Bitcoin Stays Range-Bound as Bulls and Bears Battle for Momentum

- Bitcoin stays locked between $107k and $100k as momentum cools across the market.

- RSI and weak volume show hesitation, with sellers still steering price direction.

- Whales add 45k BTC even as analysts warn of a looming head-and-shoulders pattern.

Bitcoin is locked in a tight battlefield where neither buyers nor sellers seems willing to surrender ground. For nearly a week, the world’s largest cryptocurrency has moved within a narrow channel between $107k and $100k, creating a tense standoff that has traders scanning for clues of a breakout—or a breakdown.

The move follows Bitcoin’s fall below $107k on November 3, a milestone that also marked its first return to the $100,000 threshold in four months. Yet attempts to reclaim higher ground have since faltered, with BTC slipping back to the $102k area after an approximate 2% dip in the past 24 hours and a broader 9% decline over the month.

This stuck range reflects a market unsure of its next step. Some traders look at the slowdown and see a chance to buy long-term positions. Others view the same pattern as a warning that the market may have more room to fall.

A Technical Picture Filled With Mixed Signals

The technical picture doesn’t offer a clean answer. On the daily chart, Bitcoin has shaped what looks like a double-bottom pattern, a structure that normally hints at a reversal. Even so, the optimism is softened by the lack of strong trading volume.

The numbers have stayed stuck inside the same narrow band, reflecting a crowd that is waiting, watching, and reluctant to jump in with conviction. Periods like this often signal a market gathering strength, but they can also mean exhaustion. The RSI tells its own story.

Source: TradingView

As shown above, it has climbed from oversold territory, which shows buyers stepping back in, albeit weakly. As of press time, the indicator sits near 40, well below the neutral 50 mark. As long as it holds there, sellers retain the advantage. Yet, the fact that the RSI is drifting toward neutral without breaking through it usually supports the idea of continued hesitation and more sideways movement.

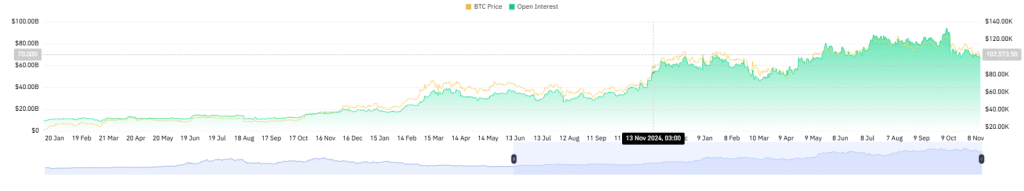

Source: CoinGlass

Bitcoin’s futures market adds another layer to the outlook. CoinGlass data shows open interest sliding from $94 billion on October 7 to about $66 billion now. This indicates that many traders are pulling back rather than holding positions through uncertainty. Falling open interest usually leads to calmer price behavior, often acting as a reset before a larger shift in direction.

Experts’ Views: Accumulation vs. Risk

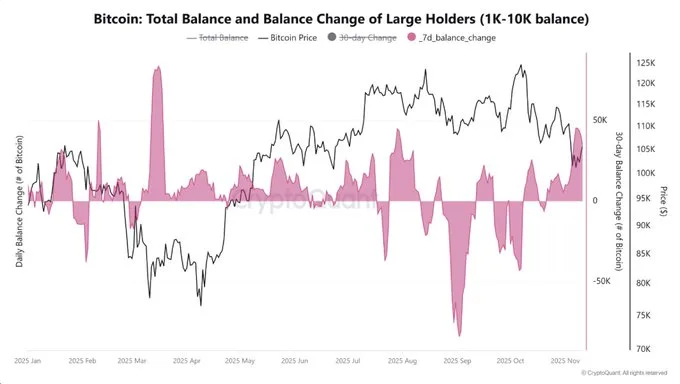

The recent downturn has fueled a flood of FUD across the crypto sector, but analysts remain split on what comes next. Some see the decline as a strategic accumulation window, especially for long-term investors. One such post from CryptoQuant highlights a major development among whales.

“The Second Largest Whale Accumulation in 2025,” the post noted.

Further data revealed that in March, whale wallets saw their largest weekly accumulation as Bitcoin fell under heavy uncertainty. Now, in the past week, these large holders have added more than 45,000 BTC, marking the second-largest accumulation event of the year.

Source: CryptoQuant

Analysts note that whales often use periods of capitulation, when small investors are exiting the market, to absorb coins at discounted prices. However, not all analysts share the same confidence. Market specialist Ali_Charts warns that Bitcoin may be aligning with a bearish formation. Ali acknowledged.

“Bitcoin $BTC could be forming a head-and-shoulders pattern! A rebound to $112,000 might form the right shoulder before a move to the $100,000 neckline, potentially leading to a breakdown to $83,000.”

The concern gains further weight as Bitcoin remains below its 200-day and 50-day moving averages, two trend markers that often show where broader sentiment stands. Trading beneath both suggests the bearish tone still dominates.

Related: Zcash Holds Support After 40% Fall: What’s Next for ZEC?

The Road Ahead

Bitcoin’s current situation feels like a standoff. Large holders continue to buy, while several indicators point to fading strength and stubborn resistance overhead. Until the price breaks above $107,000 or slips below $100,000, the market will likely stay trapped in this tight band.