Ethereum Price Falls 11% as $265M in ETH Exits Exchanges

- Ethereum slid 11% this week as price action broke key support amid heavy outflows.

- Whale wallets withdrew $265M in ETH, signaling quiet accumulation across the market.

- Analysts stay divided as Ethereum weakens, yet long-term holders remain optimistic.

Ethereum’s price dropped sharply this week, losing about 11% to trade near $3,480 after failing to stay above the $3,913 resistance zone. The sell-off came as traders pulled back across the crypto market, showing a clear shift in sentiment.

On-chain trackers also revealed that more than $265 million worth of ETH, roughly 75,000 coins, was withdrawn from exchanges within 24 hours, a sign of repositioning among large investors.

Big Transfers Add Pressure but Show Long-Term Bets

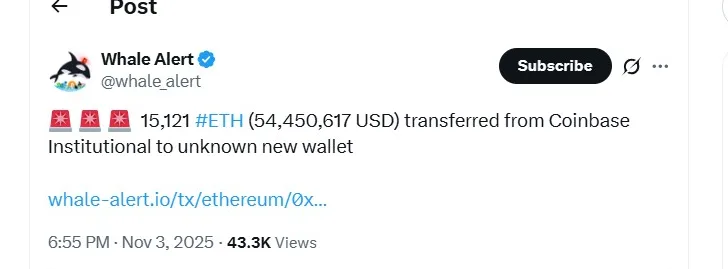

Data from Whale Alert shows a Coinbase Institutional wallet (0xceb69f6342…) made two heavy outflows totaling over 55,000 ETH. The first transfer sent 15,121 ETH, worth around $54.4 million, to a new wallet (0x629cd828…) while prices hovered near $3,594.

Later, the exact address moved 39,951 ETH, worth $139.4 million, to another wallet (0x0ea1d976…) as Ethereum traded closer to $3,493. These transfers don’t appear to be panic selling. Instead, they point to institutional reshuffling, possibly toward long-term storage or internal fund adjustments.

Elsewhere, a Bitfinex address moved 20,000 ETH, worth about $71.8 million, to an Aave lending contract, showing that liquidity is still finding its way into decentralized finance even during a market pullback.

Combined, the movements total more than $265 million in ETH leaving centralized exchanges. Historically, that’s a sign of confidence from large holders, suggesting that while short-term traders are trimming exposure, long-term investors are positioning for later gains.

Chart Signals Show Weak Structure

From a technical standpoint, Ethereum’s setup remains fragile. The 50-day moving average at $4,125 now serves as a resistance level, while the 200-day line, located within the $3,355 to $3,497 range, is key support.

A clear break below that range could push the price toward $3,100 or even $3,000, both of which are previous accumulation zones. Momentum readings also support the cautious tone. The Relative Strength Index (RSI) is currently at 34, just above oversold levels.

That leaves room for a mild bounce, but repeated rejections between $3,800 and $3,900 continue to weigh heavily on the market. Besides, a bearish engulfing candle forming under $3,913 confirmed the strength of the recent downtrend. If volume expands on the next sell-off, another leg lower could follow quickly.

Related: $425M in Solana Moves — Whale Shuffle or Exchange Play?

Analysts Divided Over Ethereum’s Next Move

Market watcher TedPillows said Ethereum is getting close to “filling its October 10 wick,” pointing to $3,400 as a key line of defense. If that level fails, he expects the token to fall into the $3,000 zone.

His charts further show layered supports at $3,354 and $3,310, creating a narrow range that could determine the next big move. Ted’s analysis also acknowledged that the upper range, between $3,545 and $3,700, has become a clear rejection zone, indicating that sellers still dominate short-term action.

Meanwhile, analyst Ash Crypto shared a different perspective, reminding traders that market cycles can flip faster than expected. He pointed out that between November 4 and December 15, 2024, Ethereum surged 75%, and the altcoin market cap soared 138%, pushing many tokens 5x–10x in under two months.

“This market only needs forty-five days to deliver explosive, parabolic returns,” Ash wrote, noting that the current conditions mirror that same setup. While the market is “dumping” again at the start of November, he believes the underlying backdrop is stronger than it appears.

In summary, Ethereum’s outlook remains uncertain as traders weigh mixed signals. Technical charts hint at further downside, yet large holders continue to accumulate quietly. Analysts remain divided between short-term caution and long-term optimism, leaving the upcoming sessions critical in determining whether Ethereum stabilizes above key levels or slips into a deeper correction.