Bitcoin Plunges 14% as Exchange Supply Shrinks—Can Bulls Hold the Line?

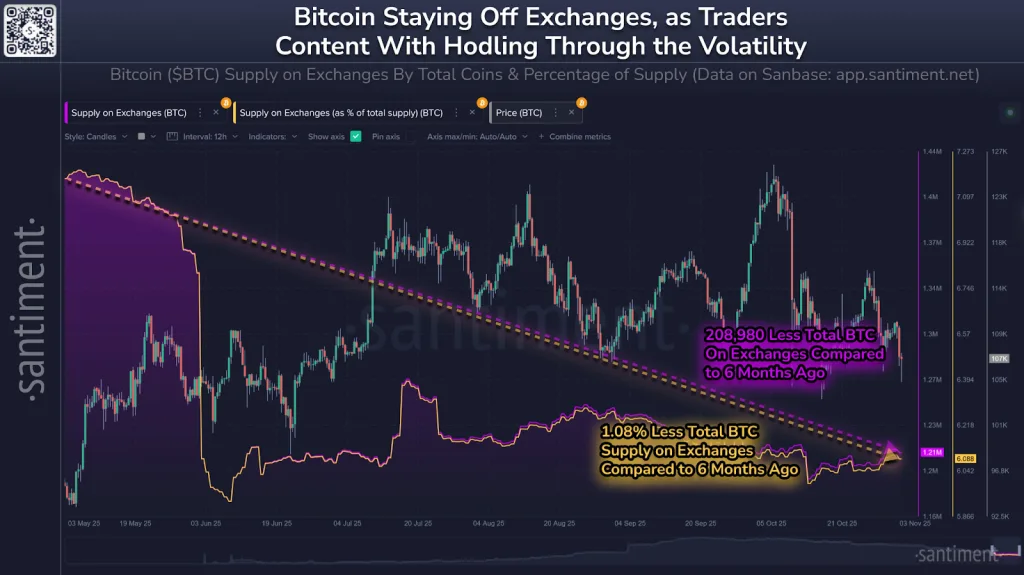

- Over 208,980 BTC were withdrawn from exchanges, cutting available supply by nearly 1.08%.

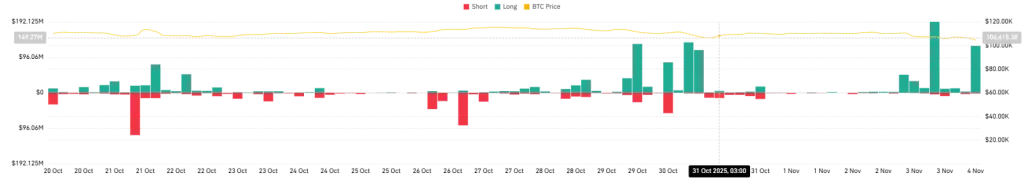

- Bitcoin drops 14% to $104k as $436M in long positions face liquidation within 48 hours.

- Fear Index falls to 24 while RSI at 36 signals more downside before a potential market rebound.

Bitcoin has taken a sharp hit, dropping more than 14% since October 6. Yet the latest on-chain numbers tell a different story. Data from Santiment shows that almost 209,000 BTC have been moved away from exchanges in the past six months, trimming the available supply by roughly 1.08%.

Instead of rushing for the exit, many holders appear to be locking their coins away, showing a reluctance to sell even as prices fall. Market watchers see that as a healthy sign beneath the surface. Fewer coins on exchanges usually mean fewer chances of panic selling and often mark the quiet phase before markets steady themselves again.

Santiment’s data shows exchange balances trending lower while the price retreats, creating a split between market sentiment and investor behavior. Many traders, rather than reacting to short-term fear, are choosing to secure their coins in self-custody wallets and wait it out. Still, the critical question remains: Can bulls hold the line?

Support Cracks as Selling Pressure Grows

As of press time, Bitcoin’s correction has deepened after the cryptocurrency recently broke below the $107k–$105k range that had acted as a firm support. Its breach has now opened the door to further losses, pushing BTC down to around $104k—a 3% daily drop, 8% weekly, and 14% monthly from its peak. The broader crypto market has also followed suit, sliding 3.6% in 24 hours to about $3.47 trillion in total value.

Analysts link much of this selloff to forced liquidations in leveraged positions. CoinGlass data shows that roughly $436 million in long positions were wiped out in two days, while only $20 million in shorts faced a similar fate. That imbalance illustrates forced selling, as traders scramble to cut losses.

The Fear and Greed Index also tells a similar story, as it now hovers around 24, deep in the “Fear” zone. This shift reflects growing anxiety across retail and institutional desks alike, as traders reassess their exposure.

Key Levels May Shape the Next Move

Technical signals suggest that Bitcoin could probe deeper levels before finding solid ground. If the decline continues, the token may test the $103.6k level, last seen during October’s “Black Friday” flash crash, when the crypto market lost $20 billion in a day.

Below that lies the $100,000 mark, the next psychological barrier. Any deeper move below this zone could reach $98,000–$97,000, close to the 127.20% Fibonacci retracement. Meanwhile, the Relative Strength Index (RSI) near 36 shows the market isn’t yet oversold, leaving room for further dips.

However, to rebuild confidence, analysts acknowledge that the token would need to climb back to the $107k-$105k corridor and convert it into support once again. Only then might buyers regain control.

Related: XRP Set for Institutional Surge as Spot ETF Nears Regulatory Approval

Opinions Split as Analysts Weigh the Outlook

Despite the adverse price action, not everyone believes this downturn signals a deeper bear phase. Analyst Altcoin Sherpa pointed to two past corrections that followed similar paths—one when Bitcoin touched $54,000 in mid-2024, and another early this year near $76,000. Both times, heavy selling was followed by powerful rallies.

Analyst Altcoin Sherpa further argues that markets often turn around when fear peaks. “It always looks the worst before reversal,” he said, hinting that this could be another setup for a recovery. His point finds support in Santiment’s data, as fewer coins on exchanges means less selling power when sentiment flips.

In summary, while short-term traders cut their losses, long-term holders continue to stack up. That shrinking exchange supply may tighten liquidity and fuel the next rally when optimism returns.

Still, the next few days are the most crucial. If bulls can defend the $100,000 region, confidence could stabilize. If not, another leg lower may unfold. Either way, the conviction of long-term investors appears unshaken.