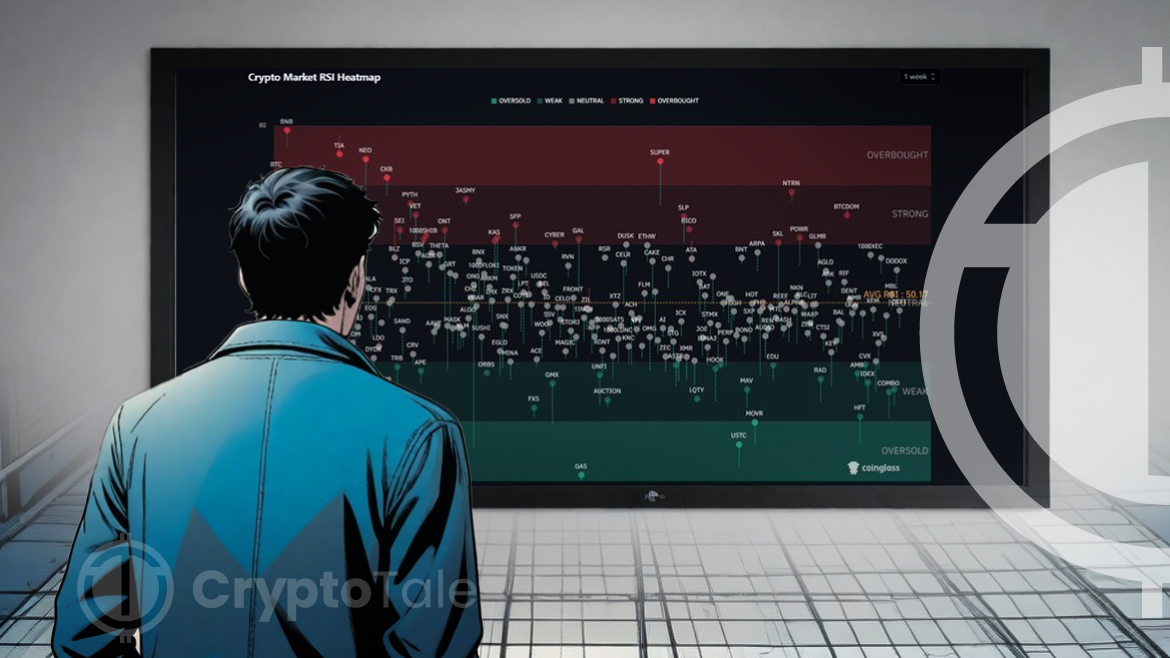

In a recent development that has caught the attention of cryptocurrency enthusiasts, renowned analyst Daan Crypto has provided fresh insights into the market’s condition. The analyst highlighted this in a recent X post that illustrated the changes in the Relative Strength Index (RSI) of various cryptocurrencies through his popular ‘Crypto Weekly RSI Heatmap’.

Daan Crypto’s analysis focuses on the Relative Strength Index (RSI), a key indicator used to determine the momentum of asset prices based on their speed and changes. The RSI is a tool commonly employed by traders to identify potential buy or sell opportunities, depending on whether the market appears to be overbought or oversold.

The analysis highlights that the mean weekly Relative Strength Index (RSI) for cryptocurrencies has stabilized at approximately 50, a level typically regarded as neutral on the RSI scale. This equilibrium suggests that the cryptocurrency market is currently neither overbought nor oversold. The return to a normalized RSI reflects a market that has moved away from the speculative extremes observed in prior months, indicating a more stable and balanced trading environment.

This recalibration comes after many digital assets reached unsustainable highs, prompting a swift and inevitable downturn as traders took profits and re-evaluated their positions. The analyst highlights this as a ‘solid reset,’ suggesting that the market could now be poised for more sustainable, less volatile growth.

Market watchers and investors pay close attention to such analyses, as they provide valuable insights into the underlying dynamics of the cryptocurrency market. By understanding these trends, stakeholders can make more informed decisions about their investment strategies, especially in a notoriously volatile market like cryptocurrencies.

As the market stabilizes, the focus may shift from quick, speculative gains to long-term investment strategies and fundamental analysis. This shift could mark a new phase in the cryptocurrency market’s maturation as investors prioritize stability and sustainable growth over rapid and often unsustainable spikes in market prices.