Bitcoin Rebounds, Uplifting Major Altcoins—Is the Bull Run Back?

- Bitcoin rebounds above $103K as traders seize the dip after a volatile correction.

- Ethereum and XRP rally, signaling renewed liquidity across major digital assets.

- Institutional optimism hints at a possible market bottom as retail sentiment wanes.

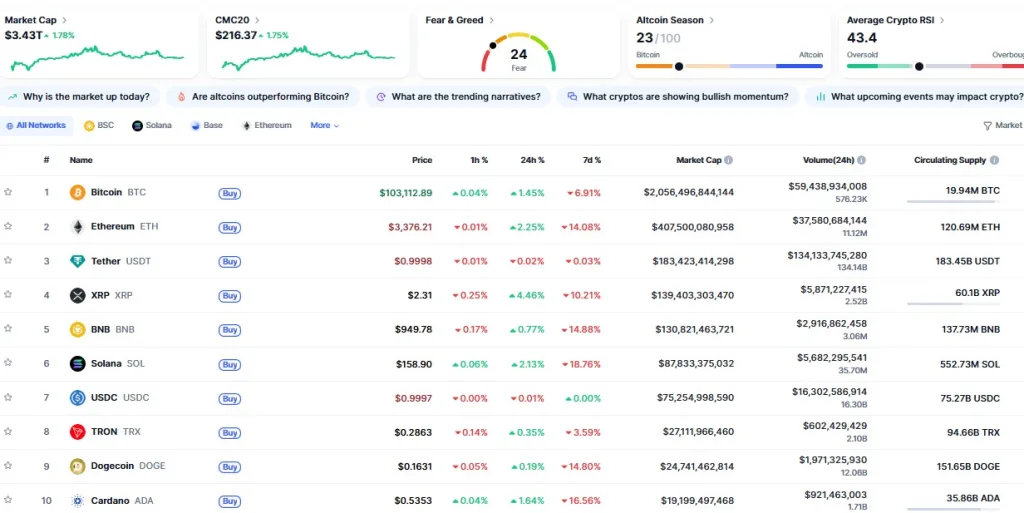

After a shaky start to the week, Bitcoin has regained strength, pushing back above the $103k mark with a nearly 2% rise over the last 24 hours. The move comes after the cryptocurrency briefly slid under $100k, losing about 10% earlier in the week. Its rebound has rekindled optimism across the digital asset market, drawing in traders who seized the recent dip as open interest begins to recover.

However, the revival wasn’t limited to Bitcoin. Ethereum and XRP led the charge among major altcoins, both posting solid gains. Ethereum rose 2.25% and is now trading above $3,300 after bouncing back from lows around $3,100. XRP advanced 4.46%, reclaiming levels above $2.30 after flirting with the $2 threshold earlier in the week.

Binance Coin (BNB) and Solana (SOL) followed with modest climbs of 0.77% and 2.13%, while Cardano (ADA) added 1.64%, although most altcoins remain down sharply over the seven-day period. Besides, the overall cryptocurrency market capitalization has grown 1.78%, now sitting at roughly $3.43 trillion.

That uptick signals improving sentiment, even as uncertainty lingers. The Fear and Greed Index, still fixed at 24, confirms investors remain wary of further volatility. Likewise, the average crypto RSI at 43.4 places most assets in oversold territory, leaving space for short-term corrections if momentum strengthens.

ZKsync, Zcash, and Quant Take the Spotlight

Amid the rebound, smaller-cap tokens have taken the spotlight. ZKsync (ZK) led the surge, rising more than 23%, with daily volume approaching $670 million. Zcash (ZEC) followed closely, gaining nearly 20%, climbing to $501, as privacy-focused assets draw renewed attention. Quant (QNT) also rose 17% to $85.81, buoyed by steady demand for cross-chain tools.

Yet, not all assets benefited from the rally. Dash (DASH) slid 13.85%, Story Protocol (IP) fell 9.69%, and Mantle (MNT) dropped 5.08%, as traders took profits following previous gains. That split performance highlights a selective market recovery driven by liquidity concentration around major coins and narrative-backed projects.

Liquidations Underscore Lingering Volatility

Despite the bounce, leverage traders continue to feel the heat. Roughly 159,000 positions were wiped out in the past day, totaling about $318 million. Shorts made up the majority, around $186 million, showing how quickly sentiment turned once Bitcoin reversed course.

Ethereum saw the largest single wipeout, worth nearly $5 million, mostly from short positions. Bitcoin liquidations, on the other hand, reached about $67 million, indicating heavier leveraged exposure compared with smaller tokens.

Nonetheless, volumes remain heavy. Bitcoin recorded more than $60 billion in turnover, and Ethereum cleared roughly $38 billion, numbers that suggest big-ticket investors are still active even as retail traders tread carefully.

Macroeconomic Catalyst Behind the Rally

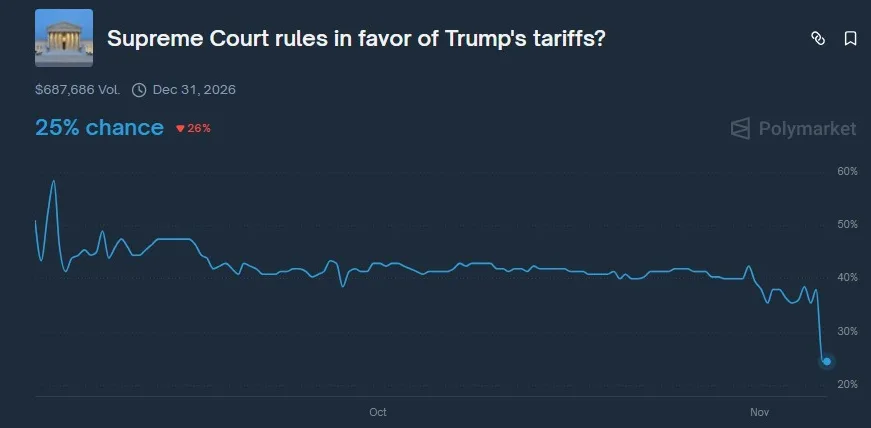

Part of the renewed buying appears tied to policy headlines. The U.S. Supreme Court began hearings this week on the legality of President Trump’s reciprocal tariffs, a case that could shape global trade and inflation outlooks.

A Polymarket prediction pool with over $667k in wagers now favors a ruling against the administration, cutting Trump’s odds of success to 25%, down from 43% earlier in the week. A decision curbing tariffs could help cool inflation, increasing the likelihood of Federal Reserve rate cuts, a scenario that has historically boosted crypto valuations.

Easier monetary policy typically channels more liquidity into risk assets like Bitcoin. Still, analysts caution that Trump could invoke Section 301 powers to reimpose selective tariffs, keeping uncertainty alive for investors watching policy headlines.

Related: ZKsync Price Jumps 150% in November as Token Gains Real-World Utility

Institutional Optimism Signals a Possible Turn

Amid the cautious optimism, institutional sentiment appears to be strengthening. Matt Hougan, Chief Investment Officer at Bitwise Asset Management, told CNBC that retail traders are nearing “maximum desperation” after months of liquidations and yield protocol failures.

He added that institutional investors remain actively engaged: “When I speak to financial advisors, they’re still excited to allocate to an asset class that’s delivered strong long-term returns.” Hougan expects a year-end rally driven by institutional capital as retail sentiment resets.

On Capitol Hill, Senator Cynthia Lummis reaffirmed her commitment to integrating digital assets within the U.S. banking system. She stated that community banks should be able to custody both fiat and digital assets, adding that several states—Wyoming, Louisiana, and Virginia—already permit such practices.

“This is the 21st-century economy,” Lummis said on X. “Digital assets are the future, and we need to make sure community banks embrace the opportunity.”

Supporting this view, on-chain analyst Willy Woo noted that “liquidity behind Bitcoin is starting to make a recovery,” suggesting that a price confirmation could arrive within two weeks.

In summary, as Bitcoin stabilizes above $103k and altcoins regain traction, the question remains: Is the bull run truly back, or is this just another relief rally? For now, both data and sentiment point to cautious optimism, with institutional interest acting as the steadying force behind the rebound.