BNB Rebounds to an ATH of $1,370 As Traders Push for Breakout

- BNB reached a new all-time high of $1,370, showing a rising trading strength.

- Funding rates turn negative as short sellers pay longs, highlighting bullish dominance.

- On-chain volume surges past $12B, signaling heightened market participation on Binance.

After a sharp weekend drop, Binance Coin (BNB) regained bullish momentum, rebounding to an ATH of $1,370 on Monday, according to TradingView data. BNB’s daily chart revealed a cup-shaped recovery pattern, bouncing from the Fibonacci 0.5 retracement level around $1,085. This recovery followed traders filling the Fair Value Gap (FVG) near $1,231, which now serves as short-term support.

If the bullish momentum continues, the coin is likely to continue and target a higher $1,400 level. The RSI indicates a value of 67.60, which means a bullish momentum, and if the buying pressure persists, it may reach the overbought area of above 70.

So, will BNB continue its bullish trend and go past 1,400 even when there are changes in on-chain and derivatives market conditions?

On-Chain Activity Signals Renewed Liquidity Surge

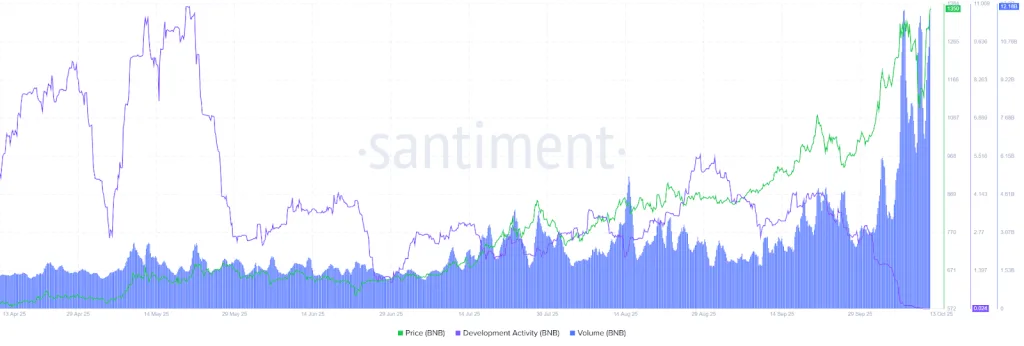

According to Santiment, after a sharp weekend recovery, BNB surged to a new all-time high of $1,370, with on-chain volume surging beyond $12 billion. Trading activity increased from around 6 billion to more than 12 billion, pushing prices upward.

The green price line shows a powerful climb from $950 in late September to $1,350–$1,370 by mid-October, marking a 42% increase in under three weeks. The rebound came as trading volume rocketed to 12.18 billion BNB, the highest level since early 2024, signaling heightened market participation.

Despite this, development activity on the Binance network declined to 0.024, indicating a reduction in code commits during the rally. The inverse correlation between lower developer activity and rising volume reflects a liquidity-led rebound rather than a product-driven one.

Shorts Pay Premium, Indicating Strong Bullish Sentiment

Data from CoinGlass derivatives shows that the funding rate weighted by open interest in BNB has turned negative at -0.0227%, meaning that short sellers are now paying a premium to hold their positions.

Despite the negative funding rate, the open interest in BNB futures rose sharply to around $2.5B, suggesting that buyers remain confident and are taking larger positions. The negative funding indicates that short sellers are paying longs to maintain their positions, reinforcing that bullish traders dominate the market sentiment. Combined with strong on-chain activity and high trading volumes, these point to a continuation of upward momentum, with BNB potentially testing the $1,400 resistance level if buying pressure persists.

Source: BNB and Solana Tops Santiment’s List of Most Discussed Crypto Tokens

Technical and On-Chain Indicators Align

The price increased from $1,085 to an ATH of $1,370, accompanied by a gradual rise in market participation, as evidenced by increased trading volumes and a corresponding improvement in derivative sentiment.

The technicals suggest that market probabilities might lead it to $1,400, but the strength of the trend will depend on the volume. Assuming that the trading volumes remain constant, Binance Coin might revisit the $1,370 extension zone and establish a better Q4 performance with renewed market confidence and data-driven momentum.