Altcoins Poised for Third Altseason as Charts Signal Breakout

- Altcoins rebound from long-term support, mirroring setups before past altseasons.

- Analysts see a rounded bottom, projecting altcoin market cap toward $3–5 trillion.

- Institutional flows and ETFs fuel momentum as altcoins eye a new bullish cycle ahead

Altcoins are showing signs of forming a bottom after months of sharp losses. Analysts say the market now mirrors the setup before the 2021 altseason. If this trend continues, it could prepare the ground for renewed strength in the altcoin sector. Investors are watching closely, hoping history will repeat.

Charts Signal Accumulation and Long-Term Support

Crypto analysts highlight that altcoins are rebounding from long-term support levels against Bitcoin dominance. A chart shared by trader WHALE shows an ascending trendline that has guided altcoins since 2016. Each bounce previously triggered a period where altcoins outperformed Bitcoin.

During the 2017 bull run, Bitcoin dominance collapsed as capital rotated into Ethereum and smaller tokens. A similar move occurred in 2021, fueled by DeFi and NFTs. Now in 2025, the same structure is forming again. Analysts believe this setup could trigger a third altseason.

Cas Abbé highlighted a separate chart of total altcoin market capitalization excluding Bitcoin and Ethereum. He said the market is forming another rounded bottom pattern. Similar structures preceded the 2021 altcoin mania, which saw altcoin capitalization surge into the trillions.

The chart shows an accumulation zone between $500 billion and $700 billion. Abbé noted that strong higher lows confirm institutional buying and long-term bullish sentiment. He added that projected targets could lift the altcoin market cap toward $3 trillion to $5 trillion this cycle.

Volume indicators support the thesis. Historically, altcoin rallies followed extended periods of sideways consolidation. Analysts suggest that the altcoins are currently preparing to enter another parabolic phase driven by the tokenized assets, gaming, DeFi, and AI narratives.

Indexes and Institutional Flows Shape Outlook

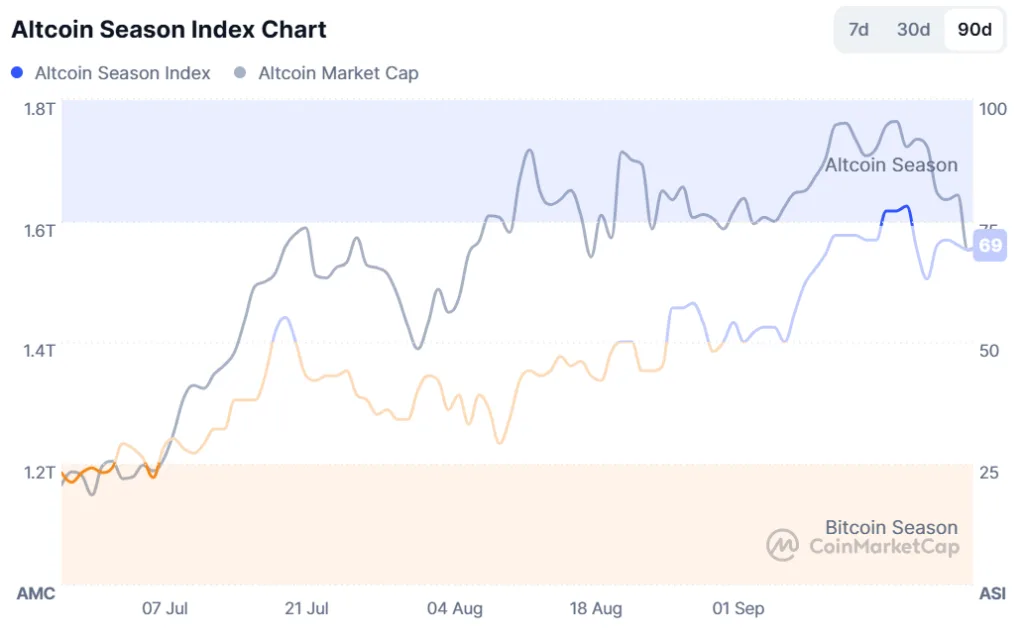

According to CoinMarketCap, the Altcoin Season Index stands at 70. The index measures the performance of the top 100 cryptocurrencies based on market capitalization to determine how they perform relative to Bitcoin. A reading of 75 and above is an indicator of a strong altcoin cycle, whereas lower figures favor Bitcoin.

Source: CoinMarketCap

This week, the index briefly dipped to 67 after Bitcoin-led declines dragged major altcoins lower. Ethereum, Solana, and Avalanche broke key supports as liquidity moved into Bitcoin. Analysts argue this rotation is temporary and consistent with historical patterns.

Altcoins usually begin to rise when Bitcoin dominance peaks. Market cycles tend to be hierarchical: Bitcoin establishes the floor, followed by large-cap altcoins, and finally midcaps outperform. Analysts emphasize that the fundamentals of altcoins are still intact despite recent weakness.

Related: SEC Clears Standards Paving Way for Altcoin-Focused Crypto ETFs

Institutional interest adds to the outlook. ETF inflows continue to reshape market structure, supporting both Bitcoin and altcoins. Bloomberg analyst James Seyffart said over 100 crypto ETFs may launch in 2025 under Rule 6c-11. These products could drive new capital into Ethereum, Solana, and other large-cap altcoins.

Meanwhile, there is an increase in regulatory transparency. Regulators are harmonizing the structures of tokenized assets and digital securities. Market participants are optimistic that this ecosystem will favour the adoption of altcoins in the decentralized finance, tokenization and Web3 infrastructure.

Despite volatility, analysts remain focused on structural signals. The rounded bottom patterns, ascending support, and amplifying institutional flows are indicative of a maturing cycle. The traders are currently waiting to see the breakouts in altcoin capitalization. If momentum builds as it did in 2017 and 2021, the market could witness another historic altseason.