WisdomTree Scales Tokenized Assets While Crypto Turns Core

- WisdomTree scaled tokenized assets from 30 million to 750 million in one year alone.

- CEO Jonathan Steinberg says crypto is core and aims for near-term profitability.

- Strong ETF earnings fund digital expansion despite weak crypto market sentiment today.

WisdomTree has positioned cryptocurrency as a core business, not an experiment, as its digital asset unit moves closer to profitability, according to CEO Jonathan Steinberg. Speaking Tuesday at the Ondo Summit in New York, Steinberg said the firm now operates with long-term conviction in blockchain infrastructure. The asset manager oversees about $150 billion in assets and has scaled its tokenized offerings rapidly over the past year.

The shift reflects a broader strategic effort to build digital finance alongside its profitable exchange-traded fund business. The key question now is simple: how fast can scale turn conviction into sustainable profit?

Crypto Growth Moves From Pilot to Core Strategy

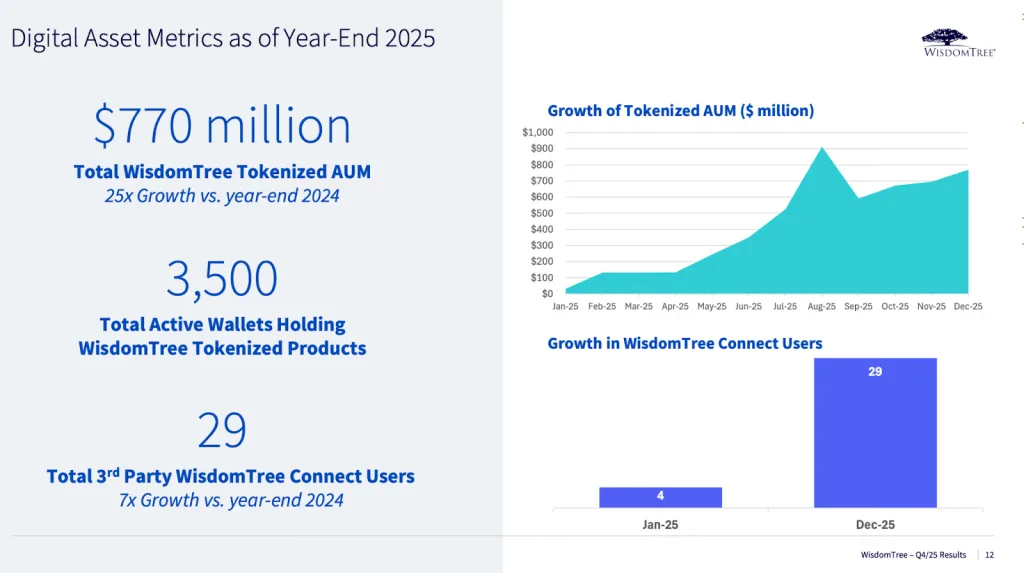

Steinberg said WisdomTree’s digital asset push now sits at the center of its strategy. He told attendees the firm plans to keep scaling its crypto operations after rapid asset growth. “We want to continue to scale,” Steinberg said during the fireside chat. He noted that tokenized assets rose from about $30 million last year to roughly $750 million.

He added that the business does not yet generate profit. Still, he said the firm remains “in line of sight of taking this to a profitable business,” signaling progress toward commercial viability.

WisdomTree has invested heavily in blockchain infrastructure. The firm launched tokenized funds and expanded support to new networks, including Solana. Steinberg said the effort reflects long-term belief rather than short-term market cycles. “It’s still early days, but it’s not an experiment now,” he said. “We have conviction.”

During its latest earnings presentation, the firm reported that total tokenized assets reached $770 million. That figure marked a 25-fold increase from 2024, reinforcing internal momentum.

Profitable ETF Business Funds the Digital Push

While crypto scales, the ETF business remains the primary profit engine. Last quarter, WisdomTree generated $40.0 million in net income. Adjusted earnings per share rose 71% year over year. Operating margins expanded by nearly 300 basis points, supported by $8.5 billion in net inflows. That performance lifted market confidence. The stock trades near $16.45 after the results, following a price target increase to $21.00 from Oppenheimer

WisdomTree moved early on blockchain infrastructure through its acquisition of Securrency. The firm later sold the compliance-focused tokenization company to the DTCC. Steinberg described the move as foundational. He said it enabled “compliance-aware tokens” and programmable finance across platforms. He framed crypto as broader than asset management. “This is bigger than asset management,” Steinberg said. “This is really about financial services.”

Related: SBI Deepens Ties With Chainlink to Power Tokenized Assets

Market Risks and Adoption Headwinds

The digital strategy carries clear risks. Crypto remains capital-intensive and does not yet contribute profits, despite sharp growth in tokenized assets. Market sentiment also remains weak. The Fear and Greed index stands at 17 out of 100, signaling extreme fear across crypto markets. Liquidity remains fragile as well. Crypto futures open interest holds near $110 billion, a multimonth low, increasing sensitivity to volatility, and slowing institutional adoption.

For now, WisdomTree’s statement that cryptocurrency is a core business underscores a strategic embrace of digital finance and reflects growing recognition of blockchain’s role in the future of investing. Investors and industry watchers will likely monitor how this commitment unfolds as market conditions and regulatory landscapes continue to change.