- Charles Hoskinson asserts Cardano did not conduct a traditional ICO, describing an alternative airdrop and trading process.

- Hoskinson challenges Bitcoin’s decentralization and critiques the SEC’s differing treatment of cryptocurrencies.

- Hoskinson Argued that 51% of Bitcoin’s hashrate could be controlled by subpoenaing the hash pools.

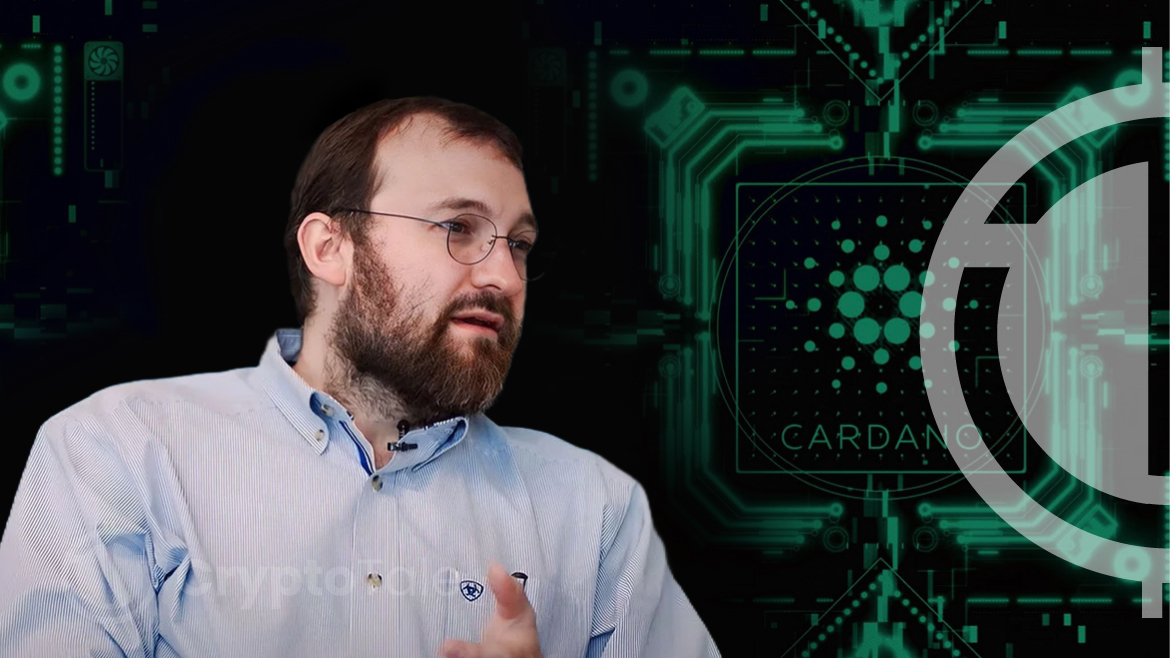

Charles Hoskinson, the founder of Cardano, recently made a bold statement asserting that Cardano did not conduct a traditional Initial Coin Offering (ICO). This claim comes amidst a broader discussion in the cryptocurrency community about the classification and regulation of digital assets by the U.S. Securities and Exchange Commission (SEC).

Hoskinson’s remarks were in response to comments made by crypto influencer Adam Back. Back had differentiated Bitcoin from other cryptocurrencies like Cardano and Ethereum, suggesting that Bitcoin’s lack of an ICO, its decentralized inception, and organic growth from zero value set it apart. He argued that these factors classify Bitcoin more as a commodity rather than a security, unlike other cryptocurrencies.

Contradicting this view, Hoskinson clarified the nature of Cardano’s initial distribution. He explained that Cardano’s started as an airdrop, where its native token, ADA, was given out on a distribution network. After this, many different people started trading ADA on their own. He emphasized that this process did not involve a traditional ICO. Hoskinson detailed that the initial offering was a voucher sale for a different asset, conducted outside the United States, priced in Yen, and settled in Bitcoin, targeting a Japanese audience with no U.S. participants.

In addition to clarifying Cardano’s position, Hoskinson also challenged the perception of Bitcoin’s decentralization during a live stream. He questioned the SEC’s rationale for not scrutinizing Bitcoin as a security, as it does with other cryptocurrencies. Hoskinson contended that the extent of Bitcoin’s decentralization is exaggerated, highlighting the possibility that more than half of Bitcoin’s hashing power could be influenced by legally compelling the top three mining pools. This, according to Hoskinson, undermines the commonly held belief in Bitcoin’s decentralized nature.

Hoskinson’s comments highlight the ongoing debate and regulatory uncertainty in the cryptocurrency sector. The lack of clear guidelines from U.S. regulators has been a point of contention, with industry leaders like Hoskinson calling for more equitable treatment across different cryptocurrencies.