Bitcoin Poised for Parabolic Growth as Gold Takes the Lead

- Bitcoin steadies after liquidations, suggesting a strong rebound.

- Gold outshines Bitcoin as investors seek shelter from uncertain global markets.

- Experts predict a capital rotation from gold, which could ignite Bitcoin’s next surge.

Bitcoin is showing signs of a major upward shift after a week of intense market turbulence and heavy liquidations across crypto exchanges. A recent CNBC feature comparing gold to Bitcoin suggested that funds could soon shift from gold into Bitcoin, setting the stage for a powerful rally over the next two months.

The graphic that Vivek Sen provided showed gold’s stunning rise in comparison to the much less dramatic price movements of Bitcoin. Gold has gained around 50-60% this year, breaking new records, while Bitcoin has reached an ATH nearing $125,000 mark. Experts predict that this stability in the midst of market turbulence could be an indication of accumulation, a phenomenon often observed before price expansions.

Market analysts tracking macroeconomic indicators note that Bitcoin and gold now move in closer alignment than before. Their correlation—estimated to be above 0.85—shows investors increasingly treating both as hedges against inflation and economic uncertainty.

Liquidations Clean the Slate

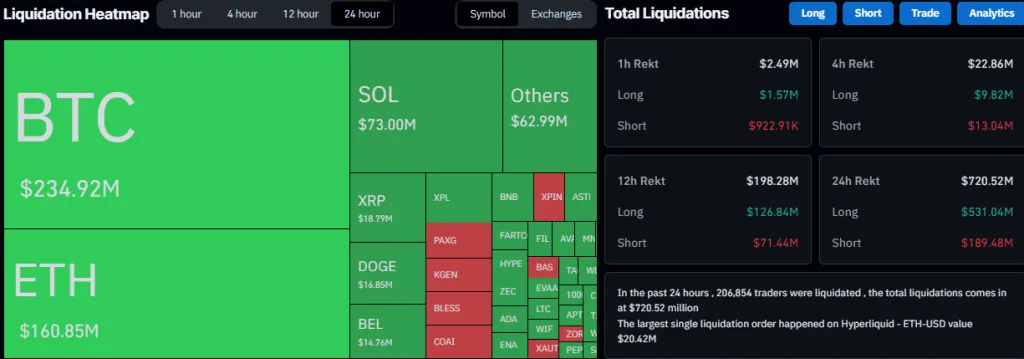

Fresh figures from CoinGlass reveal more than $720.52 million in positions were liquidated over the past 24 hours, affecting nearly 206,854 traders worldwide. Bitcoin accounted for the largest share, at $234.92 million, followed by Ethereum at $160.85 million and Solana at $73 million.

The smaller coins also received a shock: XRP (18.79 million dollars), DOGE (16.85 million dollars), and BEL (14.76 million dollars) all experienced heavy sell-offs. Longs accounted for approximately $531 million of the total liquidations, while shorts were responsible for $189 million. The largest single liquidation occurred on Hyperliquid’s ETH-USD pair, amounting to $20.42 million.

Source: Coinglass

Market commentators characterized this liquidation as a “clearing event,” which typically removes excessive leverage and restores the market to its original structure. In the previous cycles, similar liquidations occurred just before strong Bitcoin bull markets, after liquidity and confidence returned.

Related: BTC Tests $109K Support Amid Mixed Market Signals

Gold’s Rally and Bitcoin’s Lag

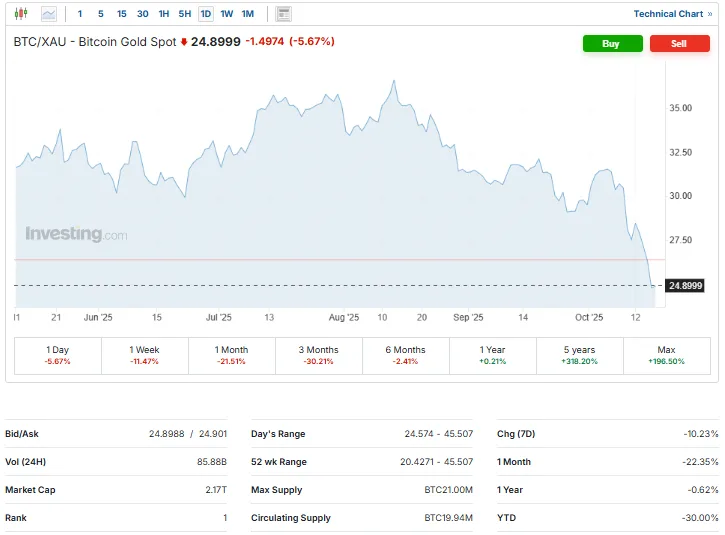

Meanwhile, Investing.com data shows the BTC/XAU (Bitcoin-to-Gold Spot) ratio has fallen 5.67% in the last 24 hours to 24.8999. It also declined 10.23% over the week, 21.51% over the past month, and 30.21% in the previous quarter.

Source: Investing.com

Gold continues to attract global capital as investors hedge against geopolitical tensions and inflation, while Bitcoin consolidates after widespread liquidations. Still, the long-term data paints a different picture: the BTC/XAU ratio remains 318.20% higher over five years and up nearly 198.50% since inception, confirming Bitcoin’s stronger performance across multiple cycles.

Investing.com estimates Bitcoin’s market capitalization at $2.17 trillion, based on $85.88 billion in 24-hour trading volume and a circulating supply of 19.94 million BTC. Analysts say the recent drop in the ratio could represent a short-term rotation into gold.

Yet, such phases have often preceded Bitcoin’s strongest comebacks when global liquidity improves and institutional capital flows back in. If Bitcoin regains strength relative to gold, the crypto market could be entering a new risk-on phase, echoing past moments that triggered parabolic advances.