DOGE Price Strengthens as Bullish Structure and Analyst Signals Converge

- DOGE forms a double bottom at $0.133 as the price rebounds inside the falling channel.

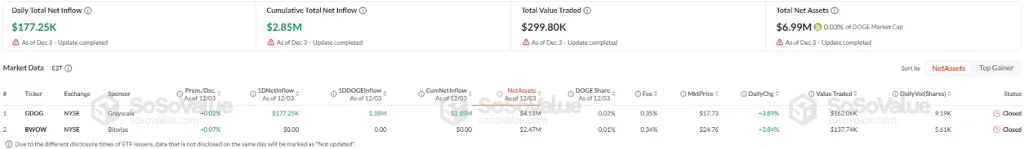

- U.S. DOGE spot ETFs log $177K daily inflows, totaling $2.85 million since launch.

- Analysts confirm new weekly reversal signals from Dragonfly Doji and TD Sequential.

Dogecoin strengthened its chart structure after forming a double-bottom pattern near the $0.133 support band, setting the tone for a technically organized rebound. The move comes as analysts highlight new weekly reversal signals that align with improving on-chain flows, rising open interest, and early ETF inflows into the two U.S. spot DOGE products.

Double Bottom Rebuilds Short-Term Structure

Dogecoin regained stability after the price touched the $0.133 region for the second time in two weeks, creating a confirmed double-bottom formation. This price zone has acted as a multi-week demand area, repeatedly halting declines during the ongoing downward channel that has shaped the market since early October.

At press time, DOGE trades near $0.15, positioned under the upper boundary of the falling channel that has consistently rejected upward attempts. The latest reaction from support mirrors previous symmetrical touches on both the resistance and support trendlines, reinforcing the channel’s validity across the last three months.

The token also trades between its 20-day and 50-day moving averages, which remain above the price but have begun tightening. Fibonacci retracement levels place the next major technical markers at $0.174 and $0.199, derived directly from the prior decline.

Notably, momentum indicators show firming strength. The RSI has climbed into the mid-40s after spending several weeks under 40. The rise matches the timing of the double-bottom rebound and the lift from the support trendline, indicating a synchronized improvement across the chart.

ETF Inflows Add a Regulated Tailwind

Dogecoin’s structural rebound has unfolded alongside modest inflows into the two newly listed U.S. spot DOGE ETFs: Grayscale’s GDOG and Bitwise’s BWOW. According to SoSoValue, the products recorded $177.25k in net inflows on December 3, lifting cumulative inflows to $2.85 million since launch.

While not large in scale, the flows show steady early participation from traditional investors as regulated DOGE products begin establishing a presence in the ETF market. The broader memecoin sector remained quiet, but DOGE benefited from the continued ETF intake as it attempted to reclaim higher chart levels.

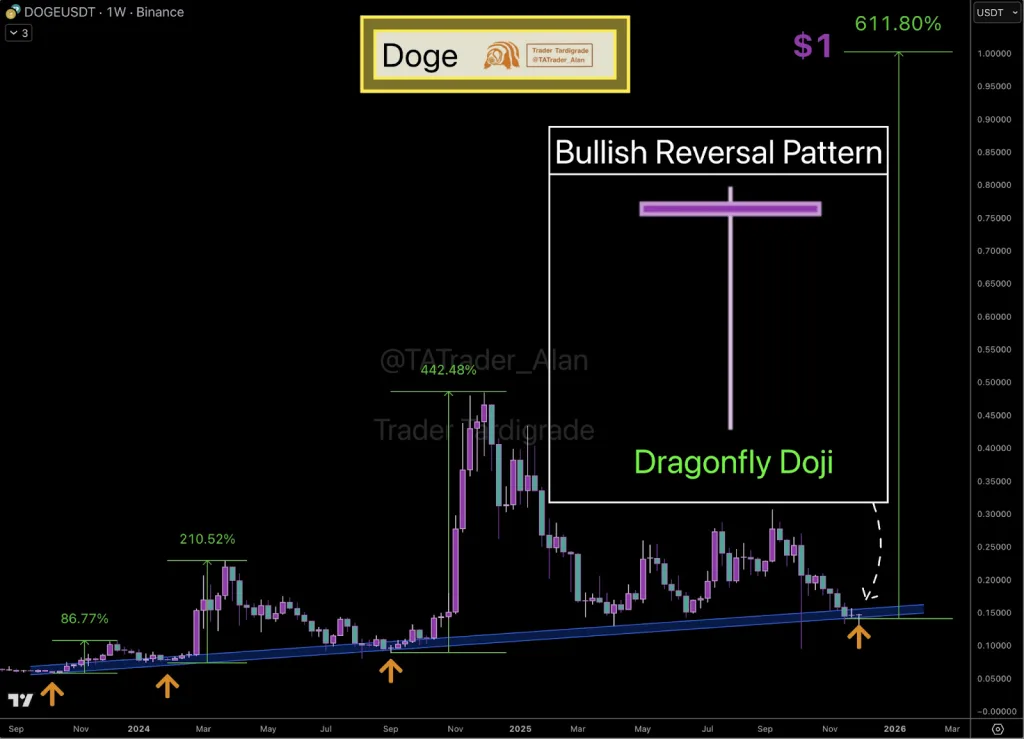

Analysts Cite New Weekly Reversal Signals

Not to leave out, analysts are highlighting the emergence of fresh weekly reversal markers that align with Dogecoin’s double-bottom recovery. Trader Tardigrade reported that the latest weekly candle has formed a Dragonfly Doji directly on a long-term support trendline.

His chart references prior DOGE rallies of 86.77%, 210.52%, and 442.48% that developed after similar support-based patterns. He notes that the new candle mirrors the structural behavior seen in those prior setups and “could mark the start of the journey towards pumping to $1.”

Related: PENGU Smashes $0.012 Barrier After 26% Rally: Can Bulls Keep Momentum Alive?

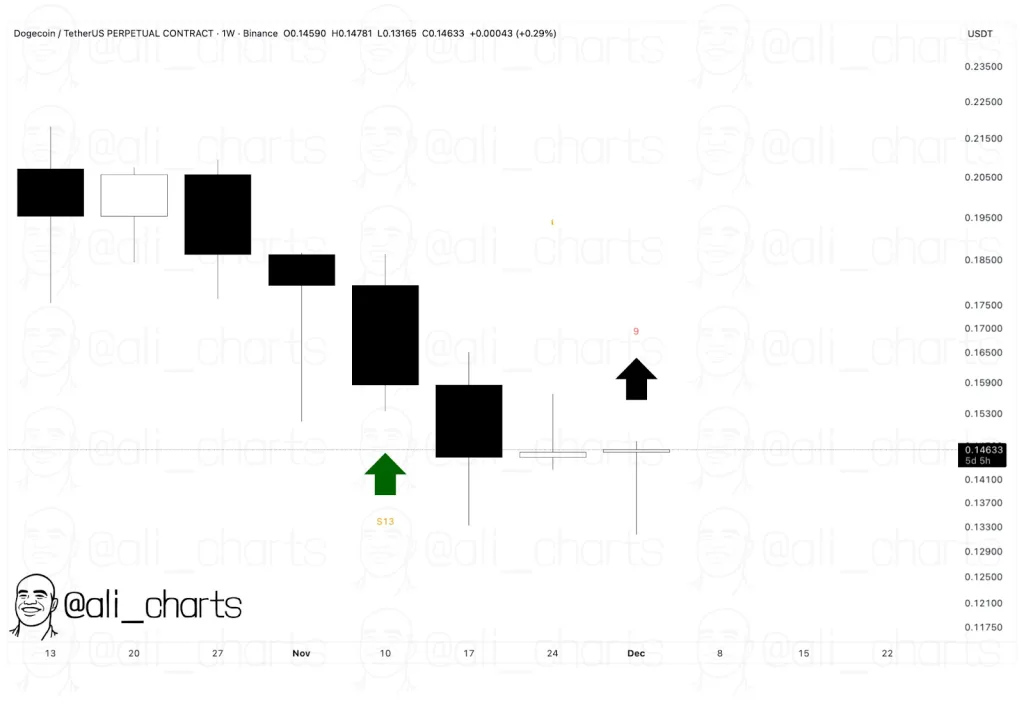

A second analyst, Ali, reported that the TD Sequential indicator has printed a weekly buy signal after a prolonged downtrend, identifying the completion of the indicator’s “9” setup. He states that this configuration historically appears near trend-exhaustion levels on the DOGE chart.

Together, these chart signals, steady ETF inflows, and analyst alerts present a more organized DOGE structure anchored by firm support. The current setup reflects stronger demand as Dogecoin continues to hold its established technical floor.