Schiff: Crypto and Wall Street Unite to Knock Gold Rally

- Schiff says crypto and Wall Street are downplaying gold’s rally to protect Bitcoin gains.

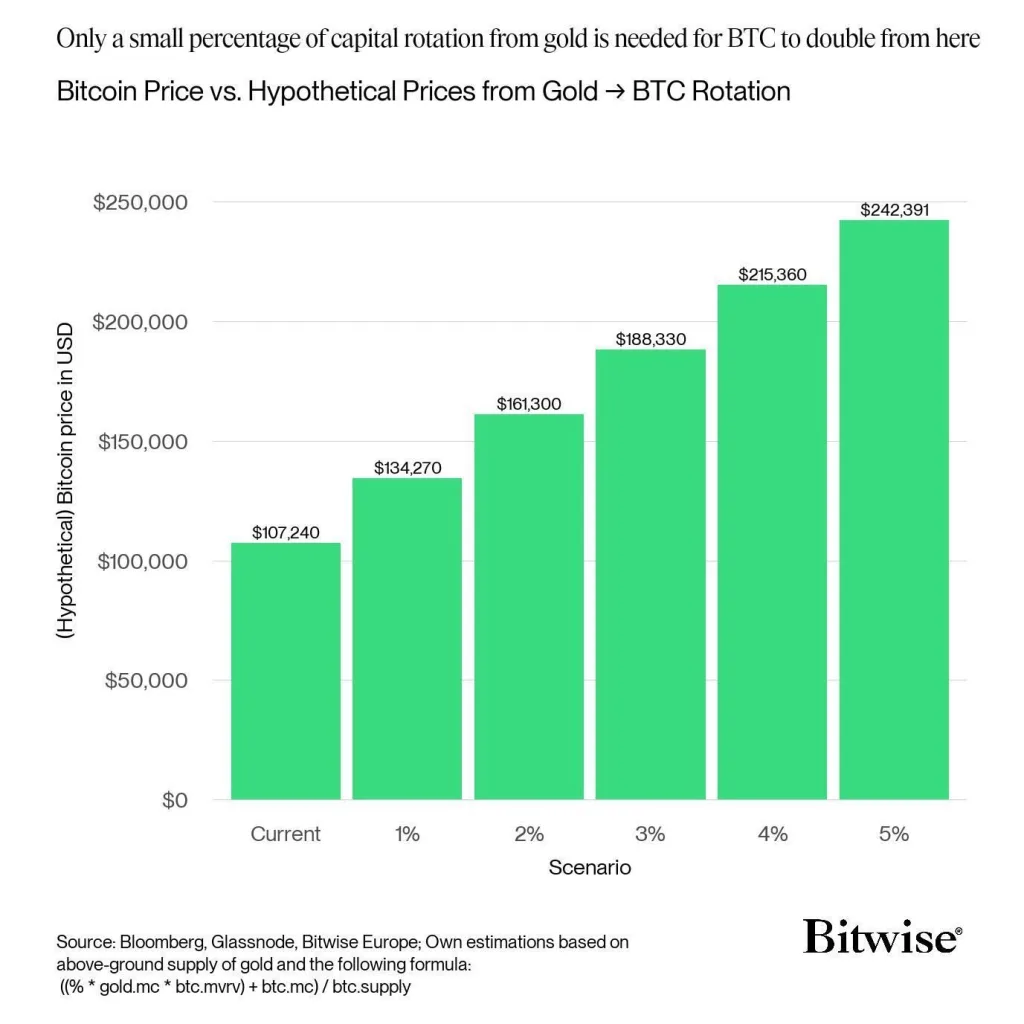

- Bitwise says a 5% move in gold could double Bitcoin, as Goldman targets $4,900 for gold.

- Central banks’ annual purchases of 1,000 tonnes keep gold’s long-term structural demand strong.

Gold’s sharp rally to $4,378 per ounce has triggered a new front in the market’s narrative war, this time pitting crypto advocates and Wall Street strategists against gold bulls. Economist Peter Schiff, in his YouTube episode “Crypto Industry & Wall Street Unite Against Gold”, accused both camps of trying to suppress gold sentiment to protect Bitcoin and equities.

Schiff described the violent pullback from recent highs as a “classic bull-market shakeout.” He said the correction was temporary and that gold’s uptrend remains safe above the $4,000–$4,100 support zone. He added that lower energy prices have improved miner margins, noting that Gold hasn’t peaked yet; it’s simply resting.

Data from CoinMarketCap show that despite the short-term drop, gold is up 51% year-to-date, outperforming most commodities. Silver followed with a 44% gain, while Bitcoin led with a 60% gain. However, Schiff argues that over the past three months, gold has matched Bitcoin’s momentum, challenging the claim that crypto dominates the store of value space.

Crypto Promoters and Wall Street Shift the Narrative

Crypto analysts have amplified warnings that gold’s rally is overdone. As per reports, Nick Puckrin, CEO of Coin Bureau, said gold’s relative strength index had crossed 80, calling the metal “overheated.” He projected a rotation of capital into “undervalued alternatives like Bitcoin.”

A Bitwise Asset Management report supported that thesis, claiming that even a 3-5% reallocation from gold’s $13 trillion market could double Bitcoin’s price. Meanwhile, Goldman Sachs released a note projecting that gold’s record-breaking rally could extend to $4,900 by December next year., “The rally remains grounded in fundamentals, not frenzy,” Goldman Sachs’ Research analyst Lina Thomas noted in a video.

According to CoinGlass data, Bitcoin futures open interest increased as gold futures experienced mass liquidations, suggesting that speculative traders indeed rotated funds between the two assets during the correction.

Related: Saylor Forecasts 30% Yearly Bitcoin Rise Amid Market Volatility

Central Banks Anchor a Structural Gold Bull Market

Schiff’s argument gains weight from the World Gold Council and IMF, which confirm that central banks have added over 1,000 tonnes of gold reserves annually since 2023, led by China, Russia, and India. The Bank for International Settlements (BIS) reports this as the strongest gold-buying streak since the 1970s, signaling a long-term shift away from the U.S. dollar.

At current prices, gold miners are thriving. Industry data cited by U.S. Global Investors show average all-in sustaining costs near $1,200 per ounce, meaning miners like Barrick Gold and Newmont now enjoy margins above 200%. Schiff believes this is the early stage of a global “post-dollar reset,” a structural shift rather than speculation.

Market watchers agree that as long as central banks keep buying and inflation persists, gold’s strategic floor will remain firm. Whether or not crypto and Wall Street are coordinating, one fact stands: gold has reasserted its dominance as the world’s most resilient store of value.

In summary, while Schiff defends gold’s strength amid digital asset hype, shifting capital flows and central bank actions show both markets are redefining value in a changing economy. As competition intensifies, gold’s resilience and Bitcoin’s innovation continue shaping the global conversation on wealth preservation and financial evolution.