Meme coin Market Crashes to 2025 Lows as Crypto and NFTs Slide

- Meme coins dropped to $39.4B after losing over $5B in 24 hours, with rising trading volume.

- Total crypto market cap fell from $3.77T to $2.96T, wiping out $800B in three weeks.

- Bitcoin and Ethereum both posted sharp weekly losses as sentiment weakened across assets.

Meme coins reached their lowest valuation of 2025 on Friday. Their combined market capitalization fell to $38.76 billion, according to CoinMarketCap. The sector lost more than $5 billion in 24 hours. Trading volume rose by 59.80%. The decline reversed gains recorded earlier this year. The fall followed the January 5 peak, when the meme coin market reached $116.7 billion and marked a 66.2% drawdown from that high.

The broader crypto market moved in the same direction. CoinGecko reported that total crypto capitalization dropped from $3.77 trillion on November 1 to $2.93 trillion on Friday. The fall erased about $800 billion in three weeks. The decline showed that traders reduced exposure to volatile assets.

Bitcoin traded at $82,798 at the time of reporting. It fell 12.40% over the past week. Ethereum also weakened. It declined 16% to $2,688 over the same period. These movements suggested a shift in sentiment across major digital assets.

Leading Tokens Slide as Sector Weakens

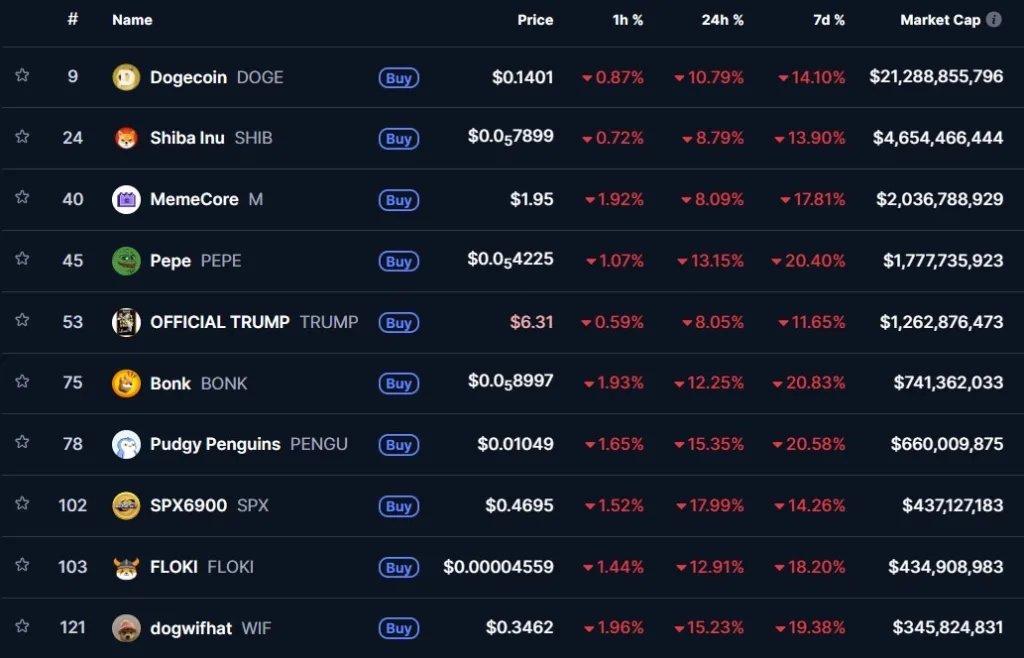

Meme coins posted uniform losses across all major time frames. Dogecoin and Shiba Inu recorded double-digit weekly declines. Pepe, Bonk, and Floki fell even further. Weekly losses across the sector ranged from 11% to more than 20%. The pattern showed that risk appetite in the segment weakened.

The Official Trump meme coin recorded the smallest drop among the leading tokens. It still declined 11.65% during the week. Dogecoin followed with a 14.10% loss. SPX6900 posted a 14.26% decline. These figures showed that no major meme token avoided the downturn.

Several tokens faced deeper pressure. Bonk, Pudgy Penguins, Pepe, and Dogwifhat each fell by about 20%. These tokens had seen strong activity earlier in the year. Their performance this week pointed to reduced demand for high-volatility themes. The shift also aligned with broader market trends.

The NFT market weakened alongside the meme coin sector. CoinGecko reported that NFT market capitalization fell to $2.78 billion on Friday. The figure marked a 43% decline from $4.9 billion recorded 30 days earlier. This was the lowest market cap for NFTs since April. The drop indicated waning interest in digital collectibles.

NFT Collections Face Broad Monthly Declines

Most leading NFT collections recorded clear declines during the past month. Hypurr NFTs from Hyperliquid posted the largest drop at 41.17%. Moonbirds fell 32.99%. CryptoPunks declined 27.21%. Pudgy Penguins dropped 26.9% during the same period. The declines covered a wide range of top collections.

Only two major collections avoided significant losses. Infinix Patrons gained 11.20% over 30 days. It became the top performer in the group. Autoglyphs held close to its previous level. It recorded a 1.91% decline, the smallest drop among major NFT collections.

Related: Whale Dumps PEPE at $1M Loss, Shifts to Aster Amid Sell-Off

The collective losses in meme coins, cryptocurrencies, and NFTs reflected a broad pullback in digital-asset markets. It was a reversal of months of fierce speculation. The move indicated a slight pivot toward lower exposures in risk-sensitive sectors. The decliners also highlighted investors’ increased caution.

Trading volumes rose during the sell-off. This indicated that market participants continued adjusting positions rather than stepping away. The drop in valuations showed weaker confidence in short-term gains. The behavior reflected a more defensive approach in the current environment.

Observers noted that liquidity conditions and changing sentiment added pressure to the market. These factors influenced trading patterns across several asset classes. Investors monitored these movements while reassessing exposure to volatile tokens.

The week’s developments suggested that volatility may remain elevated. Market participants continued to track changes in Bitcoin, meme coins, and NFT collections. Their next moves would determine whether the digital-asset market stabilizes or declines further.