Robert Kiyosaki Warns of “Giant Crash” as He Buys More Bitcoin

- Robert Kiyosaki warns a historic market crash is imminent and urges investors to prepare now.

- He confirms buying more Bitcoin during market weakness as others react to rising volatility.

- Critics cite past crash forecasts, yet his Bitcoin accumulation keeps markets watching closely.

Robert Kiyosaki, the bestselling author of Rich Dad Poor Dad, once again stirred financial markets today with a stark warning about the global economy and a public announcement that he is increasing his Bitcoin holdings. In a social media post that quickly went viral, Kiyosaki said the “biggest stock market crash in history” is now imminent and framed the downturn as a strategic opportunity for investors prepared to act.

In the post shared on X, Kiyosaki reminded followers of predictions he first made more than a decade ago in his 2013 book Rich Dad’s Prophecy. He wrote that this anticipated crash, which he referred to as a ‘giant crash,’ was drawing closer and could create extraordinary wealth for those who had taken steps to prepare.

That giant crash is now imminent. The good news is those of you who followed my Rich Dad’s warning and prepared… The coming crash will make you richer beyond your wildest dreams,” Kiyosaki posted on his social account.

Crash as Opportunity: Buying the Dip

Unlike most bearish forecasts, Kiyosaki’s message was explicitly contrarian: he welcomed the prospect of a market downturn. The finance author stated he is actively buying more Bitcoin ($BTC) as other investors panic and sell, viewing price declines not as a threat but as discounted entry points into scarce assets.

I am so bullish on Bitcoin I am buying more and more as Bitcoin’s price goes down,” he notes in an X post.

Kiyosaki’s strategy aligns with a long-standing theme in his commentary: during times of economic stress, so-called real assets like Bitcoin, gold, silver, and even Ethereum ($ETH) outperform traditional financial instruments like stocks and bonds. He has reiterated this belief repeatedly, advising that crises often present the best moments to accumulate these assets.

Analysts note this approach reflects what some investors call “buying the fear,” acquiring assets at lower valuations during periods of market aversion, with the belief that long-term demand and structural supply limits will eventually lift prices again. In Bitcoin’s case, scarcity is a commonly cited bullish factor, as the protocol hard-caps the total supply at 21 million coins.

A Broader Economic Context

Nonetheless, Kiyosaki’s warning doesn’t reference cryptocurrencies alone. He has linked his outlook to broader economic conditions, contending that massive money printing, debt expansion, and what he refers to as the “fake economy” have created unstable financial foundations. Critics and supporters alike have followed his warnings for years, and some see today’s message as a reinforcement of those previous calls.

While some market commentators caution that Kiyosaki’s predictions should be weighed carefully, pointing to a history of both accurate and inaccurate forecasts, his viewpoint continues to attract attention precisely because it deviates sharply from the prevailing bullish consensus entrenched in recent years.

Related: Hong Kong Grants VDX Virtual Asset License as Victory Fintech Joins SFC List

Market Reaction and Analyst Perspectives

Reaction across the crypto market was immediate. Traders and analysts began debating whether a sharper pullback, if it comes, could reset positioning and open the door to renewed accumulation. Some argued that even absent a full-scale crash, heightened volatility often revives interest in assets perceived as scarce or independent from traditional financial systems.

In unsettled periods, narratives tend to travel quickly. Regardless, not everyone is persuaded. Several market commentators dismissed the warning outright, pointing to a long record of similar forecasts that did not align with prolonged market breakdowns. Financial planner and commentator Mark McGrath was among the more vocal critics.

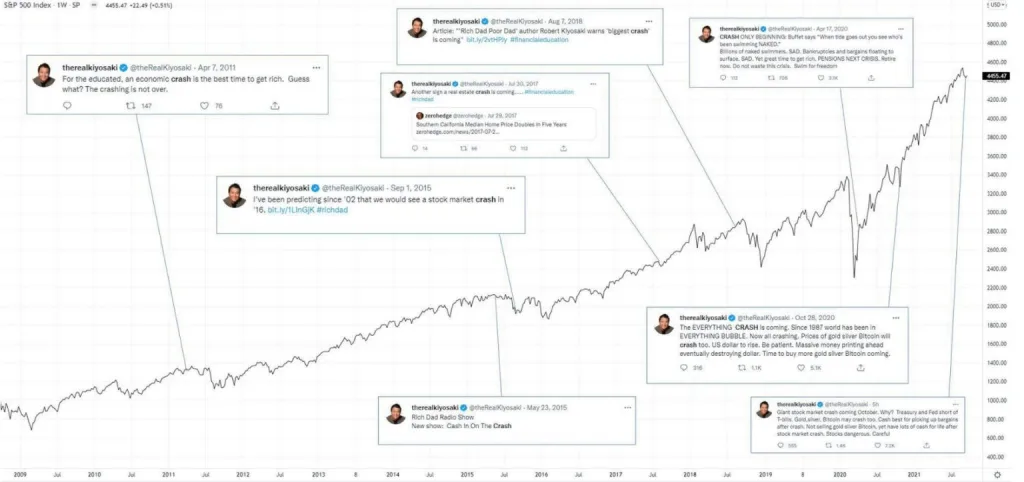

Source: X

Responding to a circulating chart that cataloged years of prior crash predictions, he wrote on social media, “Lol imagine being wrong for 14 years straight but still clinging to the grift.” The remark reflected a broader skepticism that has followed Kiyosaki’s commentary for years.

Market observers note that warnings of dramatic collapses have surfaced repeatedly, including calls tied to 2011, 2015, 2018, and 2020. Despite periodic corrections, global equity markets have generally advanced over the longer term. That record has sharpened the divide between followers who see foresight and critics who see pattern repetition without outcome.

For now, the immediate market impact appears limited to conversation rather than measurable price swings. Whether the “giant crash” Kiyosaki foresees materializes remains uncertain. What is clear is that he is positioning himself, once again, on the side of volatility, buying Bitcoin while cautioning that the broader financial system may be approaching another test.