Bitcoin’s recent market movements have garnered significant attention as the digital asset experienced a notable pullback and showcased that investor sentiment is increasingly cautious. On April 14, 2024, crypto analysis account Rekt Capital took to X to dissect Bitcoin’s price history since the bear market bottom in November 2022.

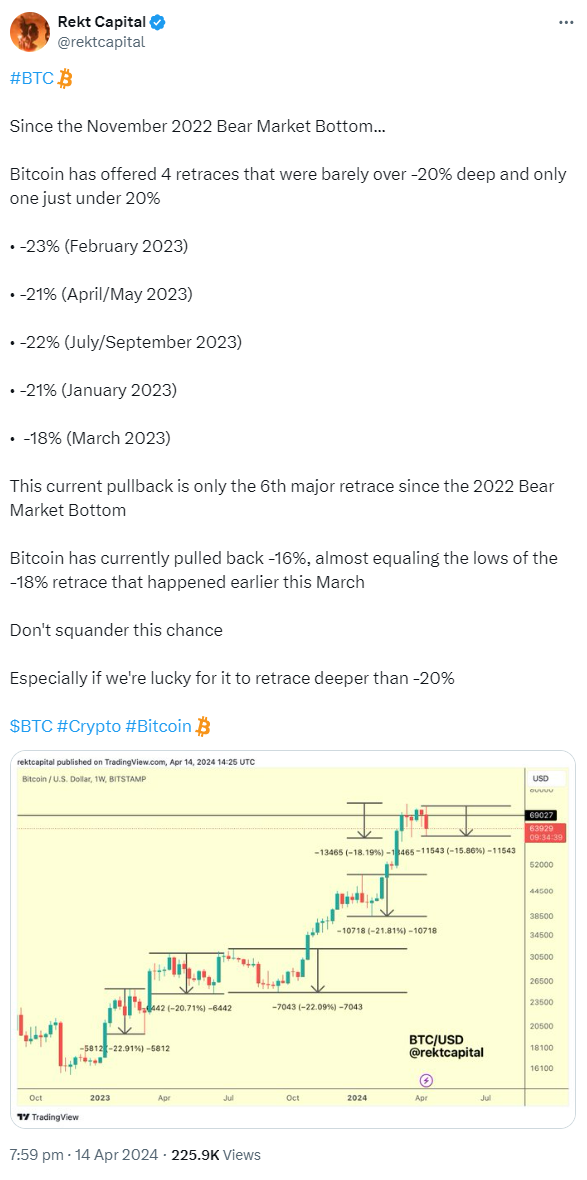

Highlighting key retraces, Rekt Capital pointed out five significant downturns, with only one being just under 20%. The most recent pullback, amounting to a 16% decrease, is stirring concern as it approaches the lows seen in March 2023. The analysis, coupled with a chart displaying Bitcoin’s price fluctuations, underscores the precarious nature of the current market situation.

Adding depth to the discussion, an analysis by IntoTheBlock on TradingView delves into the behavior of large Bitcoin holders, those controlling wallets with at least 0.1% of all Bitcoin. This cohort, often referred to as whales, holds substantial sway over market dynamics. IntoTheBlock showcases a clear decline in Bitcoin’s price from around $74,000 to its current value of $68,285.06, with a minor daily increase of 0.13%.

In light of recent geopolitical tensions in the Middle East, Bitcoin has experienced a significant retracement. The pertinent question on everyone’s mind is whether the dip has reached its nadir.

However, insights gleaned from the behavior of these large holders offer a sobering perspective. Unlike previous downturns, where whales strategically accumulated Bitcoin during dips, the current scenario presents a stark contrast. The absence of accumulation amidst the ongoing dip hints at a cautious approach adopted by major investors.

Bitcoin managed to find support at a crucial level this week, according to Rekt Capital. The price action comes as the week of the highly anticipated Bitcoin halving event kicks off. The chart attached above showcases Bitcoin hovering around the lower boundary of its recent accumulation range, currently at approximately $66,000.