Cboe Eyes Regulated All-Or-None Options For Event Trading

- Cboe studies all-or-none options as regulated tools for fast-growing event trading.

- Prediction markets post volumes as platforms expand into politics, sports, and worldwide.

- Cboe reviews modern binary designs under US oversight, with talks still at early stages.

Cboe Global Markets has confirmed it is developing an options-based product with all-or-none payouts, a move that could place it against fast-growing prediction markets. The exchange has entered early discussions with brokerages and market makers on product mechanics, according to a Wall Street Journal report, while no launch timeline exists.

Cboe already dominates listed options trading and created the Cboe Volatility Index, or VIX, which anchors its reputation within traditional derivatives markets. At the same time, event-driven trading demand has surged. Platforms that offer simple outcome contracts now attract both retail and professional traders seeking defined risk structures.

Prediction markets typically price contracts between $0.01 and $0.99 and settle at $1 for the correct outcome, creating clear payouts without multi-leg strategies. The Cboe has presented its project as an experimental initiative while indicating its intent to create a regulated exchange to meet growing market demand.

Prediction Markets Reach Record Volumes

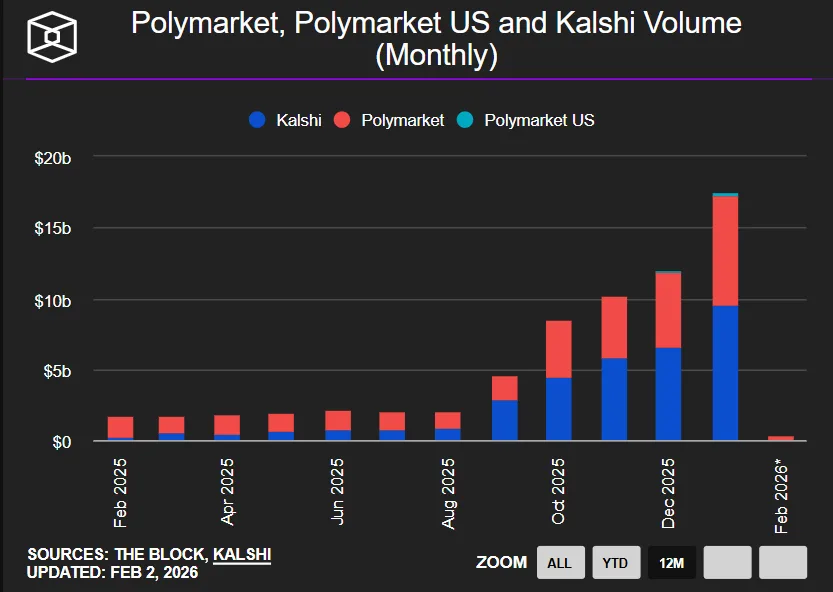

Prediction markets have established themselves as a major force across three domains, which include politics, sports, and macroeconomic events. The Block reported that Kalshi and Polymarket together achieved a total trading volume of $17 billion during January.

Source: The Block

That total marked a record month and followed several consecutive periods of growth across the sector. Research firms have taken note. Galaxy Research described prediction markets as entering a new phase of mainstream visibility and capital formation, while pointing to ongoing liquidity constraints.

Major trading platforms have developed their operations to approach the cryptocurrency market. Coinbase established a new prediction market through its collaboration with Kalshi, which enables retail users to access its trading platform. Established exchanges now examine event-based contracts because they present a regulated alternative to traditional trading methods.

Cboe Revisits Binary Options With a Modern Lens

Cboe has previous experience with binary-style instruments. In 2008, it launched binary call options tied to the S&P 500 and VIX. Those products allowed traders to bet on whether indexes closed above specific levels, yet adoption lagged, and Cboe later delisted them.

According to a person familiar with the discussions, the current effort does not revive those earlier contracts. Instead, Cboe is exploring updated structures that focus on clearer terms, improved access, and broader appeal for both retail and institutional traders.

Any new listing would operate under U.S. securities or derivatives oversight, separating it from offshore or lightly regulated prediction platforms. Cboe is also speaking with market makers to support execution, according to the WSJ, as it considers applying traditional exchange infrastructure to event-based trading.

Related: Cboe to List Continuous Bitcoin, Ether Futures from November

Would traders favour the flexibility of prediction markets or the regulatory clarity of an exchange-listed contract? Retailers maintain an active presence in options markets because individual investors create substantial daily trading volume. The group shows strong interest in simple outcome contracts, which Cboe now studies for their potential to develop products that maintain their current value payouts while removing all complex elements.

The current stage of discussions remains at introductory levels because both parties need to obtain regulatory approval for any future development work.