Bitcoin Eyes $95K Liquidity Zone as IFP Warns of Thin Books

- Bitcoin IFP turned red, signaling weaker exchange flows and thinner liquidity.

- BTC exchange balances reached historic lows, allowing thin order books to widen slippage.

- CryptoQuant SOPR ratio hit 1.29, showing BTC STH capitulation as Bitcoin nears $90K.

Bitcoin price has stayed relatively quiet after a pullback from the $93,000 area. BTC dipped near $88,000 over the weekend and later traded near $89,000. The narrow range has reduced short-term direction, yet several on-chain and market-structure signals point to higher sensitivity if activity returns.

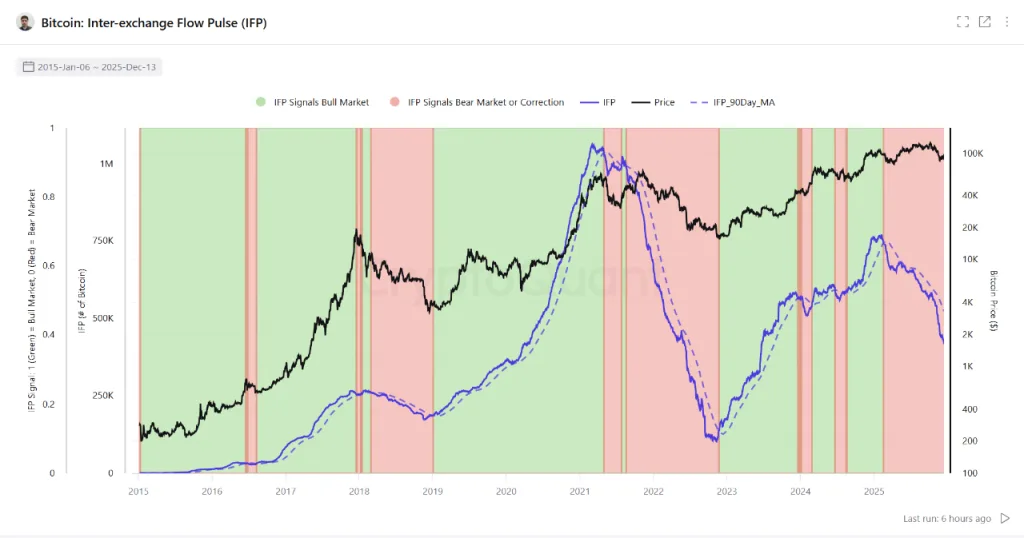

An X-Win Research analyst on CryptoQuant highlighted a shift in the Inter-Exchange Flow Pulse (IFP). The IFP signal has turned red, which the firm links to weaker capital movement between exchanges. The update frames the risk as structural rather than trend-based.

Inter-Exchange Flow Pulse turns red as liquidity circulation slows

IFP tracks how actively Bitcoin moves from one exchange to another. X-Win Research describes it as a proxy for internal market liquidity and capital circulation. The firm says high IFP tends to support smoother arbitrage and liquidity provision. That activity can help maintain thicker order books and steadier pricing.

When IFP declines, X-Win Research says the market’s “blood flow” narrows. In that environment, smaller trades can move the Bitcoin price more than usual. The chart shared with the analysis shows red IFP phases alongside periods marked by corrections and wick-driven swings. The observation focuses on reduced shock absorption, not on a single catalyst.

The same commentary notes historically low exchange balances. A limited sellable supply can support prices during normal conditions. However, thinner order books can also increase slippage once the price starts moving. X-Win Research argues that thin liquidity can amplify moves in either direction, even when the market looks calm.

SOPR ratio signals capitulation among short-term Bitcoin holders

CryptoQuant also pointed to signs of a “speculator cleanse” in recent market insights. The platform reported two-year lows in a ratio that compares loss-making on-chain transactions from short-term holders (STH) and long-term holders (LTH). The framework uses the spent output profit ratio (SOPR), which tracks whether coins move on-chain at a profit or a loss.

CryptoQuant data showed the SOPR Ratio at 1.29 in recent days. The platform described that reading as the lowest since BTC/USD began rising during the Q3 2023 bull run, when BTC traded around $30,000.

CryptoQuant contributor NovAnalytica stated that the drop suggests short-term holders incurred heavier losses, while long-term holders largely held firm and incurred limited profits or losses.

CryptoQuant also noted that extreme lows in this ratio have aligned with capitulation phases in past cycles. The firm framed those periods as weaker speculative positioning. The analyst cited the ratio as a signal of stress among short-term participants.

Related: BONK Price Bounces Off Support at $0.0000089: Is $0.00001 Next?

Bitcoin price levels: $90K pivot, $95K liquidity zone draws focus

With Bitcoin near $89,600, traders note $90,000 as a key price level. Crypto analyst Michaël van de Poppe said a break above $90,000 could trigger faster moves toward $92,000–$94,000. He also warned that failure to reclaim that area could leave room for a deeper slide.

His comments reflect how traders map short-term direction in a range-bound market. CoinGlass data also shows concentrated liquidity in the $95,000 to $98,000 level, which some analysts see as a short-term magnet. The price drop below $88,000 also drew attention to corporate buyers. Michael Saylor hinted at another Bitcoin purchase after BTC moved under that level, based on his public posts.

That context adds another narrative layer, yet the current setup still centres on liquidity conditions. X-Win Research argues that a red IFP environment can turn low volatility into fragility, especially when leverage builds and order books thin.