Bitfarms Shares Drop 18% After Decision to Exit Bitcoin Mining

- Bitfarms confirms a full exit from Bitcoin mining as shares fall sharply by 18 percent.

- The Washington site shifts to Nvidia GB300 AI compute with a $128 million plan.

- Q3 results show $69 million in revenue and a $46 million loss as investors grow cautious.

Bitfarms shares fell sharply on Thursday after the company confirmed it will wind down its entire Bitcoin mining business and transition fully into high-performance computing and artificial intelligence workloads. The move marks the most dramatic strategic shift by a major publicly listed Bitcoin miner to date and follows months of rising operational costs and tightening mining economics.

Washington Site Becomes First AI Hub as $128M Deal Sets Direction

Bitfarms announced it would convert its 18-megawatt mining site in Washington State into a high-density HPC and AI facility designed to support Nvidia’s next-generation GB300 GPUs. The company signed a fully funded US$128 million agreement with a large U.S.-listed infrastructure provider to supply all IT hardware and construction materials needed for the conversion.

The upgraded site will support up to 190 kW per rack, feature advanced liquid cooling, modular infrastructure for phased deployment, and validated reference designs for Nvidia hardware. The facility is scheduled for completion in December 2026 and is expected to achieve an industry-leading Power Usage Effectiveness (PuE) of 1.2–1.3.

CEO Ben Gagnon said the Washington site is less than 1% of Bitfarms’ developable footprint. Yet, it could generate more net operating income as a GPU-as-a-Service or cloud operation than the company has ever produced from Bitcoin mining.

“Despite being less than 1% of our total developable portfolio, we believe that the conversion of just our Washington site to GPU-as-a-Service could potentially produce more net operating income than we have ever generated with Bitcoin mining,” CEO Ben Gagnon noted.

Q3 Financials Show Revenue Growth but Wider Losses

The strategic pivot comes as Bitfarms’ Q3 data shows a mixed financial picture. The company reported:

- Revenue: $69 million, up 156% year over year, but missing analyst estimates by more than 16%.

- Net loss: $46 million, compared to $24 million a year earlier.

- Operating loss: $29 million, including $9 million in impairments and $27 million in non-cash depreciation.

- Adjusted EBITDA: $20 million, up from $2 million in Q3 2024, representing 28% of revenue.

- Gross mining margin: 35%, down from 44% in the prior year.

- Bitcoin mined: 520 BTC at an average direct cost of $48,200 per BTC.

As of November 12, Bitfarms held 1,827 BTC and reported $814 million in total liquidity, with $637 million in cash and $177 million in unencumbered Bitcoin.

The company also sold 185 BTC during Q3 at an average price of $116,500, adding $22 million in proceeds. Additional Bitcoin sales in October brought in $12 million.

Bitfarms recently closed a $588 million convertible notes offering due in 2031, while completing its ATM program that issued 165 million shares, raising $363 million in net proceeds.

Stock Drops as Market Reacts to Full Exit from Mining

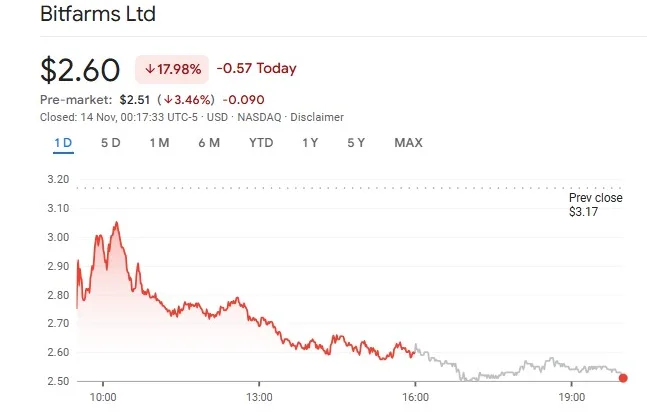

Investor sentiment turned negative after Bitfarms confirmed that it will wind down all Bitcoin operations in 2026 and 2027. Shares dropped 18% to $2.60 by Thursday’s close and slipped further in after-hours trading to $2.51, extending losses by nearly 3.5%.

Source: Google Finance

Analysts noted that while AI infrastructure is a rapidly growing market, the shift removes exposure to potential long-term Bitcoin upside. Zacks assigned Bitfarms a Rank of #4 (Sell) after unfavorable earnings-estimate revisions leading into the Q3 report.

Although Bitfarms shares remain up 112.8% year-to-date, Thursday’s steep slide shows that investors are cautious about the company’s timeline and the cost of converting its mining portfolio to compute-focused infrastructure.

Meanwhile, Bitcoin’s market value has dropped nearly 7% in the past 24 hours, pulling the asset back to just above $97,000, a level it has not revisited in six months. Despite the decline, trading volume has climbed more than 44% over the same period, signaling that market participation remains elevated even as price pressure intensifies.

Related: Solana Company to Tokenize HSDT Shares on Superstate

Broader Mining Sector Faces Rising Difficulty and Structural Shifts

Gagnon told investors that U.S. Bitcoin miners are facing mounting competitive pressure as mining difficulty rises and lower-cost regions such as the Middle East, Africa, and Russia gain market share. He said most public miners, who represent nearly one-third of the global network, are evaluating moves into HPC and AI due to their higher revenue potential and the U.S.’s strong demand for compute capacity.

Other Bitcoin miners have begun similar shifts. Earlier in November, IREN signed a $9.7 billion multi-year compute agreement with Microsoft, and Marathon Digital announced plans to scale its AI services business.

Bitfarms, however, is the first major miner to declare a full exit from Bitcoin mining, signaling a turning point in how the sector may adapt to macro-level energy costs, hardware cycles, and the surge in global AI infrastructure spending.