KOSPI Reaches Record High While Crypto Trading Sees Major Drop

- The KOSPI index rose nearly 98 percent from 2023 lows, showing strong equity demand.

- Crypto trading in South Korea declined sharply, marking reduced retail enthusiasm.

- Ki Young Ju linked the surge to government efforts redirecting speculative flows.

South Korea’s benchmark index, the KOSPI, has climbed to a record 4,221.92 points, even as trading on major crypto exchanges has fallen to yearly lows. The data, shared on X by CryptoQuant CEO Ki Young Ju, reveals an extraordinary divergence between equity and crypto activity.

As shown in the chart, the KOSPI nearly doubled over two years, climbing from 2,134.77 in 2023, a gain of 97.77%. The buying momentum intensified in 2025 amid institutional investment and easy-money policies, eventually turning overall market sentiment positive.

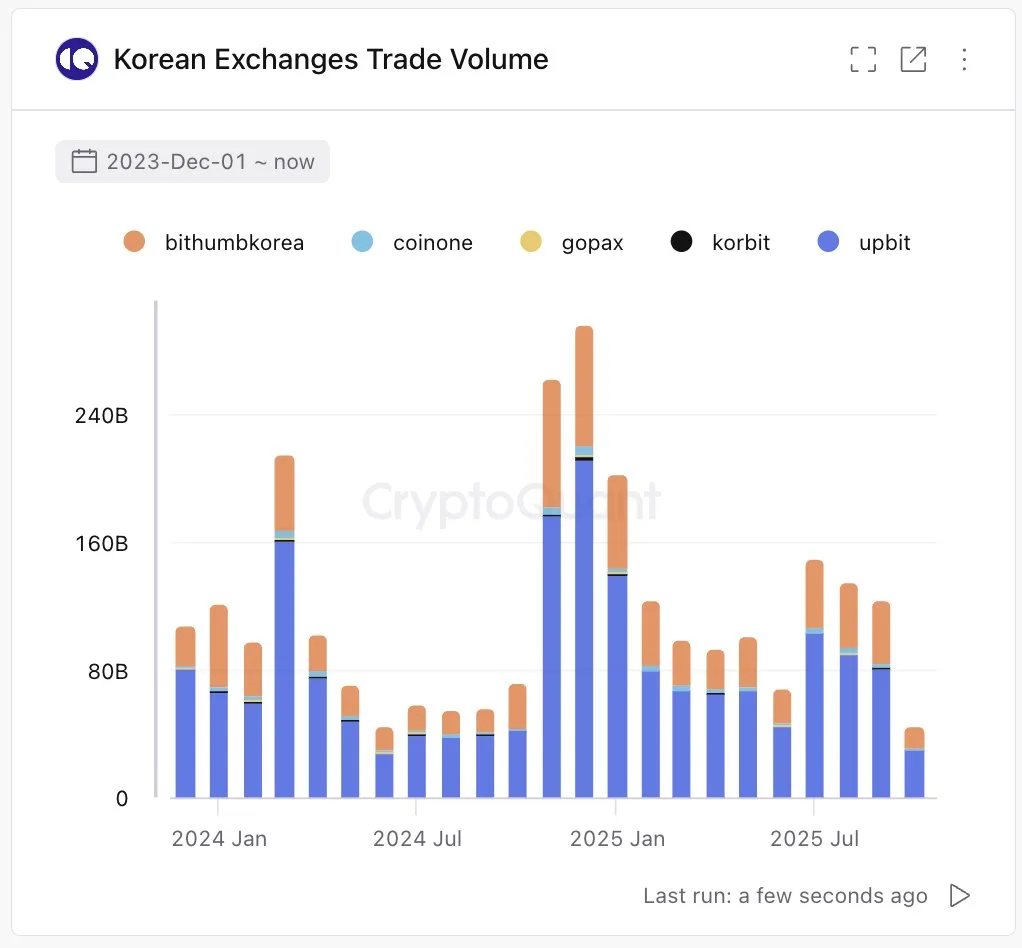

At the same time, the major cryptocurrency exchanges, namely, Upbit, Bithumb, Coinone, Gopax, and Korbit, saw a significant reduction in their trading activities. Data from CryptoQuant shows that trading volume dropped sharply from over ₩160 billion at the beginning of 2025 to about ₩60 billion in the last few months. This decrease suggests a weakening presence of retail investors and a shift in investor preferences in the South Korean financial market.

Ki Young Ju Echoes Political Speculation

Ki Young Ju acknowledged public speculation suggesting that South Korea’s government may be influencing market direction. He agreed with a user’s remark that claimed the president is actively boosting the stock market to redirect speculative capital from cryptocurrency and real estate.

The observation comes amid broader political tension and ongoing legal scrutiny surrounding the administration. Upbit remains the largest market in Korea, accounting for around 60% of the country’s total crypto trading, while Bithumb’s share has decreased since January 2025. The changes in the cryptocurrency market have occurred alongside the increase in equities and the government’s positive signals about the stock market.

Market Dynamics and Institutional Shift

The KOSPI’s rapid ascent is a clear indication of the growing trust of investors and the government’s support. All the essential moving averages, 5, 20, 60, and 120 days, have turned bullish, thus confirming the sustained momentum.

According to analysts, it has been technology stocks and exporters that have primarily driven the market upward, facilitated by the dovish interest rate policy and a strong inflow of foreign capital. The upward trend is one of the fastest recoveries of the Asian stock markets since 2023.

Related: Kaia Chair Challenges South Korea’s Bank-First Plan

Nevertheless, this question begs to be answered: Has the capital movement from crypto to stocks been purely driven by the market, or has it been guided by policymakers? Should the rally be attributed to underlying political motivations, there is a chance that existing investor confidence may be altered, and consequently, future market behavior may be changed.

Currently, South Korea is at a crucial point: the government is supporting a skyrocketing stock market, while the crypto sector is struggling to maintain its liquidity. According to Ki Young Ju’s data, the two forces have moved no longer in the same direction but in stark opposition, thus marking a new era in South Korean finance.