Bitcoin Slips Below $100K, Triggering Billions in Liquidations

- Bitcoin lost key ground below $100K, sparking vast liquidations in leveraged trades.

- Ethereum and Bitcoin combined wiped out over a billion in forced market liquidations.

- Volatility and thin liquidity continued to crush traders across global exchanges.

Bitcoin (BTC) dropped below $100,000, sparking a wave of forced liquidations that swept across the broader cryptocurrency market. Within 24 hours, over $1.78 billion in leveraged positions were erased, according to data from Coinglass on Wednesday. The drop marked one of the largest single-day liquidation events of the quarter, pushing sentiment into risk-off territory. Over 441,069 traders were affected, as major positions on BTC and Ethereum (ETH) triggered margin calls and liquidation.

Bitcoin’s Freefall Reshapes Market Sentiment

At present, BTC is being exchanged at around $101,551, having gone through a slight recovery from an intraday low of $98,966, which corresponded to a very minor recovery of 0.05%. The market’s direction is currently being dictated by the descending wedge that was formed during the sharp drop from $116,400.

Resistance at $105,561, corresponding to the 0.382 Fibonacci level, is the key point of the current struggle of the bulls and bears. The major support area is next to $98,861, which is basically the local low.

Source: TradingView

The RSI (14) is currently at 32.39, indicating that the market is oversold; however, the moving average is close to 44.74, which suggests that buyer interest is weak. The broader picture shows a huge resistance zone between $116,000 and $123,600, as well as a strong support base from $98,800 to $101,000.

Both of which have been in place since August and have been tested several times. A close below $98,800 could lead to further losses, possibly down to $96,000; however, a break above $107,000 could restore short-term confidence.

Moody traders have become more cautious during the brief rally because of reduced liquidity and increased volatility. The market is still absorbing the effects of heavy derivatives trading, where leveraged players are struggling to maintain their positions as momentum continues to shift.

$1.78B Liquidations Across the Crypto Market

Data from CoinGlass shows that ETH was at the top of the liquidation list, with an amount of $590.72 million, while BTC was next at $519.73 million. They accounted for more than 60% of total liquidations due to their financial losses. MMT was next in the list with $129.59 million, then XRP with $40.84 million and finally a group of small altcoins with their sum of $107.32 million also belonging to the category of major losers.

Source: CoinGlass

Within much shorter periods, 4-hour liquidations totaled $37.69 million, and 12-hour totals reached $1.09 billion, indicating persistent pressure on the exchanges across the board. The largest single liquidation occurred on Hyperliquid’s ETH-USD pair, worth $26.06 million, illustrating the dangers of employing high leverage in unstable markets.

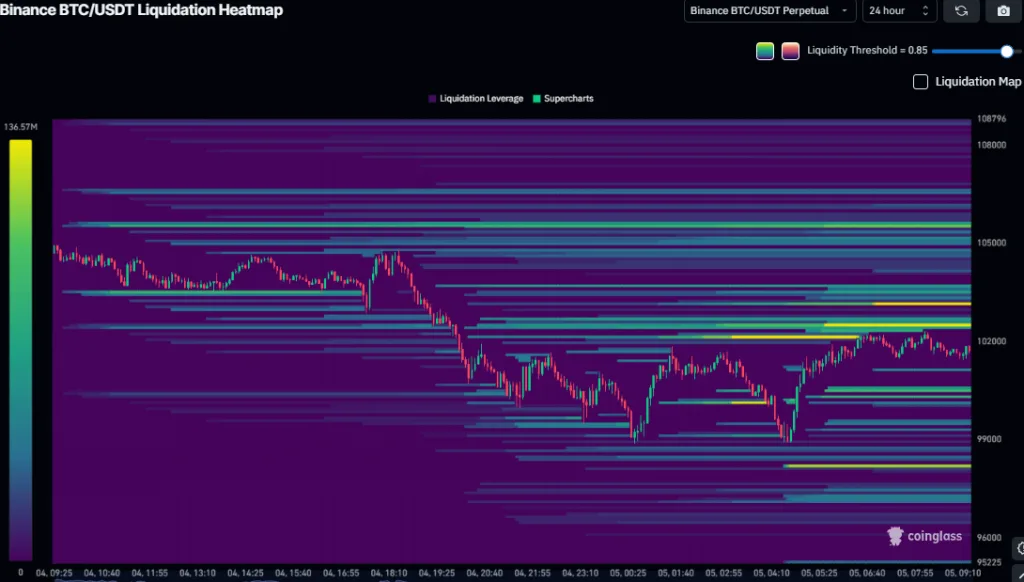

At the same time, the BTC/USDT liquidation heatmaps highlighted dense groups around the prices of $101,500 and $99,800, where forced sell-offs were occurring at a faster rate. The liquidity level remained around 0.85, indicating that there were few orders and weak depth. The significant liquidation bands of $98,500–$99,000 signify the market’s intense long exposure, which was crushed by the price compression from $105,000 to $96,000.

Source: Coinglass

A Market on Edge: Can Bulls Regain Control?

Bitcoin is currently trading at approximately $101,800, which is just above the support levels. Market players are interpreting the price action as a possible reversal, but only if Bitcoin closes above $105,000. Until then, the situation remains delicate, as traders are facing challenging times due to market uncertainty.

Related: Bitcoin Plunges 14% as Exchange Supply Shrinks—Can Bulls Hold the Line?

The market fluctuations linked to ETH, BTC, and other altcoins remain considerable, leading to margin calls one after another. Coinglass’s liquidation map illustrates over-leveraged clients, marked with yellow bands, who have been liquidated due to swift price changes. The entire crypto industry, which is still recuperating from the impact, is now put to the test of its strength.