Bitcoin Sinks to Five-Month Low as Losses Rise Rapidly

- Bitcoin drifts to $96,240, and short-term losses reach rare levels unseen in recent cycles.

- Exchange reserves are falling toward multi-year lows as supply on major platforms shrinks.

- Prices break levels, and traders watch for signs that selling pressure may cool soon.

Bitcoin has slipped to $96,240, reaching its lowest level in five months as multiple datasets show weakening momentum, shrinking exchange reserves, and rising losses among short-term holders. The daily chart shows price sliding into the $94,136–$98,000 demand zone after printing a low of $94,558 and a high of $96,846.

Short-term holder losses have reached extreme levels, as data from Glassnode shows almost 99% of all Bitcoin bought within the last 155 days now sit underwater. Meanwhile, CryptoQuant data shows exchange reserves falling to 2.39 million BTC, their lowest level of the year.

With technical and on-chain signals now pointing in the same direction, the market faces pressure as Bitcoin trades near the lower boundary of a steeply descending channel.

Price Tests Major Support Levels

Bitcoin continues to respect a clear downward structure defined by two parallel trendlines that have been in place since early October. The recent move pulled the price directly into the $94,000–$98,000 support block, which has acted as the chart’s most important defensive zone.

Source: TradingView

Price slipped beneath several key Fibonacci levels during this decline. The 0.618 level at $107,895 failed first, followed by the 0.5 level at $105,268. The 0.382 level at $102,641 broke shortly afterward. The market now trades just above the 0.236 retracement at $99,390, a level that Bitcoin briefly lost earlier in the week.

The chart also shows two rejected resistance zones. The first, marked R1, is priced around $100,000. The second, labeled R2, stretches between $114,000 and $118,000, where the price was rejected twice before the decline.

Additionally, the Relative Strength Index stands at 33.99, reflecting weak momentum but still hovering above oversold territory. The RSI continues to form lower highs that align with chart peaks.

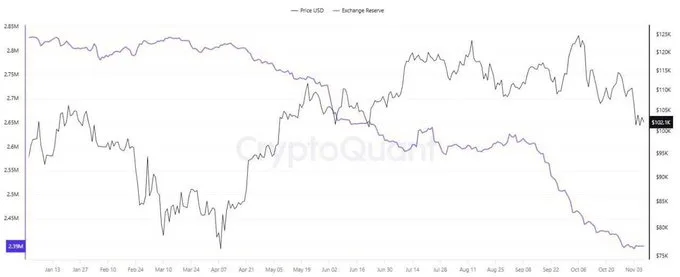

Exchange Reserves Hit Multi-Year Lows

Data posted on X by Bitlanger, citing CryptoQuant, reveals a sharp decline in exchange reserves. Holdings dropped from 2.65 million BTC in January to 2.39 million BTC today.

These reserves fluctuate between 2.75 million and 2.80 million BTC for the first quarter of the year before sliding below 2.55 million BTC in April. The decline accelerated after September.

Source: X

During the same period, Bitcoin’s price ranged between $110,000 and $125,000 before falling below $102,100. Analysts note that falling reserves typically reduce immediate sell pressure, although the price has still declined from its late-August peak of $120,000.

Bitlanger noted, “BTC exchange supply keeps dropping,” adding that the pattern suggests continued accumulation even as price weakens.

Related: Bitfarms Shares Drop 18% After Decision to Exit Bitcoin Mining

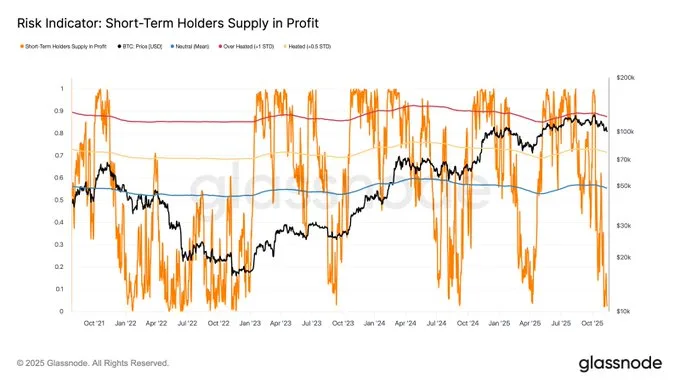

Short-Term Holders Sit Almost Entirely at a Loss

Data from Glassnode shows a sharp deterioration among short-term holders as Bitcoin trades near $96,000. The firm wrote on X, “At $96K, nearly 99% of investors who accumulated Bitcoin within the past 155 days are now holding at a loss.”

Source: X

The “Short-Term Holders Supply in Profit” metric has collapsed toward 0.01, a level not seen since major reset phases in past cycles. The price line shows a drop from $110,000 in early October to the current $96,000 region.

The neutral mean band remains near $80,000, with the overvalued region still above $120,000. Volatility spikes on the chart have tightened close to zero, signaling uniform unrealized losses across the entire short-term cohort. These conditions increase the risk of capitulation events; however, they also historically precede strong recoveries when liquidity stabilizes and selling pressure eases.