Bitcoin ETFs Top Gold ETFs, Yet Safe-Haven Doubts Persist

- Bitcoin ETF growth advanced, yet gold held stronger appeal during renewed global tension.

- Market behavior showed that Bitcoin exited while gold drew long-horizon demand.

- Structural triggers have shaped debate on how BTC may secure a future safe-haven status.

Bitcoin reached a historic milestone when total ETF assets surpassed gold ETFs for the first time. The achievement took only 11 months and signaled sharp growth for the digital asset. Yet, Bitcoin still moves with risk markets as investors treat it like a high-volatility tech instrument. As of November 2025, Bitcoin ETF assets stand near $120 billion, while gold continues to attract stronger safe-haven demand.

A Gap Between Scale and Trust

Hashed CEO Simon Kim wrote on X that Bitcoin’s rapid expansion did not change its fundamental market identity. He stated that “Bitcoin grew fast, but trust needs time,” noting that gold holds a 5,000-year advantage shaped through repeated crises. He added that Bitcoin’s 16-year history “remains short in the eyes of global capital.” This disconnect raises a core question that drives current debate: When will Bitcoin secure true digital gold status?

Kim pointed to the Lindy Effect and said long survival builds stronger expectations. He noted that Bitcoin has not endured a major global crisis on the scale seen in past economic shocks. He referenced the 2020 pandemic as Bitcoin’s only real stress event and said it did not rewrite long-term market perception.

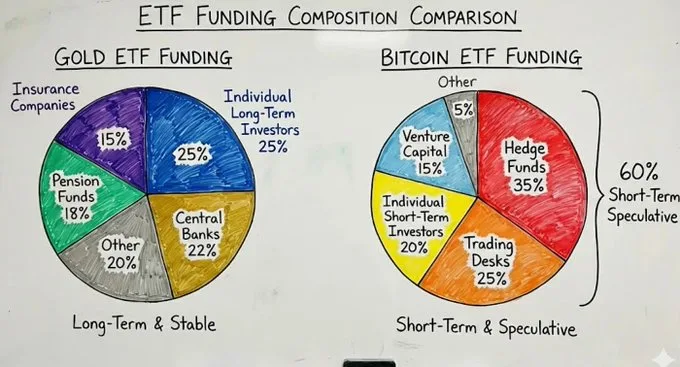

He also compared capital profiles. Gold ETFs attract pension funds, central banks, and insurance portfolios with patient capital. Bitcoin ETFs lean toward hedge funds and trading desks. Kim said this creates fast inflows during risk appetite, yet quick exits during fear. He stated that “Bitcoin still reacts like a high-beta tech asset whenever Nasdaq volatility increases.”

Market Behavior and 2025 Reversal

Kim cited correlation data to show Bitcoin’s attachment to equity sentiment. The 60-day correlation between Bitcoin and the Nasdaq 100 has averaged 0.65 since 2024. Gold maintained a near-zero or slightly negative correlation. He noted that Bitcoin dropped 64% during the 2022 rate shock, while gold slipped about 3%.

The market shift in 2025 created a deeper divide. Gold ETF assets reached $325 billion by August, while Bitcoin ETF assets held nearly $162 billion. Gold gained 60% year-to-date and surged to $4,000 per ounce. Bitcoin gained about 20% during the same period. Kim said these numbers “show continued preference for safe-haven certainty during instability.”

He linked the gold surge to central bank purchases. China, India, and Russia expanded gold reserves in 2025 as they sought lower dollar dependence. Countries such as Turkey and Poland also raised allocations. Rising geopolitical tensions across major regions added more demand for gold holdings.

He said some Bitcoin investors reconsidered their allocations as the digital gold narrative met stronger resistance. Reports on X showed several portfolio groups shifted toward blended Bitcoin-and-gold strategies as they watched capital behavior during 2025 volatility.

Related: Gold Declines While Bitcoin Holds $113K and Signals Strength

Triggers for Bitcoin’s Qualitative Shift

Kim outlined four structural triggers that could change Bitcoin’s long-term status. First, he said sovereign wealth funds and pension funds must give Bitcoin a strategic allocation. He noted that BlackRock’s IBIT grew to $97 billion and that some U.S. pension plans reviewed ETF exposure. Abu Dhabi Investment Council also added small positions.

Second, he said state-level adoption could redefine Bitcoin’s role. He noted the recent proposal submitted to the U.S. House, which calls for Bitcoin to become a national strategic asset.

Third, Kim said Bitcoin must show safe-haven performance during real crises. He pointed to the March 2023 SVB collapse when Bitcoin jumped more than 20%. He said the event did not repeat enough to form a pattern.

Finally, Kim said Bitcoin needs stronger infrastructure. Lightning Network channels rose above 150,000 in 2025. Major banks launched custody platforms, and renewable mining energy passed 50%.

Kim concluded that Bitcoin could reach digital gold status around 2030, depending on institutional actions, state approval, and repeated crisis performance.