Bitcoin Whale Sends 100 BTC to Kraken After $160M Short Gain

- A whale sends $11.48 million in Bitcoin to Kraken after a massive $160M short gain.

- The market eyes move as Bitcoin holds steady above the $115K support.

- Analysts debate potential insider ties while BTC trades at $115K with investor resilience.

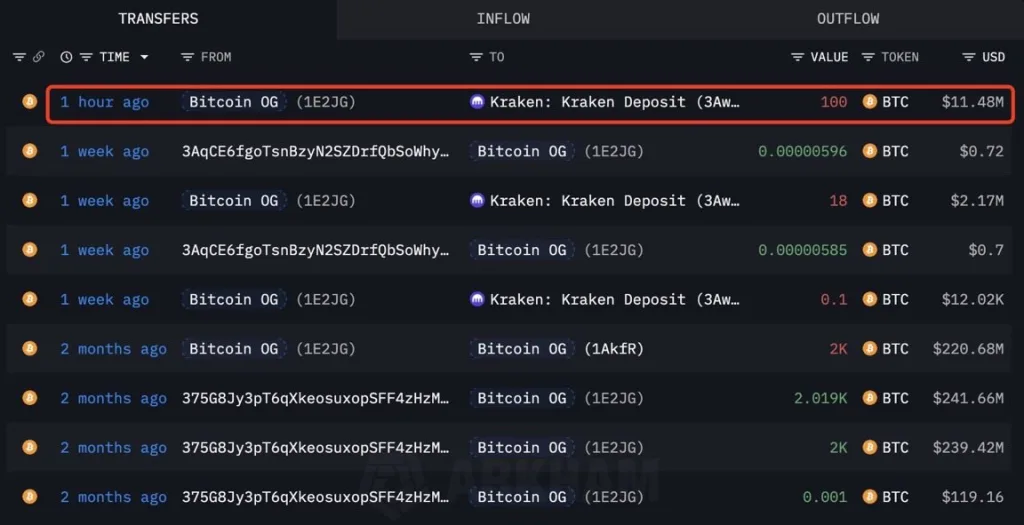

A trader known as the “Bitcoin OG,” who allegedly earned over $160 million by shorting Bitcoin and Ethereum during last week’s crash, has transferred 100 BTC—worth approximately $11.48 million—to Kraken. The move, confirmed by on-chain tracker Lookonchain, has sparked debate about the trader’s motives and possible insider advantage amid recovering market conditions.

Source: X

Bitcoin Rebounds as Trading Activity Surges

Data from CoinMarketCap shows Bitcoin trading at $115,247, marking a 3.51% daily rise as investor sentiment strengthens. The coin’s 24-hour volume jumps 23.31% to $92.78 billion, while market capitalization reaches $2.29 trillion. The circulating supply stands near 19.93 million BTC.

The charts depict the upward movement of Bitcoin after it hit a daily low of approximately $111,520. Higher lows and stable movements up are the result of this recovery. According to analysts, there has been so much accumulation during night sessions and expanded trading in the $114,000–$115,000 bracket. Inflows into exchanges are not high, and the derivative markets have taken a neutral stance, indicating that trading activity has returned to a balanced level after the previous volatility.

HypurrScan data suggests that the whale’s newly acquired position is already netting over $3.4 million in unrealized gains, with a liquidation price set at $123,520, which is slightly below the October 7 all-time peak of $126,198.Traders now monitor whether buying pressure above $115,000 confirms a short-term bullish reversal across the broader crypto market.

Market Crash and the Whale’s Strategic Short

The trader’s earlier short positions on BTC and ETH were placed minutes before President Trump’s announcement of tariffs on Chinese imports. The statement triggered a sharp sell-off that wiped out $19 billion in leveraged positions, mostly from long holders. The whale, positioned inversely, profited massively from the market downturn.

Investigators began questioning the timing. YouTuber Stephen Findeisen, known as Coffeezilla, wrote on X that the HyperLiquid whale shorting BTC/ETH yesterday placed shorts up until exactly 1 minute before Trump threatened tariffs. What incredible luck.

This activity led to speculation of insider awareness or early access to information. Analysts started linking wallet addresses involved in the trades to potential associates within past crypto projects, intensifying scrutiny of possible ties.

Disputed Links to Former BitForex Executive

Researcher Eye proposed a connection between the whale and Garrett Jin, the co-founder of the now-defunct exchange BitForex, which closed in 2024 due to a $57 million loss and allegations of fraud. Eye identified a 40,000 USDT transaction with a wallet named garrettjin.eth.

Nonetheless, the blockchain investigator ZachXBT countered the assumption. He pointed out that the two addresses are linked only by this one-time 40,000 USDT transfer, while all other assumptions remain unsupported.

The information first surfaced through Emmett Gallic, who revealed that the Hyper Unit Whale sold over 50,000 BTC on Hyperunit.

ZachXBT later stated that the wallet is “more likely to be a friend of Jin,” not Jin himself. Analysts stress that all other suggested links are unconfirmed and should not be treated as factual.

Related: Bitcoin ETFs Face $4.5 Million Outflow as Tariffs Hit Markets

What Does the Whale’s Move Signal for Bitcoin?

The timeline of these trades continues to raise questions about insider access within high-volume crypto markets. Could this recent 100 BTC transfer mark the start of another large market maneuver?

Whale activity has not entirely disappeared from the market, as evidenced by the still-existing daily average of $95 million in ETF inflows, which could help mitigate any bear trend caused by whales. Approximately $115,000 is the stabilizing point for Bitcoin, and the market is very critical, waiting to see whether this marks a reshuffling of positions or the beginning of a new round of volatility.