Coinbase Buys Echo for $375M to Boost Crypto Fundraising

- Coinbase secured Echo to reshape community-driven fundraising in digital finance.

- The deal opens new channels for startups to raise funds directly from their users.

- Echo’s Sonar platform will merge into Coinbase to enable fair investor participation.

Coinbase has purchased Echo, a young crypto startup built around on-chain fundraising, in a deal worth about $375 million. The move strengthens Coinbase’s effort to make early-stage crypto investment more open and direct. Echo was founded by a veteran crypto figure known by the pseudonym Cobie.

Since its launch, the platform has helped projects raise more than $200 million through roughly 300 fundraising rounds. It gives startups a way to collect funds straight from their communities, avoiding many of the barriers that block access to early capital.

A Closer Look at Echo’s Role

Echo’s main product, called Sonar, lets founders run token sales privately or through self-hosted public campaigns. That design allows investors and project supporters to take part directly, creating a transparent funding environment.

In a post on X, Cobie said Echo will keep its brand identity for now, but its tools will gradually merge with Coinbase. “Echo will remain a standalone platform,” he said, adding that Sonar would soon appear within Coinbase’s ecosystem to give founders new channels for raising capital and investors new routes to early projects.

Coinbase said the goal is to build a “full-stack” fundraising platform, one that brings startups and investors together on-chain. The company called Echo’s community-driven approach a good fit for its long-term vision of open access to finance.

Building Broader Access to Capital

Coinbase explained in a blog post that both firms share a mission to widen access to investment opportunities. Many startup teams still struggle to attract early funding, while individual investors are shut out of private token sales. Echo’s tools are designed to bridge that gap by linking projects and backers directly through blockchain infrastructure.

The exchange said it will start by integrating token sales through Sonar but plans to grow beyond crypto into tokenized securities and real-world assets. That expansion would rely on Echo’s technology to simplify compliance and automate fundraising steps that traditionally require intermediaries.

The company described this partnership as a foundation for more open, efficient capital markets, an idea central to Coinbase’s long-term strategy in digital finance.

Related: Coinbase Unveils Global Payments Platform Powered by USDC Stablecoin

Market Response and Strategic Direction

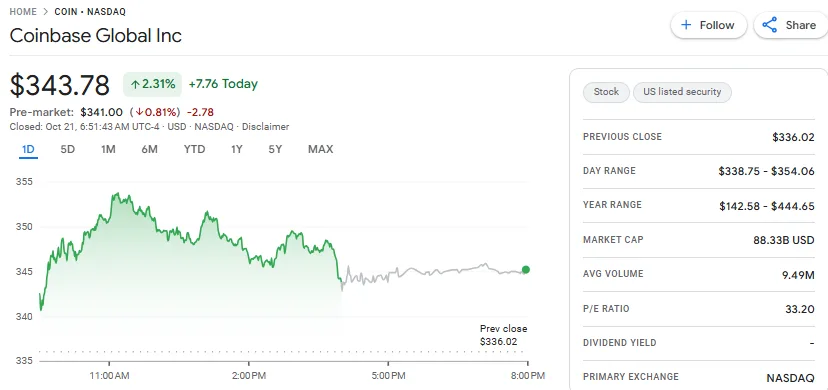

Coinbase’s shares climbed after the news. According to Google Finance data, Coinbase Global Inc. shares closed at $343.78, marking a 2.31% daily rise. The stock traded within a range of $338.75 to $354.06, reflecting strong buying momentum.

Coinbase’s market capitalization reached $88.33 billion, supported by a P/E ratio of 33.20, underscoring investor optimism toward the company’s profitability outlook. The trading volume averaged 9.49 million, highlighting consistent market participation.

Despite pre-market weakness at $341.00, the stock recovered swiftly, aligning with broader strength in cryptocurrency-linked equities as Bitcoin prices advanced. The company’s year range between $142.58 and $444.65 shows its strong recovery from earlier lows, positioning it as a leading indicator of sentiment within the global crypto economy.

This deal follows Coinbase’s earlier acquisition of the token management platform LiquiFi and its $25 million spend to bring back Cobie’s UpOnly podcast. Once Echo’s systems are fully integrated, Coinbase plans to help more projects access funding while giving investors a clearer way to participate in early-stage offerings.