BTC Options Point to a Potential $100K Comeback Post-Q4 Crash

- Bitcoin options cluster at $100,000 as upside positioning replaces heavy downside hedging.

- Spot Bitcoin ETFs log $697M inflows, marking strongest demand since October 2025.

- Exchange outflows persist as reduced supply supports price stability near $93,000.

Bitcoin derivatives markets are showing renewed expectations for a move back toward the $100,000 level. Positioning reflects a recovery after the sharp correction in the final quarter of last year. Options data indicates that market participants are increasingly leaning toward upside scenarios rather than preparing for deeper declines.

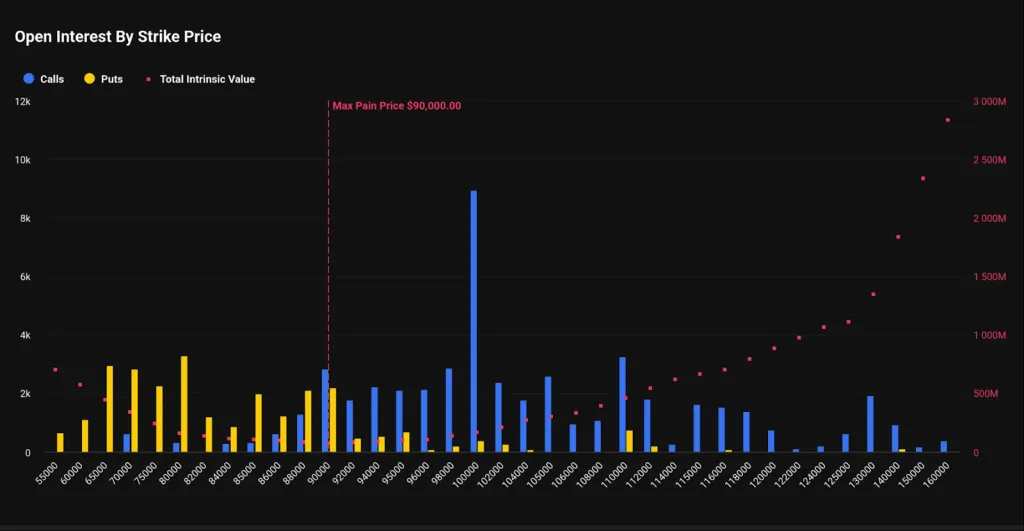

Bloomberg reported that open interest in Bitcoin options is concentrated at contracts expiring on Jan. 30 with a $100,000 strike price. These contracts represent the largest pool of outstanding positions in the options market. Their total notional value is more than double that of the next most active contracts. Those are put options set at an $80,000 strike with the same expiry, based on Deribit data.

Source: Deribit

Downside Hedging Eases and ETF Inflows Return

Market participants describe the positioning as cautious but directional. Jake Ostrovskis, head of over-the-counter trading at Wintermute, said the size of positions is not extreme. He added that the direction has remained consistent. Ostrovskis noted that put premiums further along the curve have declined. This reflects reduced concern about sharp downside moves.

The current structure differs from conditions seen during the late-2025 market rout. At that time, the market had a high sell in the spot markets and an increase in the number of downside hedge demand.

As of press time, BTC is trading at $93,250 and up by 0.72% over the past 24 hours. Despite the rebound, BTC remains below previous highs. The asset fell 24% in the fourth quarter and ended last year at $87,648. BTC last traded at $100,000 in mid-November.

Institutional activity has also shown signs of recovery. Spot Bitcoin exchange-traded funds recorded $697.25 million in net inflows on Monday. This was the strongest single-day inflow since October 2025. Large ETF inflows are often linked to increased institutional participation. Past periods of strong ETF accumulation have aligned with short-term price gains.

Source: SoSo Value

These inflows follow a period of heavy withdrawals. After the early October market crash, spot Bitcoin ETFs saw significant outflows. Around $19 billion in bullish positions were wiped out in one day during that period. The return of inflows suggests some investors are re-entering the market after the correction.

Related: Bitcoin ETFs Face $4.5 Million Outflow as Tariffs Hit Markets

The data on the exchange flow is indicative of weak selling pressure. During the last week, net outflows of BTC in centralized exchanges have been recorded as a steady stream. This means that coins are getting off exchanges but not being ready to sell. This action is usually considered supportive when prices are increasing.

BTC Supply Tightens as Key Resistance Levels Remain in Focus

Approximately 12,946 BTC were exchanged out of exchange in the past 24 hours. These withdrawals were estimated to be worth about one point two billion. Low exchange balances impair supply to be traded immediately. This would come to aid in price strength in cases where demand is high.

Bitcoin’s recent movement has occurred alongside gains in other markets. Gold has reached record highs. Equity markets have been supported by technology stocks. Greg Magadini, director of derivatives at Amberdata, said this backdrop creates opportunities to buy longer-dated BTC call options. He noted that Bitcoin has lagged behind precious metals in recent performance.

Satraj Bambra, chief executive of hybrid exchange Rails, said a retest of the $100,000 to $106,000 range remains possible. He cautioned that such a move does not confirm a bullish trend. Bambra added that Bitcoin would need to reclaim and hold above $106,000 on a weekly basis. Only then would a renewed push toward record highs be supported.

Options positioning suggests a faster move through the $90,000 range if momentum continues. Analysts see $105,000 as a potential pause level. For now, traders are watching whether ETF inflows, reduced exchange supply, and shifting options sentiment could sustain the recovery.