BNB Meme Frenzy Sees 70% of Traders in Profit Amid CZ Buzz

- More than 133,000 traders joined BNB’s meme rally, with about 70% securing solid profits.

- BNB’s market value has climbed past $181 billion as futures open interest nears $3 billion.

- Traders remain upbeat, watching resistance levels between $1,500 and $2,000 for direction.

A new wave of speculation has gripped the BNB Chain, turning casual traders into unexpected winners. Fresh data from Bubblemaps shows that more than 133,000 wallets joined the latest meme coin rush, and roughly seventy percent are sitting on profits, a rare result in such a volatile corner of the market.

The scale of earnings has stunned even seasoned traders. One participant reportedly cleared over $10 million. Besides, more than forty others crossed the million-dollar mark, while hundreds pocketed six-figure returns. Thousands more booked smaller but still impressive gains, pushing total realized profits beyond half a billion dollars.

Still, not everyone walked away with gains. Roughly forty thousand traders ended in the red, with some losing thousands as they chased fast-moving tokens that turned volatile overnight. A few saw six-figure drawdowns, underscoring the double-edged nature of meme speculation, where sharp rallies often give way to equally sharp corrections.

Retail FOMO or Whale Play? Analysts Split on BNB Surge

Binance founder Changpeng Zhao, better known as CZ, appeared amused by the trend. He posted on X, saying, “#BNB meme szn! I didn’t expect this at all. People keep asking me to predict the future… Keep building!”

His comment summed up what many in the community felt: surprise mixed with a touch of disbelief at the speed of the rally. However, analysts remain divided on what’s driving the movement. Some credit an influx of retail traders chasing quick wins across newly launched tokens.

Others suspect coordinated strategies by large holders who may be rotating liquidity through multiple projects to stoke momentum. Both views point to the same outcome: a surge in trading volume and a fresh wave of market excitement around BNB-based assets.

Despite the risks, the results are hard to ignore. More than 93,000 wallets finished in profit, while just under 40,000 posted losses, an uncommon balance in meme trading circles. The total on-chain profit now exceeds $400 million, highlighting how BNB has quietly become a favored playground for fast, speculative bets.

Yet, the critical question still lingers: Will the BNB’s frenzy fade or spark a longer trend?

BNB Price Action: Market Confidence Soars

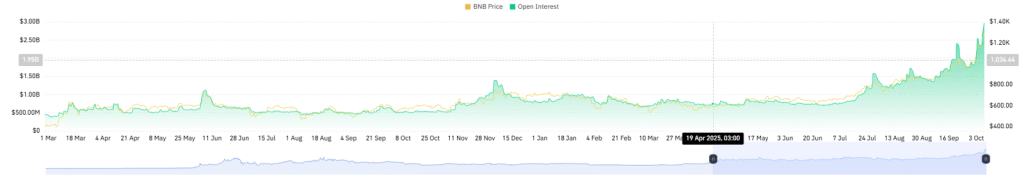

After spending years trapped under the $724–$623 resistance range, the token pushed through in force and ignited a 4-month bullish streak since then. Over the past month alone, its value has jumped by roughly 50%, extending a year-long gain of more than 130 percent.

That surge has carried its market capitalization past $181 billion, nudging it ahead of both XRP and USDT to sit in third place worldwide. On-chain metrics further reflect this growing conviction. The Open interest, for instance, across futures has climbed to approximately $3 billion, the highest ever recorded for BNB.

Such data hints at increased market activity in the BNB token, indicating growing interest and investment in the cryptocurrency. It also demonstrates that traders are opting to keep their trades open instead of cashing out profits, a sign of a firm bullish conviction in the near future.

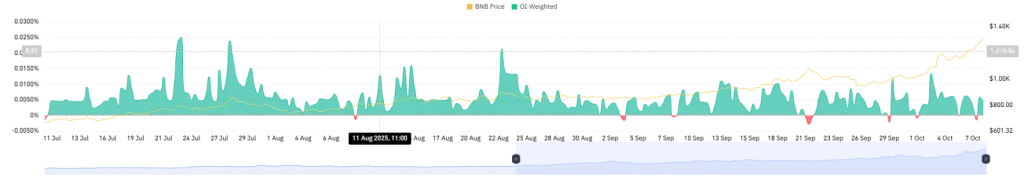

Besides, the OI-Weighted funding rate remains positive at 0.0045%, indicating that buyers are willing to pay a fee to stay in the trade, a promising signal of bullish persistence in the short term. However, it’s crucial to remain cautious, as such a high open interest comes with heightened market volatility, which could lead to sharp price swings and likely liquidations for leveraged positions.

Related: Aster’s 2,200% Rally and BNB’s $1,300 Surge, Coincidence or Chain Reaction?

Key Levels to Watch

Murrey Math levels now frame the road ahead. The token is trading near the 5/8 line, around $1,250, which serves as a fresh support after the breakout. If momentum continues, the next hurdles appear near $1,500 and $1,750, both regions where strong reversals are anticipated to form.

Should BNB power through those, a move toward $2,000 becomes plausible, a level seen by many as the final test of this rally. On the other hand, if enthusiasm cools, the first area to watch sits near $1,000. It’s a natural pullback zone and a level that could often attract new buyers.

A deeper slide could find footing around $750, an area tied to earlier accumulation and previous cycles of recovery. The monthly RSI supports this view as it stands around 85, which usually suggests the market is running hot.

That doesn’t guarantee a fall, but it does point to limited room for another vertical jump without a pause. As a result, traders may soon look for sideways action or a mild correction before momentum builds again.

In summary, BNB’s momentum still leans to the upside. Trading activity remains strong, and most participants appear confident the rally has more room to run. A short pause or minor pullback wouldn’t surprise anyone, but overall conviction across the market suggests buyers still have the upper hand for now.