How Solana Is Powering the Next Generation of Blockchain Apps

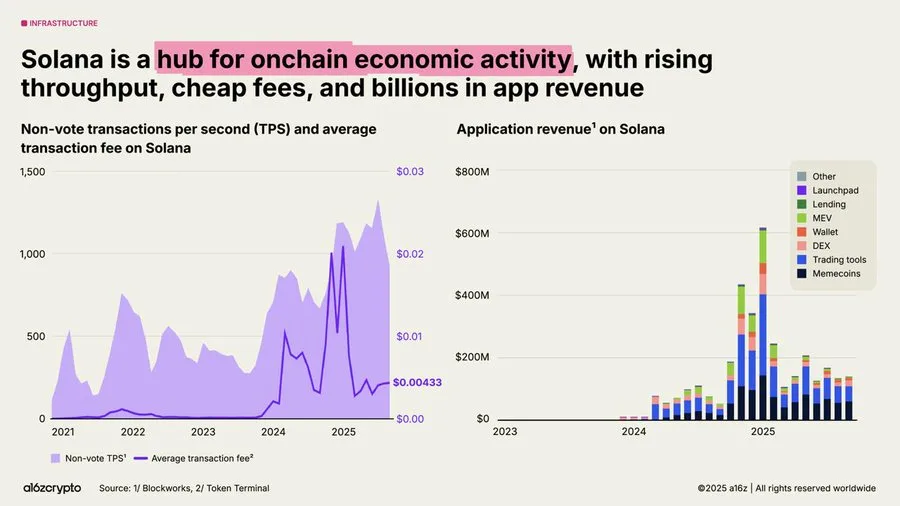

In a 2025 report by A16z, Solana was described as a hub for on-chain activity, generating approximately $3 billion in annual revenue and experiencing a 78% increase in developer interest over a two-year period. By combining proof of history with proof of stake, the Solana network prioritizes both low latency and low fees. Furthermore, new mobile, cross-chain, and validator upgrades expand reach and resilience.

Source: X

This feature article explains how these blockchain functions enable real-time, scalable applications.

Technology underpinnings and network upgrades

Proof‑of‑history and speed advantages

From a technology perspective, Solana stands out by combining a proof-of-history (PoH) mechanism with a proof-of-stake (PoS) consensus layer. The PoH feature serves as a cryptographic clock that orders events before processing, which allows nodes to agree on transaction sequences without requiring extensive coordination.

This enables Solana to process thousands of transactions per second with near-instant finality. Under ideal conditions, Solana has been designed to support up to 65,000 transactions per second (TPS). In practice, Solana’s real-world throughput for user activity, such as standard asset transfers and smart contract interactions, is approximately 1,000 transactions per second (TPS).

This is a significant difference from the much higher total TPS values of the network, which include lightweight and internal “vote” transactions that do not reflect user activity. These speeds make Solana attractive for applications such as trading, payments, and gaming that require high throughput and low latency. In comparison, early blockchains such as Bitcoin and Ethereum process fewer than 30 transactions per second and have higher fees.

Capacity improvements and finality upgrades

Developers are still increasing the capacity of Solana to accommodate the increasing activity. In July 2025, the limit on block compute in the networks was increased by 20%, from 50 million to 60 million compute units, which reduced congestion and enabled the network to support higher transaction volumes.

Solana’s other improvement includes a planned Alpenglow upgrade, expected in early 2026, which will introduce new consensus protocols that may halve finality times to 100-150 milliseconds, enabling settlement in seconds. This combination of increased block space and rapid finality allows its use in high-frequency trading and real-time remittances.

Sustainability and decentralization

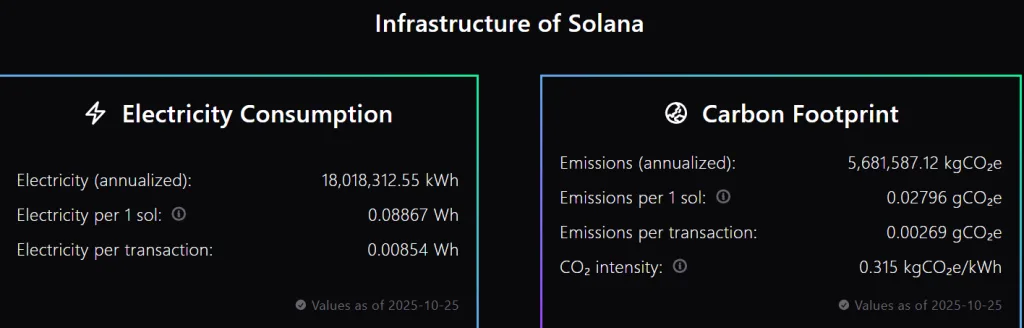

Despite the high throughput, Solana operates with a modest energy footprint. According to metrics compiled by the network, the chain consumes about 0.0086 Wh per transaction and 0.00269 g of CO₂e emissions per transaction—orders of magnitude lower than proof‑of‑work networks like Bitcoin.

Source: Solana

Furthermore, over 900 validator nodes are operating across various data centers worldwide, supporting decentralization and resilience. The network maintained 100% uptime during the 60 days before October 25, 2025, even amid a major AWS outage.

Related: How Blockchain Is Transforming Finance, Identity, and Supply Chains?

DeFi: Advanced Trading And Liquidity Tools

On the Solana network, DeFi operations rely on smart contract protocols that enable users to trade, lend, borrow, and earn yield without relying on traditional banks or intermediaries.

Key Features Include:

- Decentralised exchanges (DEXs) and liquidity pools, where users deposit their assets and earn trading fees by supporting peer-to-peer swaps.

- Lending and borrowing protocols that enable users to deposit crypto assets as collateral and borrow against them or earn interest by lending.

- Staking and yield farming systems in which users can stake SOL or provide liquidity to earn rewards, powered by Solana’s high-throughput and low-fee infrastructure.

In addition, DeFi activity on Solana has surged to over $10 billion in total value locked, according to various market trackers. The network was also responsible for nearly 81% of all DEX transactions in 2024, according to a report from Electric Capital.

Since Solana is capable of attaining high transaction speeds with low transaction fees, DeFi users on the chain can frequently transact without incurring high costs or waiting times, making it ideally suited for a scalable financial application.

Jupiter’s Ultra v3 upgrade and DeFi dominance

Jupiter, a leading decentralized exchange (DEX) aggregator on the Solana blockchain, is an example of a DeFi use case that launched its Ultra v3 engine on October 23, 2025. The upgrade features sophisticated routing algorithms, predictive execution capabilities, and gasless transaction options, culminating in transaction fees that are up to ten times lower than previous levels and providing improved protection against sandwich attacks.

Additionally, Jupiter’s Iris routing engine now examines several platforms, including JupiterZ, DFlow, Hashflow, and OKX, to enhance pricing efficiency. These improvements make high‑frequency trading and complex strategies more efficient on Solana than on many centralized exchanges.

Beyond Jupiter, Solana hosts DEXs like Orca and Raydium, lending platforms such as Solend and MarginFi, and derivatives protocols including Mango and Drift.

Stablecoin‑powered liquidity and low fees

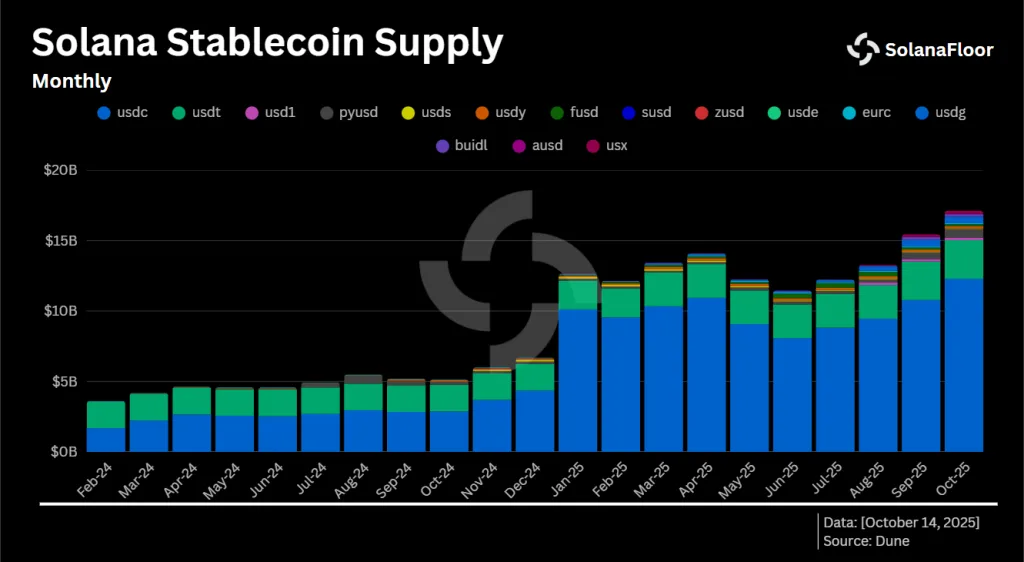

Stablecoins allow DeFi protocols to provide lending, swapping, and liquidity pools with minimal friction. According to data from the Solana floor, Solana’s stablecoin market is growing rapidly, reaching an estimated $17 billion record high by October 2025.

Source: SolanaFloor

Monthly on-chain stablecoin transactions averaged over 200 million in early 2025, with peer-to-peer volume reaching $59.2 billion in January. These numbers demonstrate the affordability and speed of transactions, making Solana a high-speed settlement layer.

According to on-chain data, Circle’s USDC is the dominant stablecoin on the Solana blockchain, with a market share of around 72.3%, equivalent to $12.64 billion.

In addition, Tether’s USDt accounts for approximately 15.7% of the stablecoins on Solana, with an estimated value of around $2.74 billion. Furthermore, PayPal’s PYUSD, launched on Solana in May 2024, uses the network’s token extension standard to enable programmable functionalities.

Other developments include Jupiter and Ethena, which are set to launch JupUSD, a Solana-native stablecoin. JupUSD will absorb around $750 million from Jupiter’s existing liquidity pool. These initiatives help to bolster Solana’s position as a popular DeFi liquidity hub.

Real‑World Assets and Institutional Integrations

Institutions can issue tokenised versions of traditional assets (such as U.S. Treasury-backed funds or equity tokens) on Solana using tools like token-extensions and permissioned environments. Furthermore, Solana’s RWA market experienced rapid growth in 2025. According to a report, Solana has more than $418 million in tokenised assets, up about 140% year-to-date.

The adoption of major financial firms is evident. For instance, Solana has collaborated with R3 (which serves banks like HSBC and Bank of America) to enable banks to use the chain for asset tokenisation and settlement. The chain is becoming a viable option for institutional use due to its high throughput, low fees, and growing infrastructure, which is suitable for compliance-oriented asset markets.

What to know: In February 2025, asset manager Franklin Templeton extended its Franklin OnChain U.S. Government Money Fund (FOBXX) to Solana, which invests in U.S. government securities and issues its shares as digital assets.

What to know: In September 2025, Galaxy Digital became the first Nasdaq-listed company to tokenize its Class A shares on the Solana blockchain. Through the Opening Bell platform by Superstate, investors can now hold and trade fractional shares of Galaxy on‑chain, bringing transparency and programmability to traditional equity.

These milestones highlight Solana’s appeal for bridging capital markets with blockchain infrastructure.

Cross‑chain interoperability and ecosystems

Solana leverages bridges and messaging protocols to link with other networks. For example, in June 2025, Wormhole launched its Native Token Transfers (NTT) framework, allowing token and data transfers between Solana and over 30 other chains, including Ethereum and Avalanche. NTT provides projects with control over metadata, customizability, and upgradeability, thereby eliminating liquidity fragmentation across chains.

Circle’s Cross-Chain Transfer Protocol (CCTP) enables the safe transfer of USDC between Solana and other blockchains with native burn-and-mint processes. Furthermore, Omnichain versions of USDT and Tether Gold (XAUT), based on bridges such as LayerZero Legacy Mesh, have been created, linking Solana to a liquidity pool outside the world. These cross-chain tools facilitate the movement of capital through networks with ease, making Solana robust within a multi-chain network ecosystem.

Furthermore, Solana’s low fees and high throughput make it ideal for NFTs and gaming. For instance, Tensor and Magic Eden use state compression to mint for about $0.00011, scaling to millions. Meanwhile, Games like Star Atlas, Aurory, and Genopets pick Solana for fast confirmation and portable assets. Hivemapper rewards contributors in a DePIN model.

Pump.fun remains the largest launchpad for memecoins on Solana, accounting for roughly 44% of market share, according to Jupiter data. By mid-2024, it had created over 11.9M tokens and briefly drove 71% of daily Solana launches. Memecoins often lack durability, yet they boost usage and showcase low-fee, high-throughput experimentation.

Related: How Pump.fun is Revolutionizing Memecoin Creation on Solana?

Developer Community and Hackathon Culture

Solana has cultivated a vibrant developer community. Electric Capital’s 2024 Developer Report found that Solana was the number‑one ecosystem for attracting new developers in 2024, with builder interest rising 83% year‑on‑year.

An ecosystem with a thriving open-source culture guarantees the sharing of improvements throughout the ecosystem. The architecture of a single global state of Solana implies that all programs run on a single ledger, allowing applications to be composable without layer-2 fragmentation.

Its development of smart-contract tools, such as the Anchor Framework, provides an easy way to build them, and better-developed RPC infrastructure and local test validators make them easier to enter. These developer-friendly features facilitate rapid experimentation, contributing to high throughput and low network latency.

Solana Mobile and the Seeker Smartphone

The consumer strategy on Solana is also focused on enabling blockchain apps to have mobile-native access. This access includes the Seeker smartphone, which began shipping worldwide in August 2025. The device has over 2,500 pre-installed decentralized applications from the Solana dApp Store, a hardware security feature called Seed Vault, and a Genesis NFT that provides early access to new applications and token rewards.

In addition, the device utilizes a decentralized TEEPIN architecture, allowing developers to distribute apps without the gatekeeping fees typically charged by traditional app stores. Priced between $450 and $500, the Seeker is made for both developers and cryptocurrency fans.

Solana’s mobile push is part of a broader trend to bring crypto into mainstream devices. Other brands have attempted crypto phones before, but the combination of Solana’s dApp ecosystem, low fees, and hardware wallet integration has drawn more than 150,000 pre‑orders. The success of the Seeker suggests that mobile‑native experiences could be crucial for the next generation of blockchain applications.

Final Words

With over 400+ dApps, Solana remains a hub for blockchain developers. In the third quarter of 2025, Solana’s corporate treasury investments exceeded $1.72 billion, indicating increasing institutional confidence in the network. The growth of corporate treasuries, ETFs, and tokenized equities, combined, suggests that the Solana blockchain is becoming a growing ecosystem in which SOL acts as both a utility token and a financial asset.