- Lark Davis uncovers a surge in Bitcoin addresses holding over 1,000 BTC, hitting the highest count since December 2022, signaling potential market shifts.

- Coinglass report highlights Bitcoin’s resilience post-ETF approval, grappling with supply overhead from GBTC conversions.

- Approval of nine spot Bitcoin ETFs signals institutional interest, with realized profit-taking trends emerging amidst surging on-chain exchange flows.

In a recent development, renowned crypto analyst Lark Davis has revealed a surge in the number of Bitcoin addresses holding over 1,000 BTC. In a recent X post, the analyst highlighted that the count has risen from 1,999 to 2,067 within the past two weeks, marking the highest level since December 2022.

According to a report from Coinglass, a well-known analytical platform, the Bitcoin market has demonstrated remarkable resilience despite the initial market fluctuations following ETF approvals. Presently, there is a major supply overhead issue because investors are rebalancing their capital out of the GBTC product after its conversion.

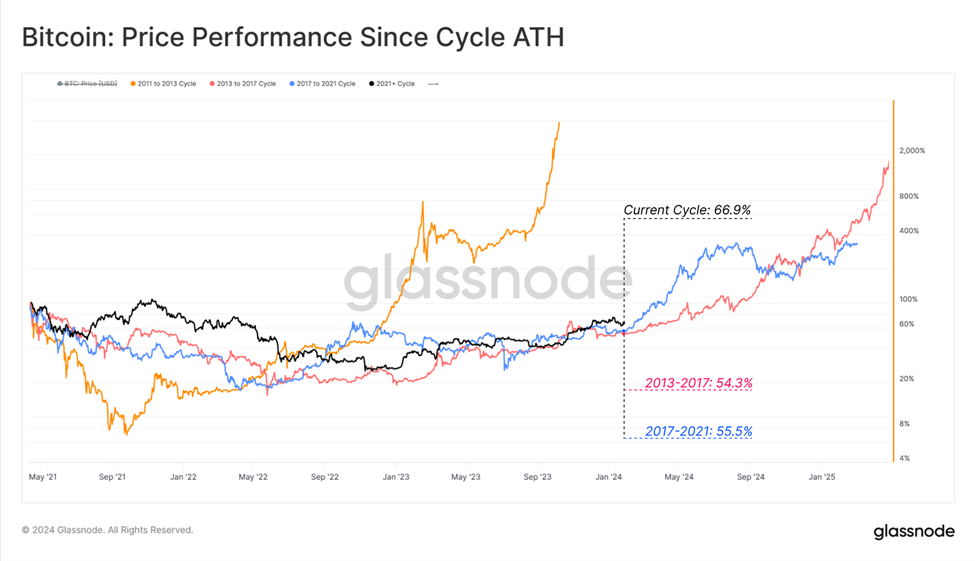

Analyzing Bitcoin’s price performance since the previous all-time high (ATH) in April 2021, analysts suggest that the current cycle is marginally ahead of previous cycles. However, corrections from local highs have remained relatively shallow, with the largest drawdown recorded at -20.1% in August 2023.

Data indicates a potential narrowing of the gap between “Stored Supply” and “Active Supply,” with a notable increase observed in all measures of active supply. This uptick aligns with older coin spending, triggering the largest increase in liveliness since the December 2022 capitulation event.

In a broader context of the crypto market, liveliness persists at levels near multi-year lows, signaling a considerable portion of the supply is firmly held, possibly in anticipation of elevated spot prices or heightened volatility as an incentive for expenditure.

As exchange flows surge, a noticeable trend of realized profit-taking has emerged in the crypto market. Despite reaching an average profit of $3.1k during the height of ETF speculation, this figure falls short of the $10.5k average profit seen at the peak of the 2021 bull market.

The recent approval of nine spot Bitcoin ETFs marks a significant milestone for digital assets, attracting institutional flows to the asset class. Despite the lingering supply overhang from investors rebalancing out of GBTC, capital inflows are accelerating, with on-chain exchange flows reaching levels equivalent to the peak of the 2021 bull market. Moreover, the average size of value transferred indicates a growing presence of institutional and large capital investors in the market.