K Support Could Fuel Next Rally,

Julio Moreno, head of research at CryptoQuant, noted Bitcoin price is now looking for orders to fill support between the $100k+ level. Consistent with Bitcoin’s 365-day moving average, this level has been an important price point in previous bull runs. If Bitcoin sustains the price above it, then $12k could be the springboard to trigger the next leg of the rally.

Source: X

Analyst Daan Crypto Trades highlighted that Bitcoin has been searching for liquidity in recent months; with this most recent sell-off being the biggest. According to analysts, Bitcoin consolidates for weeks and then suddenly reverses in the other direction whenever it hits local highs or lows.

Source: X

It is a trend that has proved especially difficult for altcoins traders, since the focus on Bitcoin and its price action echoes through the cryptomarket. The volatility and erratic price movements have had the side-effect of a choppy environment with no obvious liquidity clusters.

Related: Altcoin Market Eyes $3T Breakout as “Short Squeeze Zone” Tightens

Going forward, Bitcoin’s position as a market leader looks stronger than ever.As altcoins cool off, the market might be leaving room for a possible next leg up. Those who are patient and discerning about what they are accumulating could be in a good spot to profit when the pendulum finally swings toward a fresh growth cycle.

Even though alts are looking slow, this is just setting the market up for a more healthy run up into the next few months. Bitcoin dominance continues to rise, prompting strategic investors to monitor the market closely. They would look for opportunities to accumulate both BTC and select altcoins poised to lead in the next cycle.