Bitcoin (BTC) Surges Above $116,000 With Uptober Momentum

- Bitcoin breaks above $116K after days of consolidation, signaling renewed momentum.

- Q4 has averaged 78.88% gains, with Bitcoin (BTC) eyeing $120,300 as next resistance.

- Spot ETFs recorded $429.96M inflows, fueling optimism for sustained Bitcoin growth.

Bitcoin broke above $116,000 after several days of consolidation in a rising channel. At press time, the price stood at $116,592, marking a 3.11% daily increase and a 7.36% monthly gain. The move followed a strong green candle closing above $114,865, a signal that renewed buying activity and fresh momentum had returned to the market.

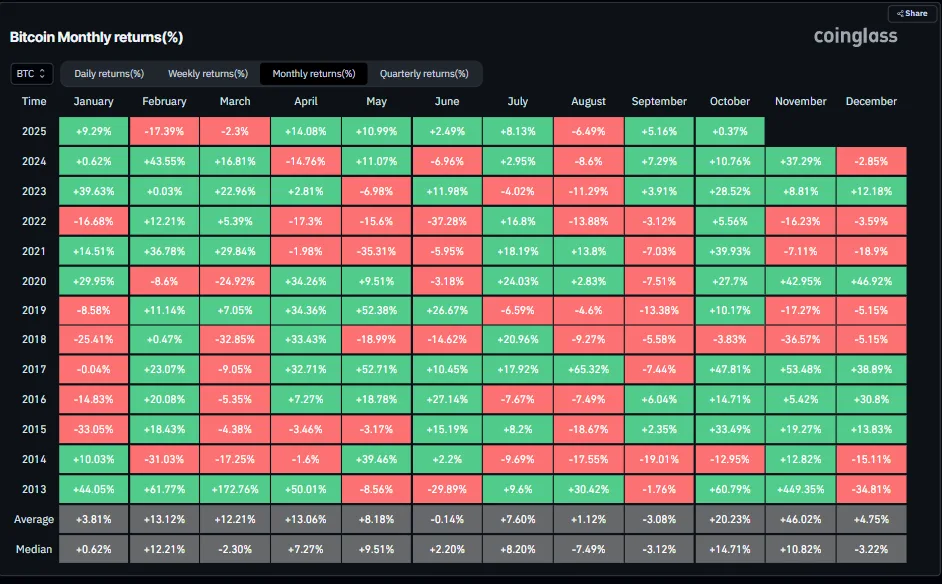

September ended on a positive note with a 5.16% gain. Across the third quarter, Bitcoin advanced 6.31%, as Coinglass data confirmed. Historical records point to October as a favorable month, averaging returns of 20.23%. The market often refers to this seasonal pattern as “Uptober.” Traders now anticipate whether the current rally would extend deeper into the month.

Source: Coinglass

Bitcoin’s Q4 Strength Backed by Resistance Tests and ETF Inflows

The final quarter of the year has traditionally been Bitcoin’s strongest. Average Q4 returns sit at 78.88%, providing a backdrop for optimism. Resistance now stands at $117,956 and $119,289. If those levels give way, $120,300 becomes the next milestone.

Source: Coinglass

Bitcoin’s market capitalization reflects the growing strength of 2025. Bitcoin’s market cap has climbed from $870B to $2.32T year to date, underscoring the scale of institutional demand fueling the rally.

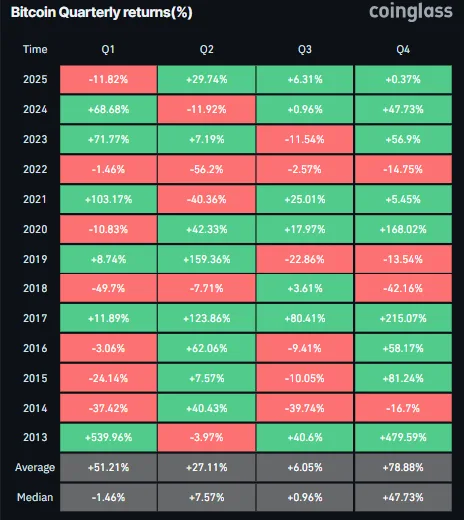

Institutional support continues to reinforce the recovery. SoSoValue reported $429.96 million in Bitcoin spot ETF inflows on Tuesday. It was the second consecutive day of ETF strength. Persistent inflows could add to upward momentum, reflecting long-term confidence from institutions. Analysts note that institutional participation is critical for sustaining this rally.

Source: SoSO Value

Bitcoin Technicals Point to $130K Breakout Potential

Market technicians highlight structural signals. Analyst Satoshi Flipper said Bitcoin broke out of consolidation near $115,000 while holding within the higher time frame ascending channel for 2025. He suggested that $130,000 remains the long-term breakout target.

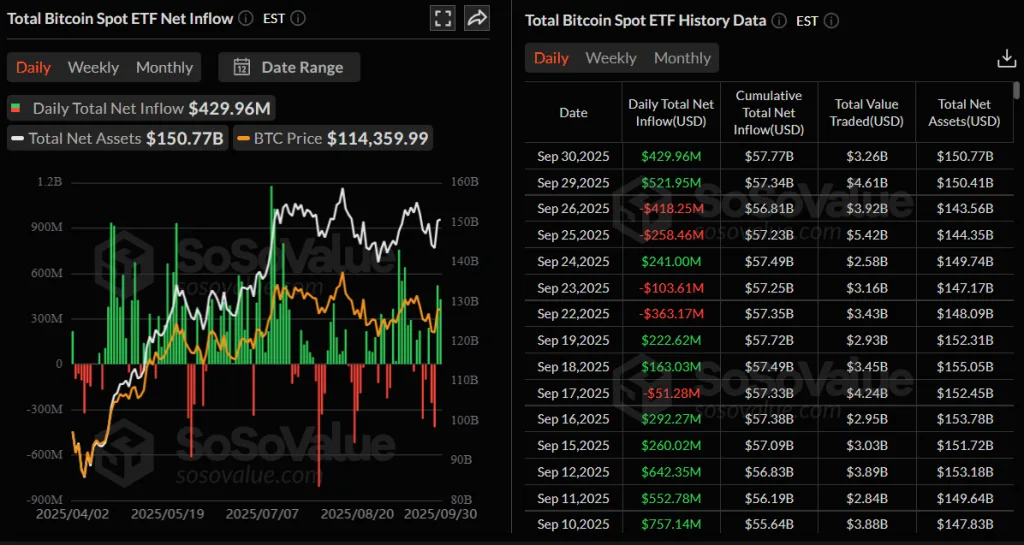

Trading activity supports the bullish environment. Coinglass showed volumes up 12.36% to $94.88 billion. Open interest rose 4.46% to $84.11 billion. The OI-weighted funding rate stood at 0.0050%.

Source: Coinglass

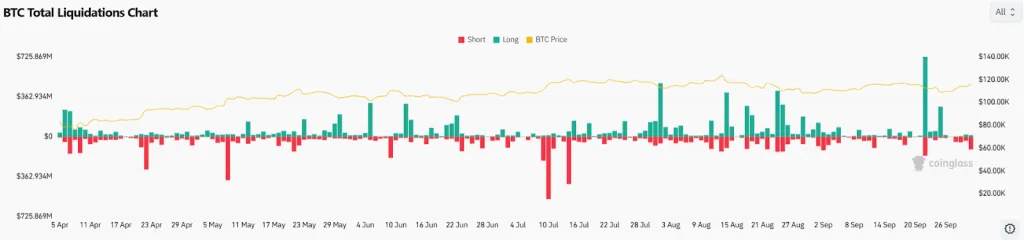

Bitcoin Volatility Rises as Liquidations Mount

Liquidation data showed heightened volatility. In the past 24 hours, $157.08 million in positions were liquidated. Shorts accounted for $136.84 million, while longs made up $20.24 million.

Source: Coinglass

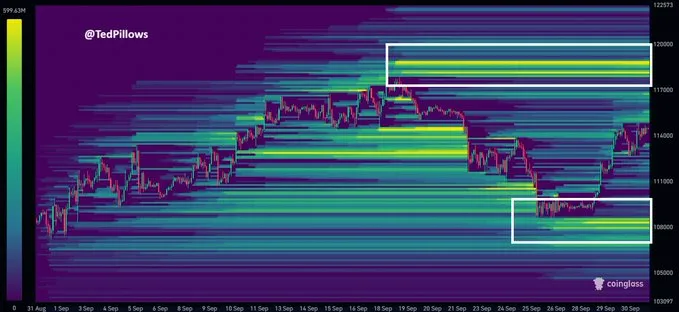

Analyst Ted pointed out two liquidity clusters. One sits between $107,000 and $108,000 with $8 billion in long liquidations. Another forms near $118,000 to $119,000 with $7 billion in short liquidations.

Source: X

This week Bitcoin rebounded from $111,000 and headed towards resistance at $120,000. Buyers seem to be in control, which results in a push of momentum higher. The rebound is a reflection of renewed confidence in the market.

Related: Bitcoin Volatility Puts Final Quarter of 2025 at Crossroads

Technical indicators show supportive signals. The MACD line made a bullish crossover, its value at -37 positioned over the signal line at -216. green bars in the histogram verified the crossover. The RSI came in at 58.56, above neutral and pointing below overbought levels. This would indicate continuing buying pressure with open upside prior to overheating markets.

Source: TradingView

Bitcoin surges past $116,000 revealing renewed vigor for the month of October. Historical evidence suggests additional upside, with Q4 the most seasonally friendly. Institutional flow, strong technicals and resilient trading activity makes the case for further. What would make or break is a clear breakout above $120,000 to determine whether it makes new highs by the end of the year.