Coinbase Data Shows The Investing Trend of Retail Traders

- Retail investors raised Bitcoin and Ethereum balances despite sharp market swings.

- February wallet balances exceeded December levels despite sharp volatility swings

- With the release of accumulation data, Coinbase’s stock increased by 16.46 percent.

Coinbase CEO Brian Armstrong said retail investors bought Bitcoin and Ethereum during early 2025 price declines, according to internal exchange data. He stated that retail wallet balances in February stood higher than in December despite price swings. Meanwhile, Coinbase Global Inc. shares closed at $164.32 on February 13, up 16.46%.

Armstrong shared the data publicly and described retail users as resilient during recent market conditions. He said users increased native unit holdings across BTC and ETH. He added that many customers held assets through volatility rather than selling.

The disclosure comes as cryptocurrency markets faced sharp price swings in early 2025. Bitcoin moved between defined support and resistance levels. Despite these fluctuations, retail activity showed steady accumulation.

Retail Accumulation During Volatility

Armstrong stated, “Retail users on Coinbase have been very resilient during these market conditions, according to our data: They’ve been buying the dip—we’ve seen a native unit increase for retail users across BTC and ETH.”

He also said retail wallet balances in February exceeded December levels even after price peaks and troughs. He noted that many users displayed what crypto-lore scholars call “diamond hands,” holding assets during downturns.

Market analysts have observed similar patterns in previous cycles. Armstrong’s data confirms the existence of this trend in modern times. Retail behavior showed different results compared to institutional strategies, which used short-term price changes and macroeconomic indicators for their operations.

Related: Brian Armstrong Explains Coinbase Insider Sales Strategy

Multiple factors created the conditions that led to this accumulation pattern. Investors learned about market cycles and long-term adoption trends through their financial education programs. The real-time data, which covered multiple platforms, enabled users to make better decisions.

At the same time, many investors maintained conviction in blockchain technology’s potential. Portfolio strategies evolved toward systematic investment approaches instead of emotional trading. Younger investors also showed different risk tolerance and longer investment horizons.

Economic uncertainty in early 2025 shaped portfolio decisions. With traditional markets facing interest rate and inflation concerns, some retail investors allocated funds to digital assets as diversification. In that context, what does steady retail accumulation suggest about long-term cryptocurrency conviction?

Coinbase Stock Rallies on February 13

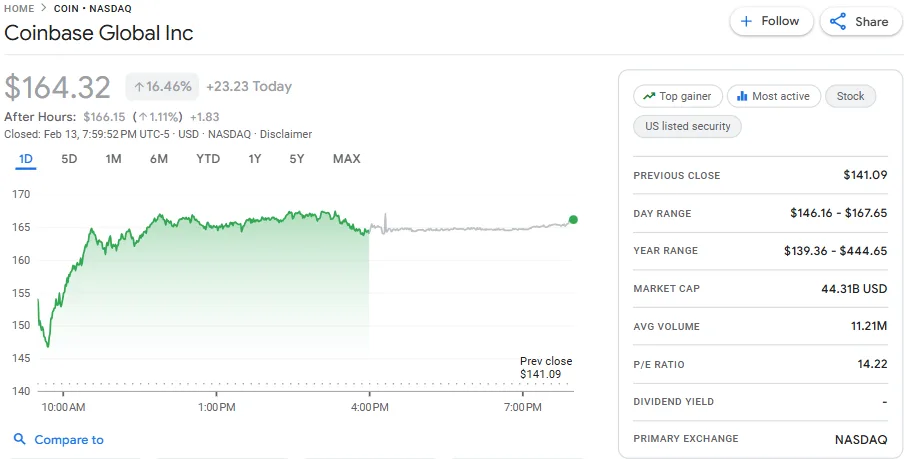

Coinbase Global Inc. closed sharply higher on February 13, according to Google Finance. The stock settled at $164.32 on the NASDAQ. Shares gained $23.23 on the day, marking a 16.46% increase from the previous close of $141.09.

After-hours trading extended the move. The price reached $166.15, rising $1.83 or 1.11%. The one-day chart showed early volatility after the market opened at 10:00 a.m. The stock dipped below $150 shortly after the open. It then rebounded above $160 before midday. Through the afternoon, shares traded in a narrow mid-$160 range and ended near session highs.

Source: Google Finance

The reported day range stood between $146.16 and $167.65. Coinbase holds a market capitalization of $44.31 billion. The company reports an average trading volume of 11.21 million shares. Its price-to-earnings ratio stands at 14.22. The listing shows no dividend yield. The 52-week range spans from $139.36 to $444.65.

Armstrong’s disclosure coincided with the stock’s sharp move. Retail customers either bolstered or maintained Bitcoin and Ethereum holdings during recent market weakness, according to the exchange’s internal data and Armstrong’s public remarks.